Poll: A Fair Tax System

This Navigator Research report contains polling data on Americans’ support for raising taxes on the wealthy, perceptions of the positions of Democrats in Congress and Republicans in Congress on taxes, and who Americans trust most to handle cost of living and making the tax system more fair.

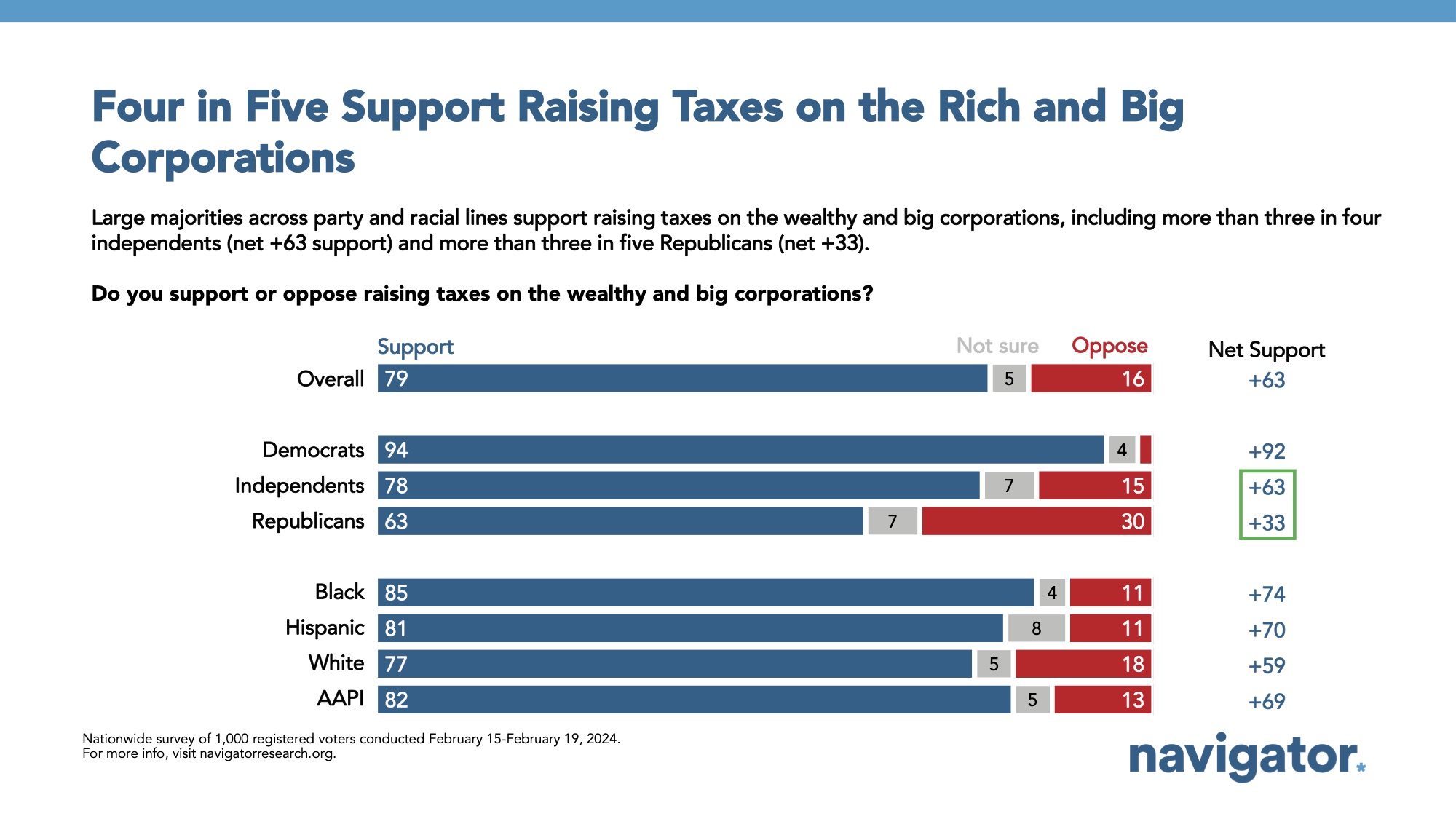

An overwhelming majority of Americans support raising taxes on the wealthy and big corporations across partisanship.

Four in five Americans support raising taxes on the rich (79 percent), including 94 percent of Democrats, 78 percent of independents, and 63 percent of Republicans. Nearly two in three Americans who say they voted for Donald Trump in 2020 support raising taxes on the wealthy (63 percent), along with over four in five who say they are unfavorable to both Joe Biden and Donald Trump (85 percent). More than seven in ten Americans support raising taxes on the wealthy and big corporations across income levels, from 79 percent making less than $50,000 per year to 72 percent of those living in households earning more than $100,000 per year.

- While a majority of Republicans support raising taxes on the wealthy and big corporations, there is a net 35-point difference in support between Republicans who do not regularly watch Fox News (net +49; 70 percent support – 21 percent oppose) compared to those who do (net +14; 54 percent support – 40 percent oppose).

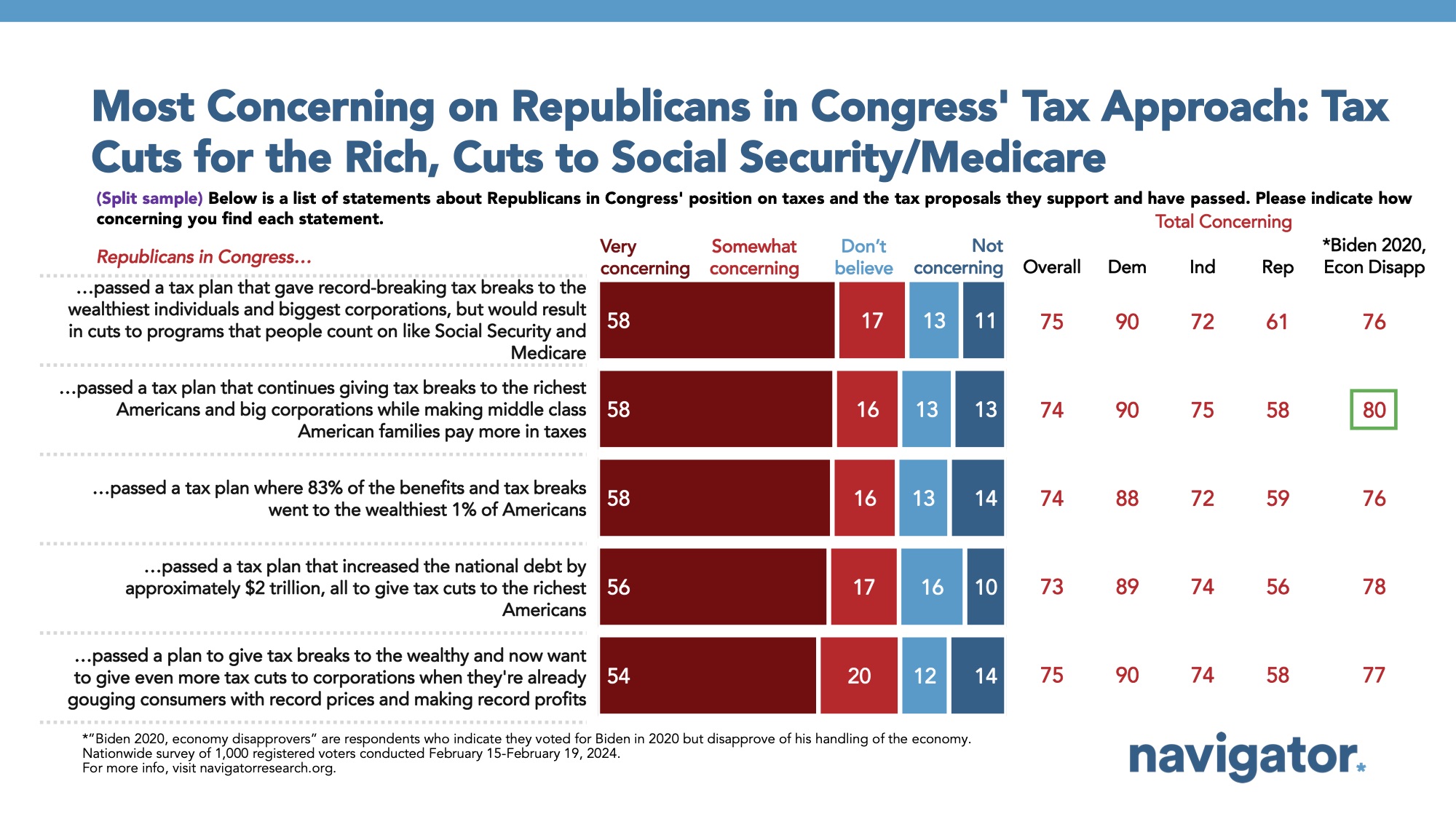

Tax breaks for the wealthy and cuts to Social Security and Medicare are the top concerns Americans have about Republicans in Congress’ approach to taxes.

Three in four Americans are concerned that “Republicans in Congress passed a tax plan that gave record-breaking tax breaks to the wealthiest individuals and biggest corporations, but would result in cuts to programs that people count on like Social Security and Medicare” (74 percent, including 58 percent who are “very” concerned). Similar shares express concern by statements that “Republicans in Congress passed a tax plan that continues giving tax breaks to the richest Americans and big corporations while making middle class American families pay more in taxes” (74 percent, including 58 percent who are “very” concerned) and that “Republicans in Congress passed a tax plan where 83 percent of the benefits and tax breaks went to the wealthiest 1 percent of Americans” (74 percent, including 58 percent who are “very” concerned).

- These concerns span across party lines, including 61 percent of Republicans expressing concern about potential cuts to Social Security and Medicare and 58 percent of Republicans concerned that the richest Americans and big corporations will tax breaks while middle-class American families pay more.

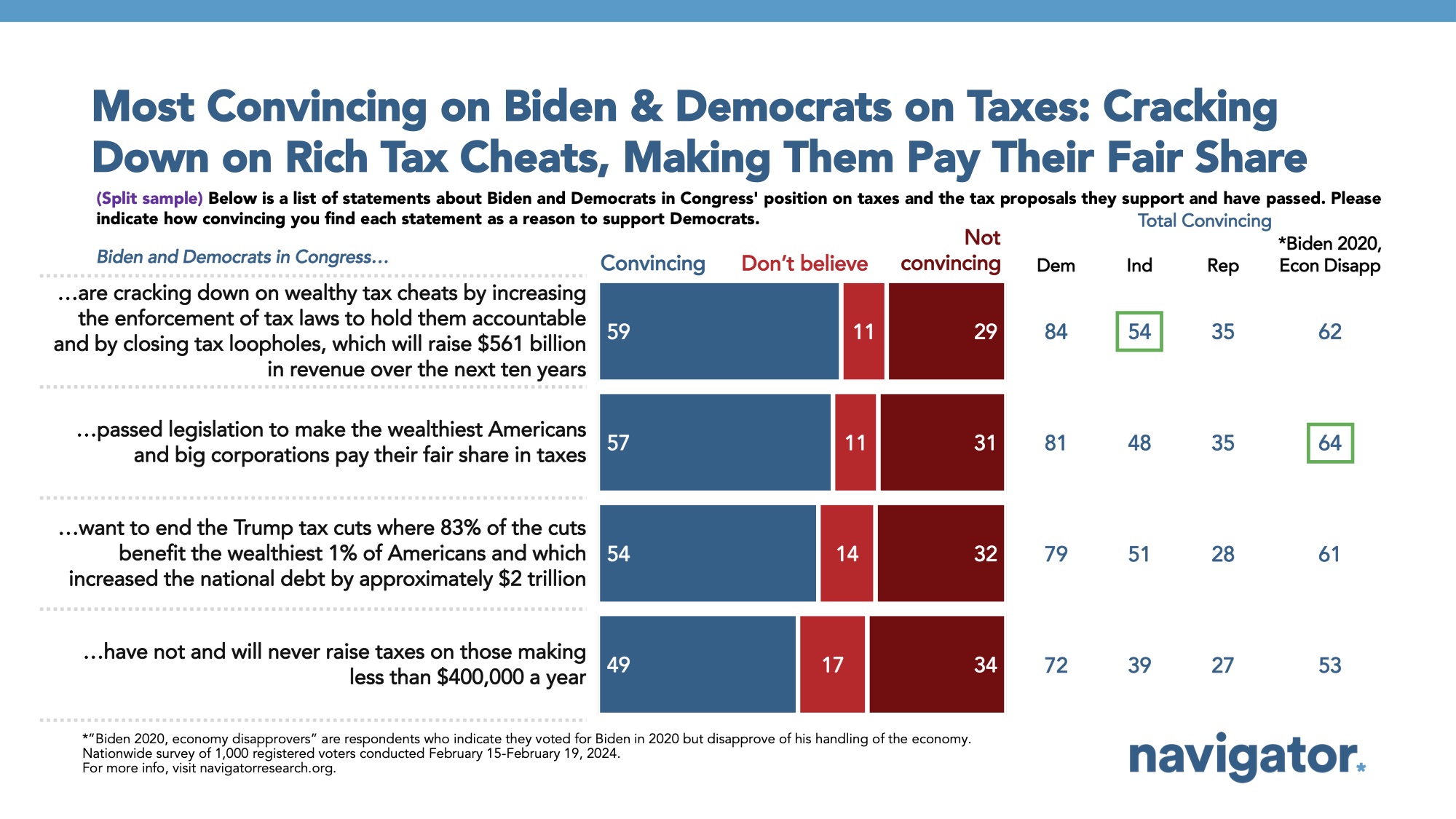

Cracking down on the wealthiest Americans is one of the most convincing statements regarding the Biden administration and Democrats in Congress’ approach to taxes.

Three in five find the statement that “[the] Biden [administration] and Democrats in Congress are cracking down on wealthy tax cheats by increasing the enforcement of tax laws to hold them accountable and by closing tax loopholes, which will raise $561 billion in revenue over the next ten years” to be convincing (59 percent, including 54 percent of independents). Similarly, 57 percent find the statement “[the] Biden [administration] and Democrats in Congress passed legislation to make the wealthiest Americans and big corporations pay their fair share in taxes” to be convincing, including 48 percent of independents.

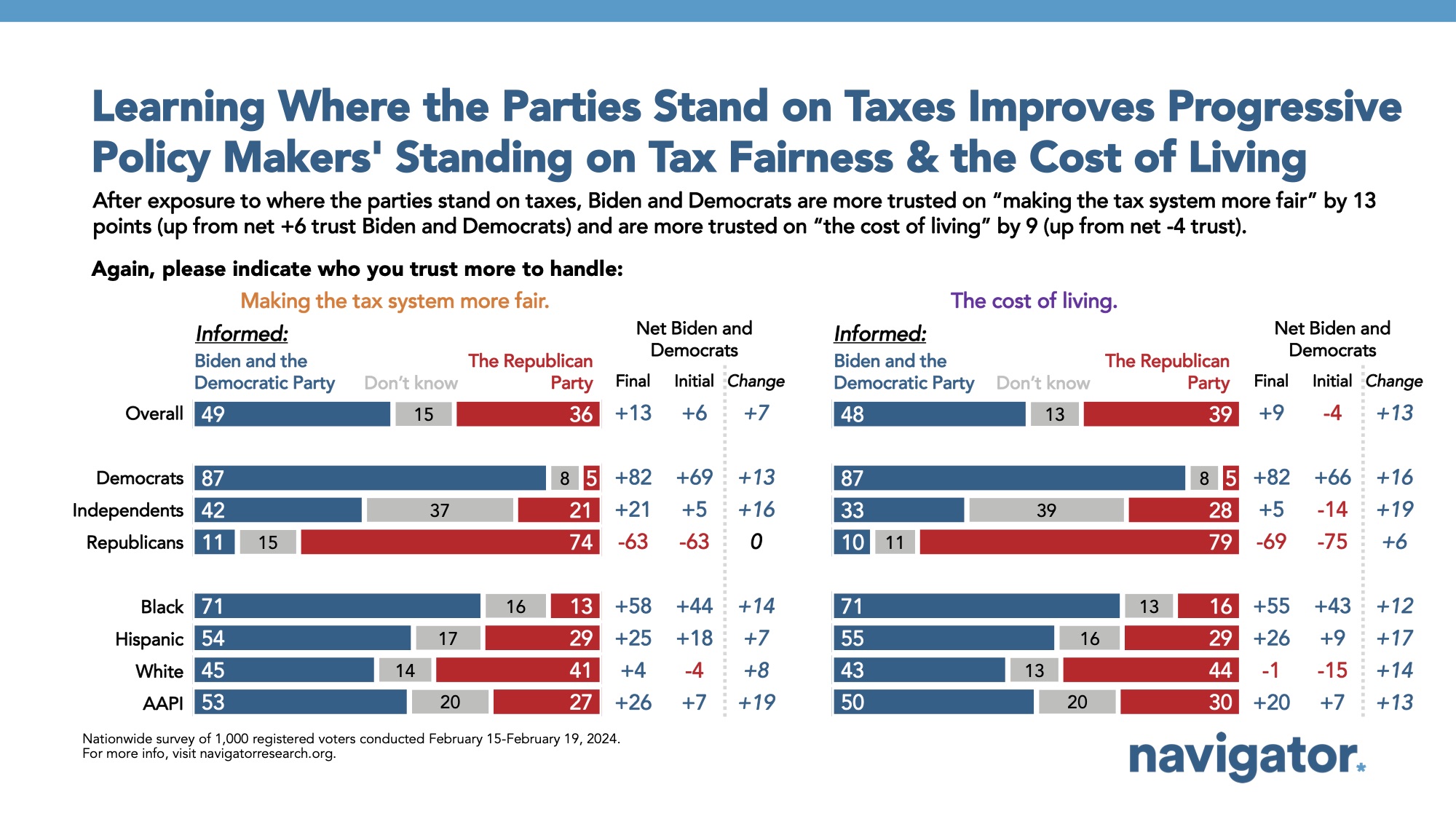

After exposure to the positions of the parties on taxes, trust increases in Biden and Democrats in Congress to handle the cost of living and to make the tax system more fair.

After learning more about tax policies proposed by Republicans and Democrats in Congress, proponents of progressive tax policy see increased trust to handle the cost of living and to make the tax system more fair. The Republican Party started this survey with a 4-point advantage over Biden and Democrats on trust to handle the cost of living (40 percent Biden/Democrats – 44 percent Republicans), while Biden and Democrats held a 6-point advantage in making the tax system more fair (42 percent trust Biden/Democrats – 36 percent trust Republicans). After reading about the positions of Democrats in Congress and Republicans in Congress on taxes, trust to handle the cost of living shifted a net 13 points toward Biden and Democrats (to 48 percent trust Biden/Democrats – 39 percent trust Republicans), while trust shifted toward Biden and Democrats by a net 7 points (to 49 percent trust Biden/Democrats – 36 percent trust Republicans).

About The Study

Global Strategy Group conducted public opinion surveys among a sample of 1,000 registered voters from February 15-February 19, 2024. 100 additional interviews were conducted among Hispanic voters. 75 additional interviews were conducted among Asian American and Pacific Islander voters. 100 additional interviews were conducted among African American voters. 100 additional interviews were conducted among independent voters. The survey was conducted online, recruiting respondents from an opt-in online panel vendor. Respondents were verified against a voter file and special care was taken to ensure the demographic composition of our sample matched that of the national registered voter population across a variety of demographic variables.