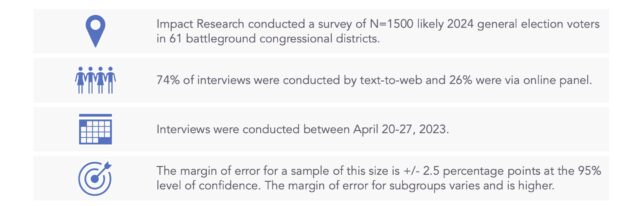

Methodology

Key Takeaways

- Persuadable battleground constituents are pessimistic on the state of the economy. Nearly half say the economy is “poor,” with day-to-day costs and government spending being their biggest concerns. Most also say that day-to-day costs are having a “major impact” on their personal financial situations.

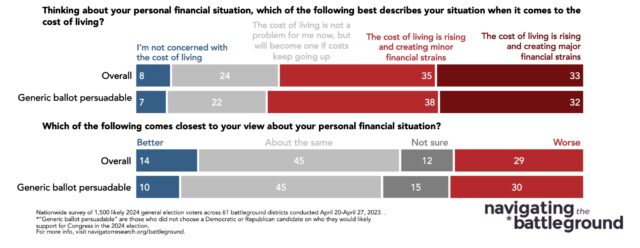

- The cost of living is causing financial strains. Seven in ten persuadables say the cost of living is causing a minor or major financial strains and 90 percent don’t see their financial situation getting better.

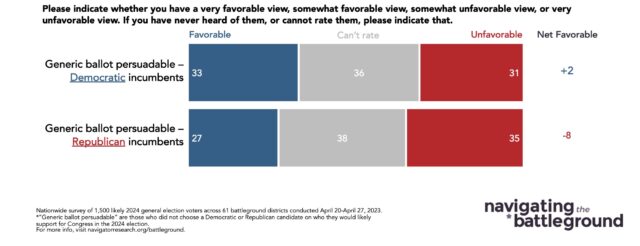

- Persuadables view Democratic incumbents more favorably than Republicans. They give Democratic incumbents positive personal and job ratings, while Republican incumbents are underwater.

- They also don’t think Republicans are prioritizing the right things. Over half say Republicans are prioritizing the wrong things, but they still trust Republicans more on economic metrics like growing the economy and bringing costs down.

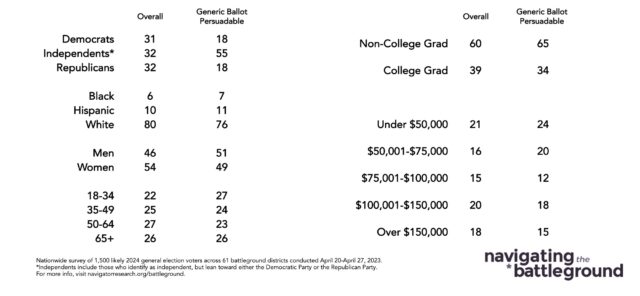

Demographic Profile of Persuadables in the Battleground

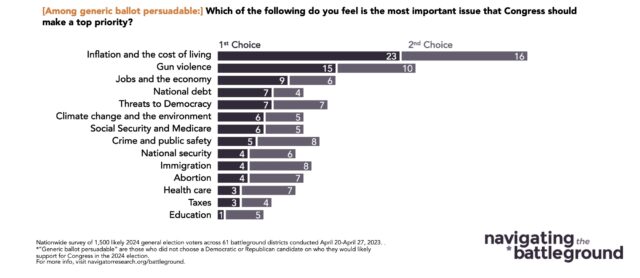

Inflation & Cost of Living is the Top Issue for Persuadables

Gun violence is the second most important issue among persuadable constituents (25% rate as one of their top two priorities).

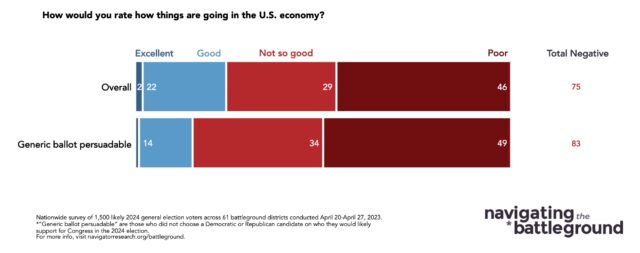

Nearly Half of Persuadables Say the Economy is “Poor”

Persuadable battleground constituents rate the economy more negatively than the overall electorate by 8 points.

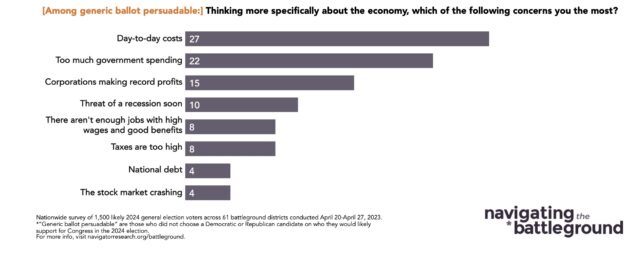

Day-to-Day Costs and Government Spending are the Biggest Concerns of Persuadables

Concerns about the national debt and the stock market crashing were among the least top-of-mind concerns for these constituents.

Persuadables Have a Personal Financial Situation Closely Mirroring the Overall Battleground

Persuadable constituents are slightly more pessimistic about their financial situation (net -20) than the battleground overall (net -15).

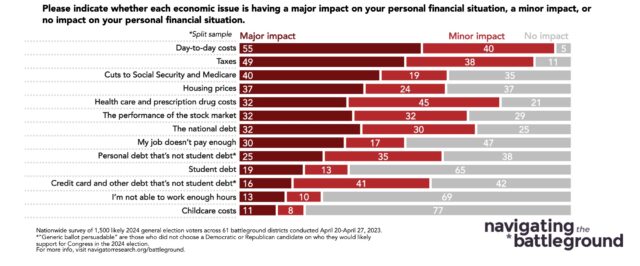

Day-to-Day Costs Top the List of Economic Issues Having a Major Impact on The Lives of the Persuadable

Taxes and cuts to Social Security and Medicare also have a major impact on persuadable constituents.

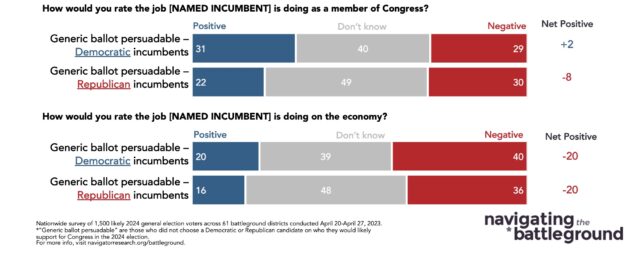

Persuadables Are More Favorable Toward Democratic Incumbents than Republican Incumbents

While Democratic incumbent ratings are evenly split, Republican incumbents are underwater by 8 points (27% favorable/35% unfavorable).

Persuadables Give Democrats a More Positive Approval Rating, While Both Parties Are Underwater on the Economy

Among persuadable constituents, while Democratic incumbents overperform Republican incumbents by net +10 on overall approval, both earn equal negative ratings on handling the economy (net -20).

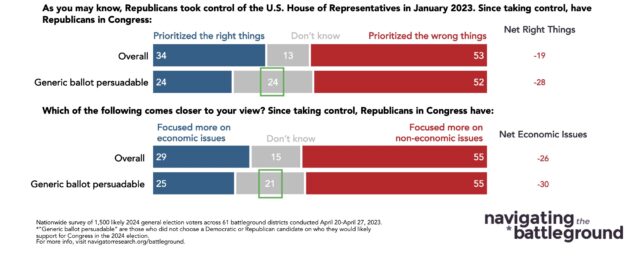

Majorities of Persuadables Say Republicans Are Prioritizing the Wrong Things; Have Focused More on Non-Economic Issues

About a quarter of persuadable constituents can’t say if Republicans are prioritizing the right or wrong things nor whether they’re focused on economic or non-economic issues.

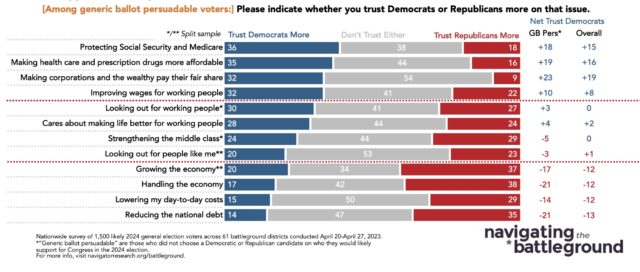

Pluralities of Persuadables Don’t Trust Either Party on Most Economic Attributes

Among persuadables, Republicans are more trusted on macroeconomic issues; Democrats are more trusted on more microeconomic ones.

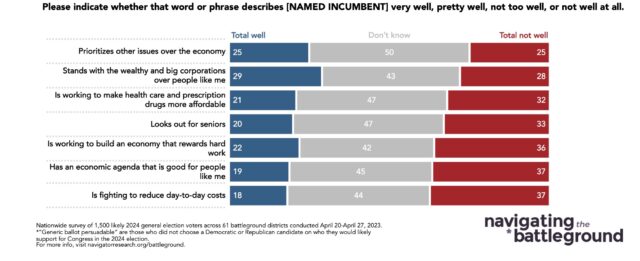

Pluralities of Persuadables Don’t Know Whether Economic Traits Describe Incumbents Well

Half of those in battleground districts say they don’t know whether “prioritizes other issues over the economy” describes their member of Congress well.

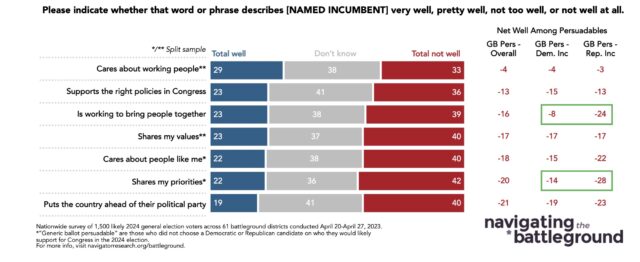

Persuadables Don’t Believe Republican Incumbents Share Their Priorities or Are Bringing People Together

Democratic incumbents are narrowly underwater on these traits, but Republican incumbents fare worse by net double-digit margins.

Appendix: Congressional Districts Included In Sample

About the Study

Impact Research conducted public opinion surveys among a sample of 1,500 likely 2024 general election voters from April 20-April 27, 2023. The survey was conducted by a mix of text-to-web (74 percent) and an opt-in, online panel (26 percent). Respondents were verified against a voter file and special care was taken to ensure the demographic composition of our sample matched that of the 61 congressional districts included in the sample across a variety of demographic variables. The margin of error for the full sample at the 95 percent level of confidence is +/- 2.5 percentage points. The margin for error for subgroups varies and is higher.