Key takeaways

- Across 15 Democrat-held House battleground districts, voters support higher taxes on the wealthy and big corporations despite conservative leanings overall.

- Centering tax proposals in the conversation about Democrats’ economic plan is helpful – not hurtful – in these House battlegrounds.

- Making a strong, positive case for Democrats’ economic vision, including its investments and approach to taxes, effectively inoculates against Republican attacks.

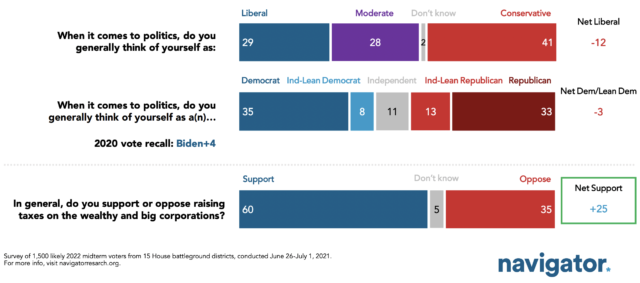

Even in Districts Where Republicans Outnumber Democrats, Taxing “the Wealthy and Big Corporations” Is Popular

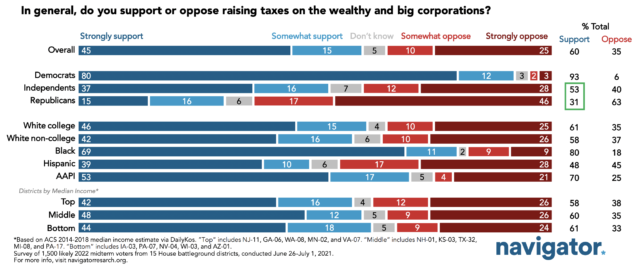

Higher Taxes for Wealthy Individuals and Corporations Have Broad Appeal

Intensity of support is high: 45% strongly support raising taxes on the wealthy and big corporations.

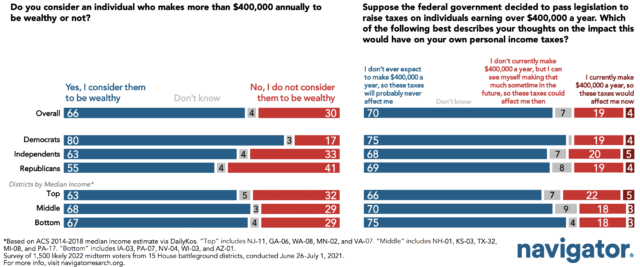

What Is “Wealthy”? Incomes Over $400,000 Qualify, and Most Voters Don’t See Themselves at Risk of Taxes on “Wealthy”

Even in the wealthier districts polled, around two-thirds of voters say $400,000 a year qualifies as “wealthy” and few believe they will ever make that much.

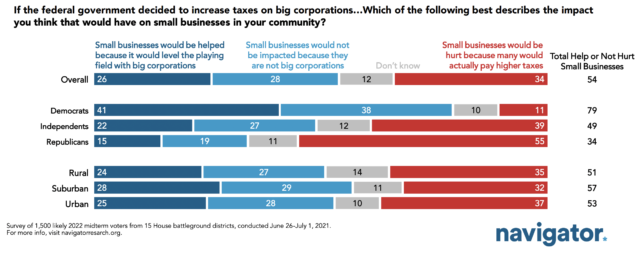

Most Don’t Think Local Small Businesses Are Hurt By Taxes On “Big Corporations”

The argument that taxes on “big corporations” will hit local small businesses has credibility with some voters, but most tend to believe small businesses will be unaffected or even helped.

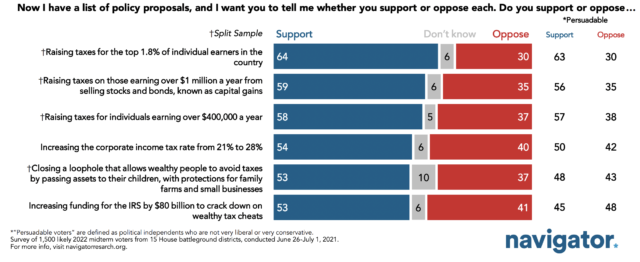

Majority Support for Array of Tax Proposals Impacting the Wealthy and Big Corporations

Tax increases on the “top 1.8% of individual earners” (64% support) are more popular than tax increases on those “earning over $400,000 a year” (58%). But, all proposals tested garner majority support.

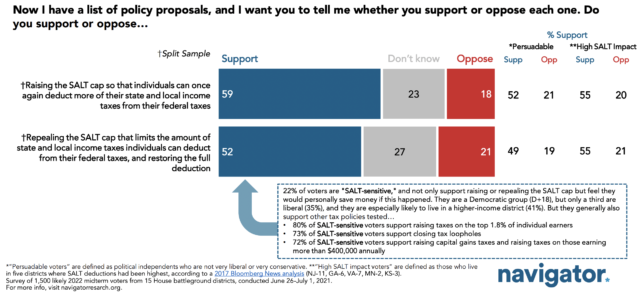

Most Voters Prefer Changes to State and Local Tax Deduction

Language of “raising” the SALT cap (59% support) has greater support than “repealing” (52%).

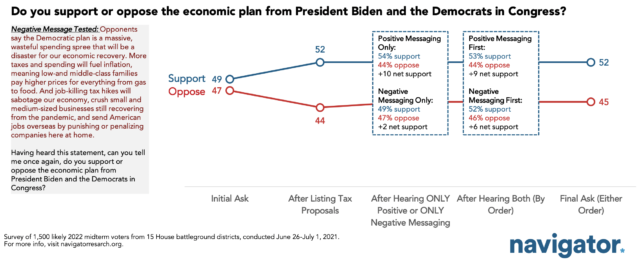

Making the Case for the Democratic Economic Vision Inoculates Against Republican Attacks

Measuring support for Democrats’ economic plan over the course of the survey shows Republican attacks can have an impact, but it is minimized if voters also hear more information in favor of the plan.

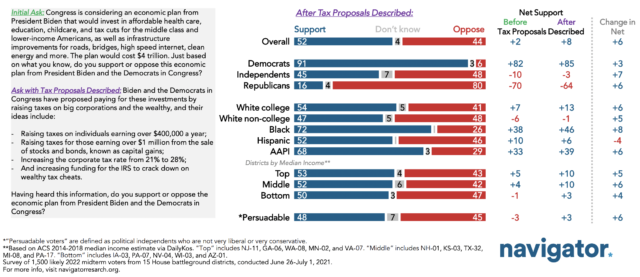

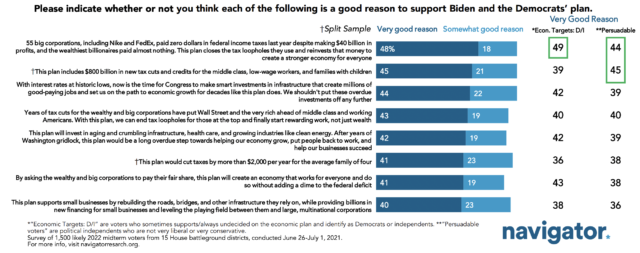

Support for Democratic Economic Plan Grows When Tax Components Are Described

With some exceptions, gains are spread evenly across demographic and political groups.

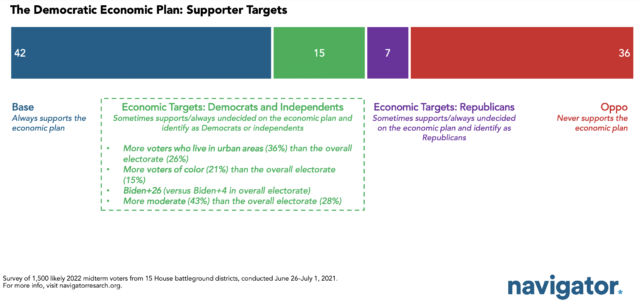

A Segment of Persuadable Voters Are Especially Critical

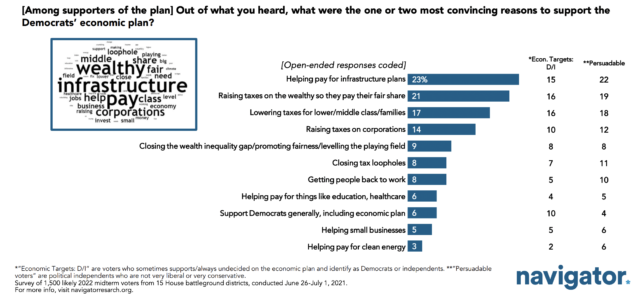

Cracking Down on Corporate Tax Dodgers – and Reinvesting in the Economy – Is a Winning Message

Among target voters, pointing to the outrageous status quo on taxes for the wealthy and big corporations is the strongest appeal. It’s also important for persuadable voters to hear about the substantial tax cuts in the plan.

Raising Taxes on Wealthy & Corporations and Lowering Taxes on Middle Class are Strong Reasons to Support the Plan

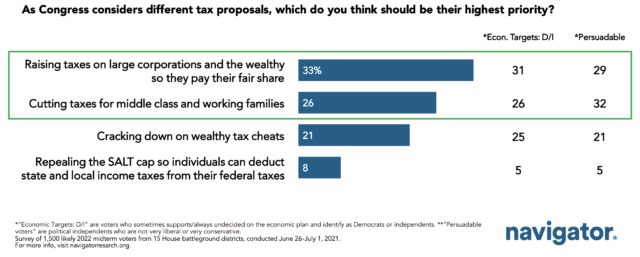

Top Priorities on Taxes: Getting All to Pay Their Fair Share, Lowering Taxes for Middle/Working Class Families

Raising taxes on large corporations and the wealthy and cutting taxes for middle- and working-class families are seen as top priorities.

Key Recommendations

Do not shy away from the debate over taxes. These proposals are popular on their own and make plans for spending and investment more palatable. The most popular proposals focus on the top tier of individual earners:

- Raising taxes for the top 1.8% of individual earners (better than: those

earning over $400,000) - Raising capital gains taxes for those earning over $1 million

The cases for increased investment and changes to the tax code can both point to problems that need fixing.

- Tell voters how bad it is: 55 big corporations paid zero dollars in

federal income taxes last year, and the wealthiest billionaires paid

almost nothing. This plan closes the tax loopholes they use. - But, remind voters there is also relief for families like their own: these investments include $800 billion in new tax cuts and credits for the middle class, low-wage workers, and families with kids.

Get out in front of conservative attacks.

- In this competitive, polarized landscape, even very popular proposals will need to overcome partisan resistance. Before voters hear more than the basics, opinion on the legislation is divided.

- Conservative narratives demonizing these plans are likely to have purchase, particularly in districts like these, unless the affirmative case is made early and proactively.

About The Study

This release features findings from a phone survey of 1,500 likely 2022 midterm voters in 15 battleground congressional districts (AZ-01, GA-06, IA-03, KS-03, MI-08, MN-02, NH-01, NJ-11, NV-04, PA-17, PA-07, TX-32, VA-07, WA-08, and WI-03) conducted June 26-July 1, 2021. Additional interviews were conducted among 50 Asian American and Pacific Islander voters and 30 Hispanic voters.The margin of error at the 95% confidence level is +/-2.5%. The margin of error on sub-samples is greater.