Methodology

Key Takeaways

- It is important to frame the debate as avoiding defaulting on debts. There is plurality support for raising the debt limit when framed as avoiding defaulting on debts rather than raising the limit alone, which a plurality oppose.

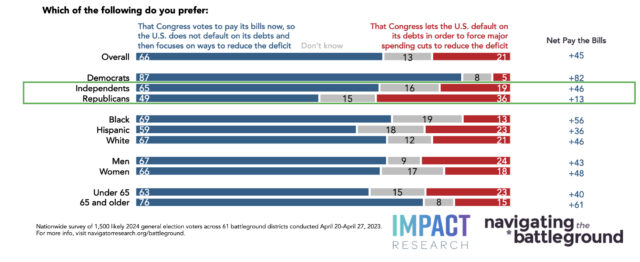

- The public would rather pay the bills now and reduce the deficit later than default. Two in three would rather see Congress pay our bills now and worry about reducing the deficit later.

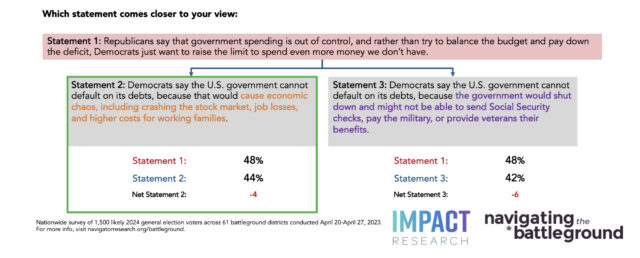

- In a partisan back-and-forth around spending, conservative arguments do have salience. Conservative arguments on out-of-control spending narrowly edge out progressive arguments; a progressive argument that defaulting would cause economic chaos is a better response among persuadable voters than the government shutting down or not paying Social Security checks.

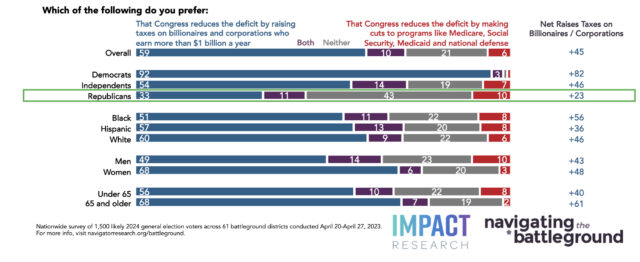

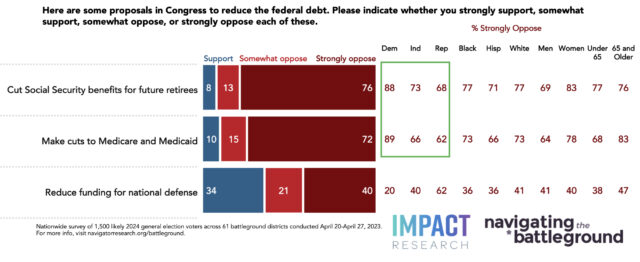

- Yet, there is strong opposition to cuts to programs like Medicare, Medicaid, and Social Security. Americans would rather see Congress reduce the deficit by raising taxes on billionaires and corporations.

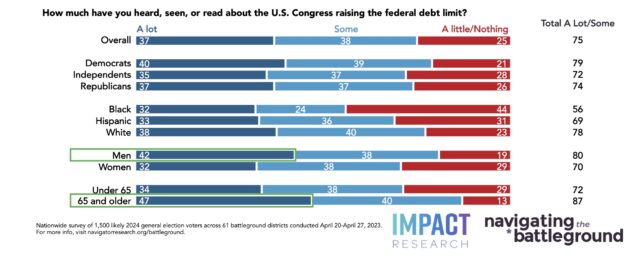

Just Over a Third of Voters Have Heard “A Lot” About the Debt Limit

Men (42%) and those over the age of 65 (47%) are the most likely to say they have heard “a lot” about the federal debt limit.

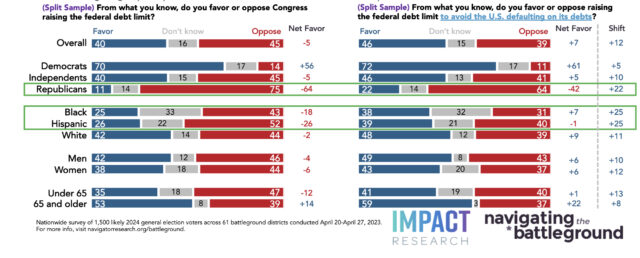

Voters are Split on Their Support For Raising the Debt Limit; Framing Around Avoiding Default Increases Support

Support shifts a net 12 points when framed as “avoiding the U.S. defaulting on its debts” (from net -5 to net +7).

- Among subgroups, Republicans (net +25), Black voters (net +25), and Hispanic voters (net +25) shift the most.

Voters are Open to Conservative Arguments on Out-of-Control Spending, Narrowly Beating Progressive Statements on Default

Men and voters 65 and older are more responsive to messaging that a default would result in economic chaos.

Across the Partisan Spectrum, Voters Prefer Congress to Pay its Bills and Not Let the U.S. Default

Independents prefer Congress votes to pay its bills now to avoid default by a 46-point margin, as do a plurality of Republicans (49%).

Most Would Rather Reduce the Deficit by Raising Taxes on Billionaires and Corporations, Not by Cutting Specific Programs

Republicans are more mixed, with a plurality neither wanting taxes raised nor entitlement cuts.

Majorities of Voters Across the Partisan Spectrum, Strongly Oppose Cuts to Social Security, Medicare, and Medicaid

Intensity opposing defense cuts is more muted and is driven by Republicans.

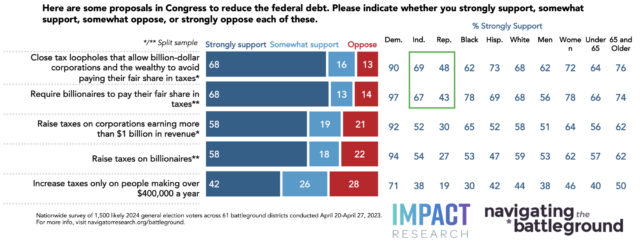

Corporations and the Wealthy Paying Their Fair Share is Most Effective When Framing Revenue Increases to Reduce the Deficit

Frames emphasizing tax fairness perform better than other language to raise taxes on the wealthy and corporations by at least 15 points among independents and at least 13 points among Republicans.

Appendix: Congressional Districts Included In Sample

About the Study

Impact Research conducted public opinion surveys among a sample of 1,500 likely 2024 general election voters from April 20-April 27, 2023. The survey was conducted by a mix of text-to-web (74 percent) and an opt-in, online panel (26 percent). Respondents were verified against a voter file and special care was taken to ensure the demographic composition of our sample matched that of the 61 congressional districts included in the sample across a variety of demographic variables. The margin of error for the full sample at the 95 percent level of confidence is +/- 2.5 percentage points. The margin for error for subgroups varies and is higher.