Poll: The Battleground and Tax Policy

This Navigator Research report covers the latest perceptions of tax policy in the country, including who battleground constituents believe tax policies favor and views of the Trump tax cuts.

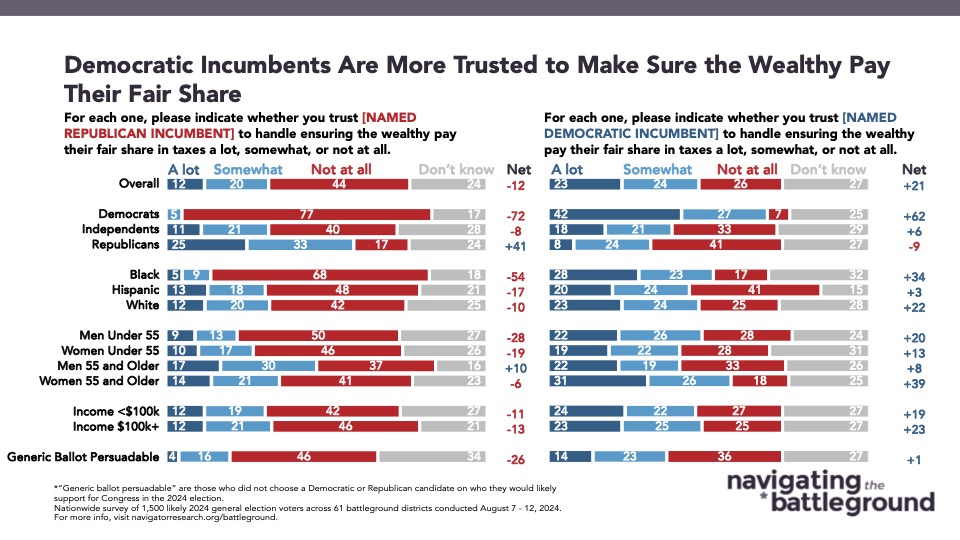

Battleground constituents say Democratic incumbents will work to have the wealthy pay their fair.

By a 21-point margin, Democratic lawmakers are trusted to ensure the wealthy pay their fair share in taxes, while Republican lawmakers are more untrusted. 47 percent of battleground constituents say they trust their Democratic lawmakers to ensure the wealthy pay their fair share in taxes (47 percent trust – 26 percent do not trust – 27 percent don’t know), compared with just 32 percent who say the same about their Republican lawmakers (32 percent trust – 44 percent do not trust – 24 percent don’t know). Independents trust Democrats by a 6 point margin, while Republicans are underwater among independents by 8 points.

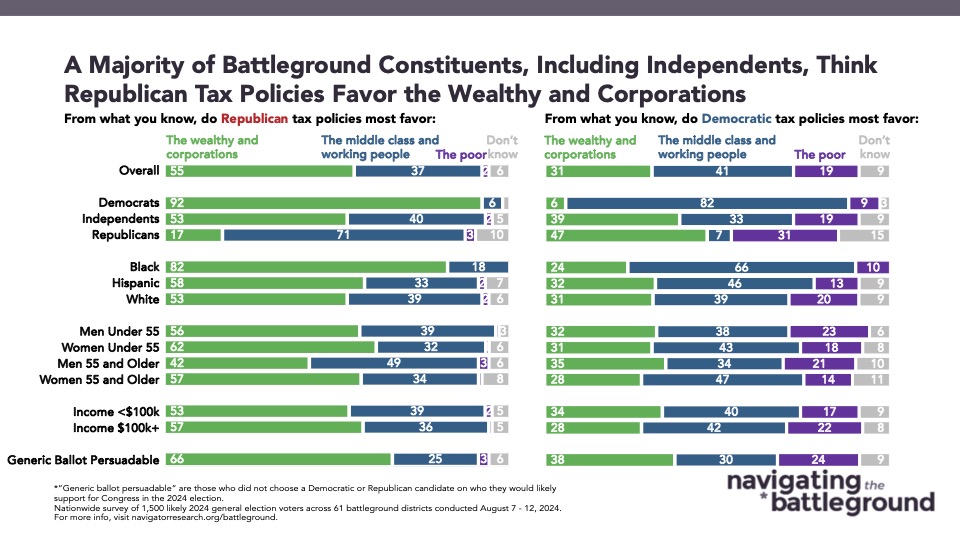

- A majority of battleground constituents feel Republican tax policies favor the wealthy and corporations over the middle class and working people (55 percent wealthy/corporations – 37 percent middle class/working people). Conversely, more battleground constituents say Democratic tax policies benefit the middle class and working people (31 percent wealthy/corporations – 41 percent middle class/working people).

Opposition to making the Trump tax cuts permanent grows after learning more about who has benefited most from it.

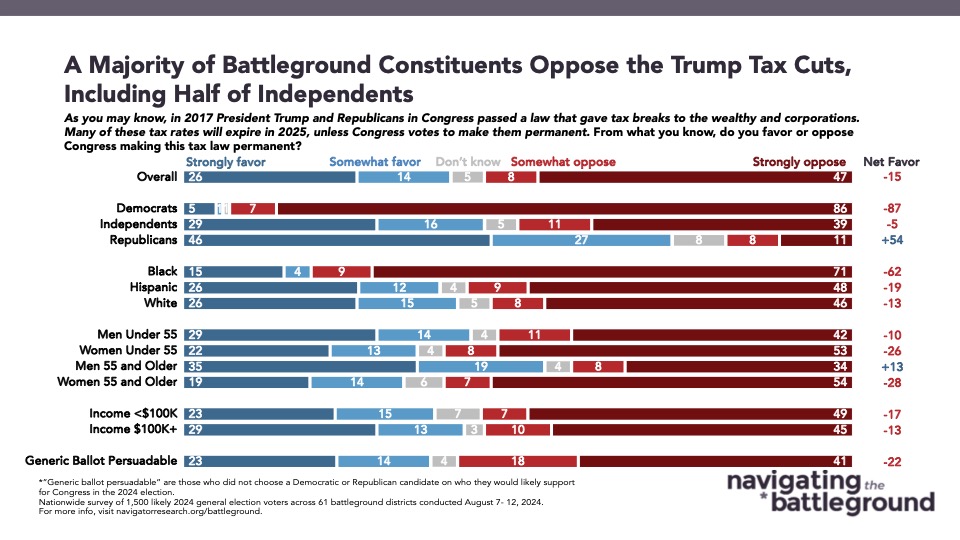

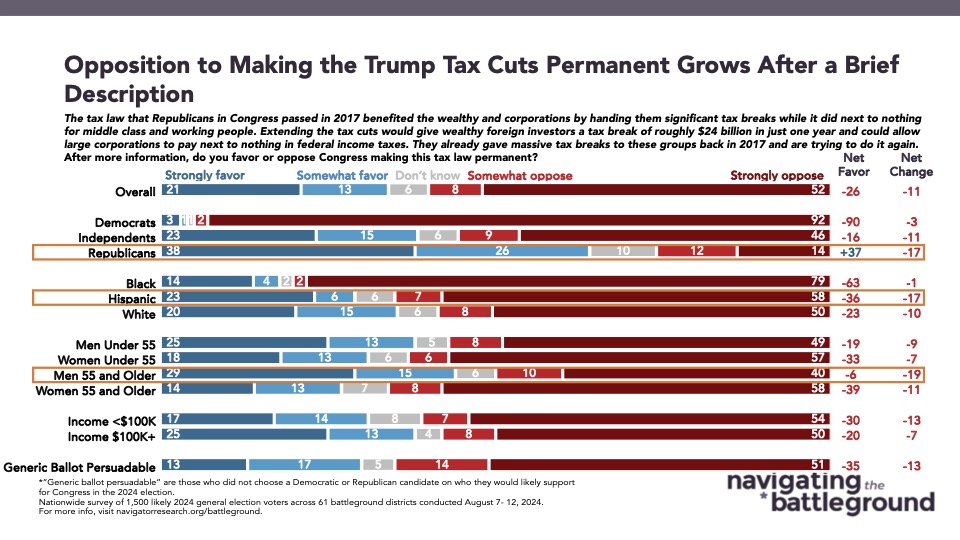

Absent any additional information, a majority of battleground constituents oppose making the 2017 Trump tax cuts permanent when they are described as “a law that gave tax breaks to the wealthy and corporations” (net -15; 40 percent support – 55 percent oppose). Only one in five “strongly” favor making the law permanent compared with 47 percent who “strongly” oppose it. Opposition grows after learning that “the tax law that Republicans in Congress passed in 2017 benefited the wealthy and corporations by handing them significant tax breaks while it did next to nothing for middle class and working people. Extending the tax cuts would give wealthy foreign investors a tax break of roughly $24 billion in just one year and could allow large corporations to pay next to nothing in federal income taxes. They already gave massive tax breaks to these groups back in 2017 and are trying to do it again” (net -26; 34 percent support – 60 percent oppose).

- Opposition to making the tax cuts permanent grew across party lines including among Democrats (from net -87 to net -90), independents (from net -5 to net – 16), and Republicans (from net +54 to net +37).

- A plurality of battleground constituents think their taxes will increase if the Trump tax cuts are made permanent (43 percent increase – 12 percent decrease – 36 percent stay the same), and a similar share feel that the wealthy and large corporations will either pay the same or less in taxes (10 percent increase – 40 percent increase – 41 percent stay the same).

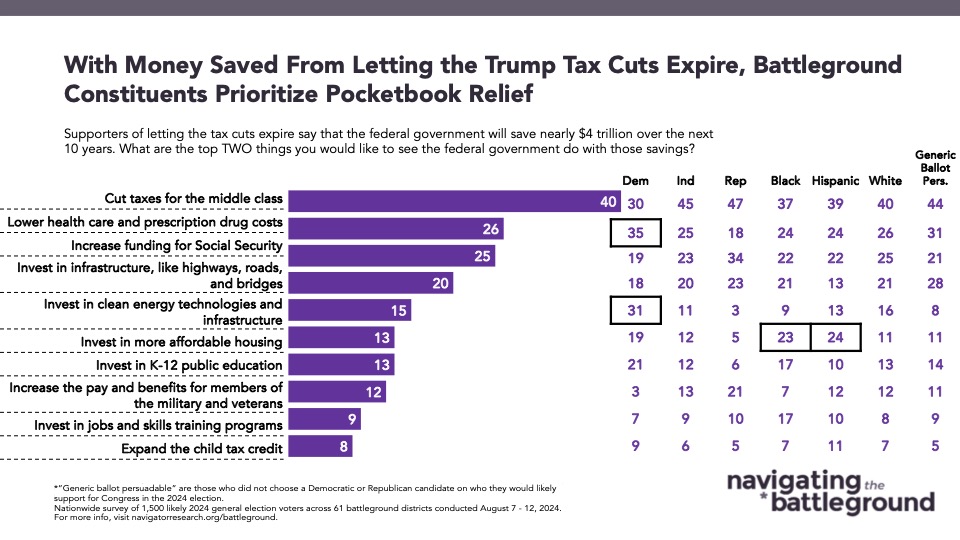

- If the Trump tax cuts expire, battleground constituents say they want to see the federal government put the nearly $4 trillion dollars it will save toward tax cuts for the middle class (40 percent). Other investments battleground constituents want include lowering health care and prescription drugs (26 percent), increased funding for social security (25 percent), and increased investment in infrastructure like highways, roads and bridges (20 percent).

About The Study

Impact Research conducted public opinion surveys among a sample of 1,500 likely 2024 general election voters from August 7 - 12, 2024. The survey was conducted by text-to-web (100 percent). Respondents were verified against a voter file and special care was taken to ensure the demographic composition of our sample matched that of the 61 congressional districts included in the sample across a variety of demographic variables. The margin of error for the full sample at the 95 percent level of confidence is +/- 2.5 percentage points. The margin for error for subgroups varies and is higher.