Key takeaways from the focus groups

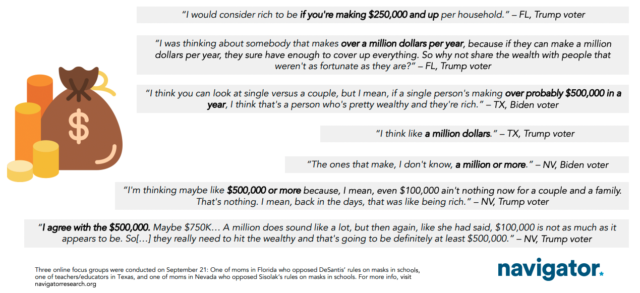

- Respondents vary on how “tax the rich” might be defined, but generally land on a range comparable to President Biden’s.

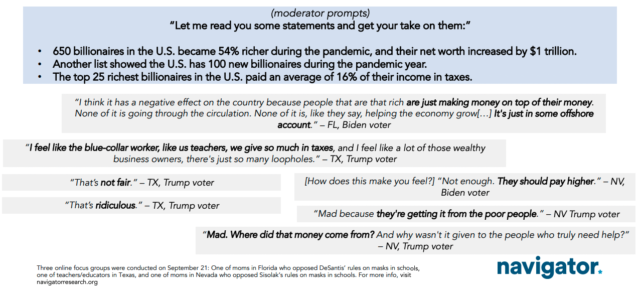

- Most in these groups—even Trump voters—are open to taxing the rich more.

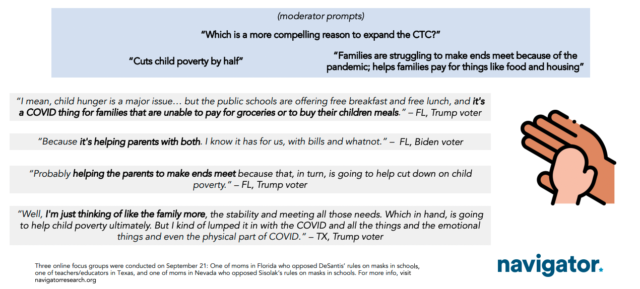

- The Child Tax Credit should be framed around support for the whole family, not just the children.

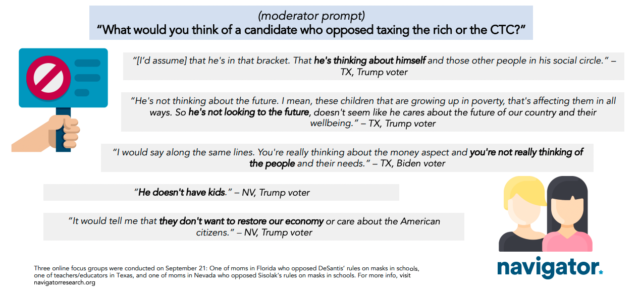

- Elected officials who oppose both Tax The Rich and the Child Tax Credit risk seeming out of touch.

While Most Wonder How The “Rich” In “Tax The Rich” Is Defined, Participants Coalesce Around A $400K-$1M Range

Even Trump Voters Are Open To Taxing The Rich, Particularly After Hearing More About Growing Disparities

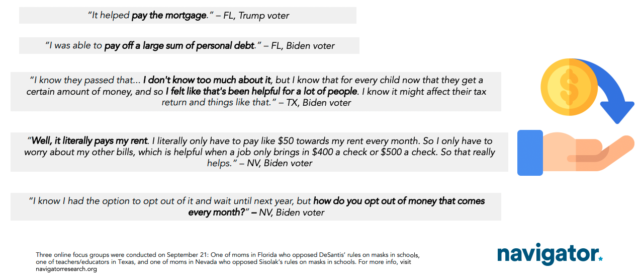

There Is Modest Familiarity With The Child Tax Credit, With Some Recounting How It’s Helped Them

Helping Families Seems To Be A Stronger CTC Frame Than Child Poverty

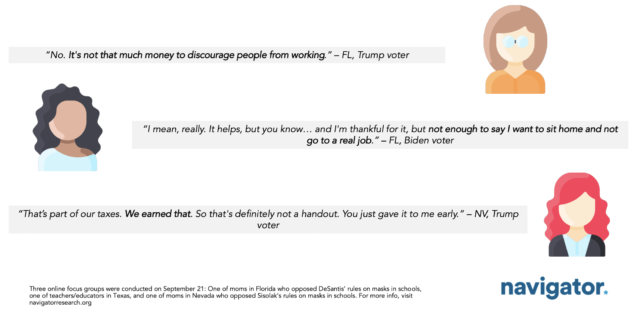

Not Many See The Child Tax Credit As A Handout Or Disincentive To Work

Respondents Say They’d Reject Leaders Who Oppose Taxing The Rich Or Making CTC Expansion Permanent

About The Study

This release features findings from three focus groups conducted on September 21, 2021 with voters in three states: Florida (mothers who opposed DeSantis’ rules on masks in schools), Texas teachers and educators, and Nevada (mothers who opposed Sisolak’s rules on masks in schools). Qualitative results are not statistically projectable.