Focus Groups: The U.S. Tax System

This Navigator Research report contains findings from focus groups among soft partisans and independents in Michigan, Minnesota, and Virginia on how they view the tax system, including who benefits the most from tax policies, and how participants feel tax dollars are and should be spent.

Participants have noticed some improvements in the economy, but remain concerned about rising costs and housing.

Many reported seeing job growth and easing inflation as some of those improvements, including one Democrat in Virginia who was optimistic about the economy: “I think watching every day and watching the news and watching CNBC, it seems like job growth overall is at record highs and doing well…” An independent from Minnesota noted that the economy has been worse in past, making his view on the economy less negative: “Well, the economy, it’s been worse than it is now, so it’s kind of that, so-so. The job market, everything to me kind of seems to be kind in that so-so, in the middle. Looking back, there’s been times that I’ve known that it’s not going as well as it’s now, but I don’t think it’s going stellar right now either.” Another Democrat from Virginia also said: “I think the economy is the best thing we have going [in the country]. Job rates are high and people are spending money. And housing prices are high, which is, I don’t know, bad or good or whatever, but it seems to me that people are still buying them.”

- Despite some optimism, several had concerns about the effects of rising costs and are skeptical of the quality of jobs available. An independent in Michigan noted: “I think there’s jobs available… the unemployment rate is down. Only issue I see now is inflation. Like okay, people have jobs and people are making decent money, but with the price of every single thing going up, it makes it almost kind of hard to make it feel like it’s an even keel.”

- Some participants both viewed the economy optimistically but continued to have concerns about specific costs like rising housing costs, including a Republican in Virginia who said: “And overall it’s true, the economy’s doing well overall. I just think that some other fields are still recovering and the housing market, it’s getting really inaccessible for a high percentage of the population.”

Participants felt anxiety about tax season, with many feeling that filing their federal taxes was overly complicated.

Most participants had already filed their taxes at the time of these groups. One Michigan Republican said: “It’s… anxiety-inducing because obviously you don’t know if you’re going to get money back or you’re going to have to owe money.” Participants also communicated their confusion about how taxes work. A Virginia Democrat said: “The tax code is just so antiquated and convoluted and complicated unnecessarily, and it just needs to be simplified… I’m so confused because there’s so many forms, and you have no idea what’s going on.”

The tax system is seen as unfair, benefiting the ultra wealthy and corporations and putting the tax burden on the middle class.

Participants expressed that the tax system is constructed to allow the wealthy and corporations to pay fewer taxes and take advantage of the system, including a Democrat from Michigan: “The tax system is set up to benefit those who make more money… I feel like if you make less money, you end up, percentage-wise, paying more taxes. I just want everyone to pay their fair share.”

- Participants believed the wealthy use loopholes to pay less than their fair share because they have advantages in navigating the tax system while those in the middle class lack such an advantage and are left frustrated. A Republican participant from Virginia said: “I think the big corporations and that one percent that they’re talking about [don’t pay their fair share], just because they pay people that know their way around taxes and they know what they do unlike the middle class that have to do their own taxes.”

- Concerns for the middle class bearing the brunt of taxes were prevalent, including one Michigan independent stating: “I think the middle class and the lower class people [are being screwed], but primarily the middle class people because it just seems like a lot of the burden falls on us.” A Virginia Democrat also said: “It seems like the ultra-wealthy should be paying a lot more in taxes. It’s almost like the middle class is kind of disappearing from this country in the traditional way it used to be.”

Many view eradicating special influence, taking money out of politics, and increasing transparency as solutions to an unfair tax system.

Participants largely believed that political special interests have allowed an unfair tax system to flourish. One Michigan Republican said: “There’s definitely people who get tax cuts and breaks for their status and what they do, and just people they know. So it’s definitely like a game, there’s no doubt about that.” Many said the solution to the unfair system is taking money out of politics and promoting transparency, including a Democrat from Michigan who said: “I think that taking money out of politics would affect the economy quite a bit. When decisions from the government aren’t coming from private corporations via lobbies and things like that, I think that’s a huge problem.” An independent from Minnesota also referred to the need for transparency in the tax system, saying: “I was thinking that it would help definitely for tax and the taxation process and also how and where the taxes are used. If that were more transparent.”

- On the topic of what the government could do to improve the economy, one Michigan independent said: “Reduce corporate influence over politics. So less influence through lobbying and super PACs and money.” While eradicating special interests and increasing transparency were salient themes in fixing the tax system, many participants could not offer specific solutions on what they thought would fix the tax system.

Participants were largely unfamiliar with the Biden administration’s tax policies, but viewed them positively when they learned more about the policies.

While participants were unable to recall many specifics of President Biden’s tax plans, many brought up that he wants to tax the wealthy and corporations, including a Virginia Democrat who said: “I don’t know all the details, but I think the plan is Biden wants to increase, again, increase taxes on billionaires and the ultra wealthy and raise the tax rate for them.” Some had heard of the Child Tax Credit when provided with more information, with one Democrat from Virginia expressing support for the policy, but also concern about how it would be funded: “I actually have heard [of the child tax credit], and I think it is investing in our future to support something like this. It does seem like a positive proposal. But again, how do we pay for it considering the debt that we’re in as a country?”

- Some who have heard of President Biden’s tax policies are skeptical because they feel as though they have not seen any of them take effect. An independent from Michigan stated: “I feel like I’ve heard false promises… like reducing a tax burden on lower socioeconomic classes, but I really haven’t really seen or noticed any effect or seen any sort of legislation passed to reduce tax burden.”

- When presented with President Biden’s proposed policy of “twenty-five percent tax on billionaires’ wealth and cracking down on tax evasion,” an independent from Michigan said he was familiar and supportive: “Yeah, I’ve heard it… well, I think if people are cheating with the current tax law, then they need to be held responsible and they need to pay the money that they’re owed with the current rules and regulations as they are.”

The Trump tax cuts remembered more fondly initially than when the details are reintroduced.

Participants were more familiar with — and initially positive toward — the Trump tax cuts, but when provided with more information, many believe they are harmful to the middle class and more for Trump’s own self interest. More participants were familiar with the Trump tax cuts than the Biden administration’s record on taxes, with some believing they paid less under Trump. One Republican from Minnesota recalled her experience under Trump as: “I remember I paid less tax. I got more [in my] tax return when he was around.” After being presented with more information about the Trump tax cuts, many felt corporations and the wealthy were the main beneficiaries. A Michigan Democrat said: “He’s a businessman, so I think he’s going to work toward trying to cut the tax because he doesn’t want to pay his fair share of how much he’s bringing in.”

- Some participants believed Trump’s tax cuts were just about his own self interest, including an independent from Michigan who said: “Like, okay, he didn’t pay his own taxes. He’s put these laws into place, but I think he did it because of this. I think he did it because of that. The reality is he did it to benefit himself and those of his counterparts, and he’s continuing to do it.”

- One independent from Michigan also expressed how difficult it was to know what policies — on taxes or otherwise — were implemented under the Trump administration: “I wasn’t able to pay attention to any of the administrative or any sort of policies that were enacted with Trump because it was like watching a dumpster fire reality TV show… the reality TV show that he was running made it impossible to pay attention to policies that he was enacting or not enacting.”

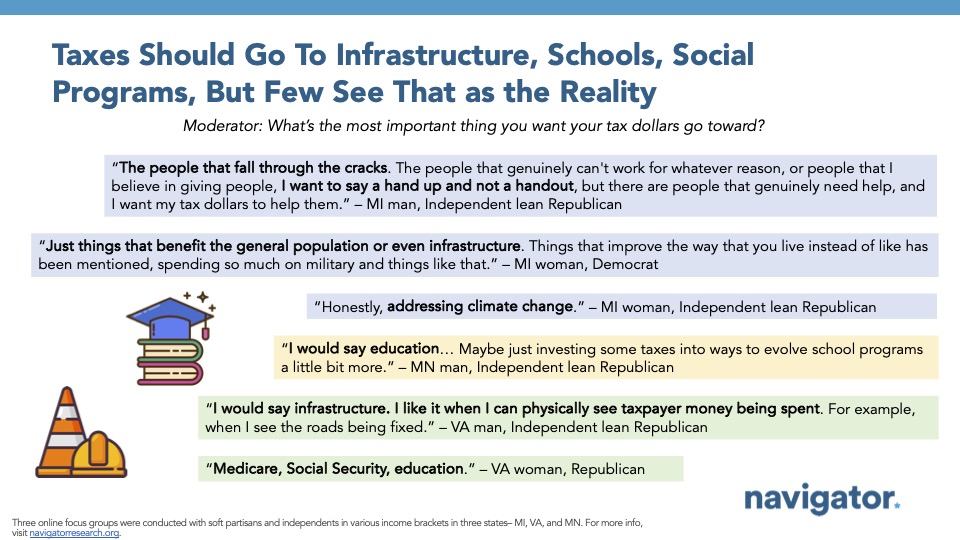

Taxes should go toward infrastructure, schools, and social programs, but the perceived reality is different.

Participants said they wanted more focus of government spending to be on domestic investment, including one Republican from Michigan who said: “I think reducing government spending, especially abroad, where it would allow us to focus more at home and bring our tax rates down, which would put more money in my pocket.” Another Republican from Michigan stated that while they supported helping other countries, they also wanted to make sure our tax dollars were prioritizing those in need domestically: “Start focusing on what’s going on at home first. And let me be clear, I have no problem with the U.S investing and helping in other countries. I think it’s one of the greatest things about this country is we help others out… but when it comes to the end of the day, we need to take care of the people that are at home first.” When asked about the top priorities they viewed for how their tax dollars were being spent, participants had a wide range of answers:

- A Republican from Michigan said his tax dollars would best be spent on “…the people that fall through the cracks. The people that genuinely can’t work for whatever reason, or people that I believe in giving people, I want to say a hand up and not a hand out, but there are people that genuinely need help…”

- Similarly, a Democrat from Michigan said she would like her tax dollars spent on “just things that benefit the general population or even infrastructure… things that improve the way that you live instead of like has been mentioned, spending so much on military and things like that.”

- Education was mentioned as a best use for tax dollars, with one independent from Minnesota saying: “I would say education… maybe just investing some taxes into ways to evolve school programs a little bit more.”

- A Republican from Virginia also said: “Medicare, Social Security, education.”

- An independent from Michigan said she would like her tax dollars going towards “…addressing climate change.”

About The Study

GBAO conducted three online focus groups April 4, 2024 with soft partisans and independents in various income brackets in three states– MI, VA, MN . Some quotes have been lightly edited for brevity. Qualitative results are not statistically projectable.