Key takeaways

-

Biden and Democrats are more trusted to handle working families’ costs and to look out for children’s best interests.

-

Most Americans view the Child Tax Credit favorably as more than half now know someone who has received it.

-

Framing the Child Tax Credit either as reducing the financial burden on working families – or that ending it will make it harder for families to make ends meet – are convincing arguments.

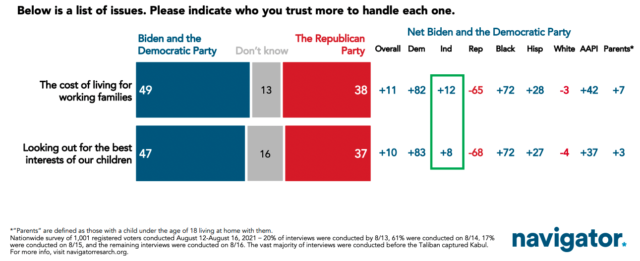

On Family Costs and Looking out For Best Interests of Children, Biden and Democrats More Trusted than Republicans

Among independents, Biden and the Democratic Party have a 12-point trust advantage to handle the cost of living for working families, with an 8-point trust advantage on looking out for the best interests of children.

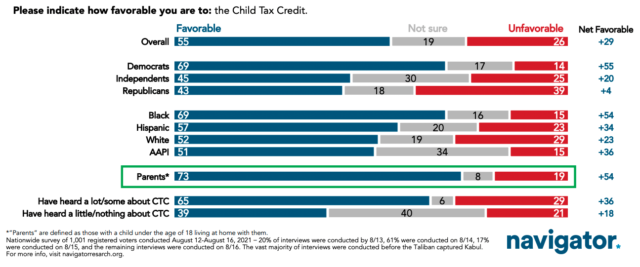

Majority of Americans View the Child Tax Credit Favorably

Among parents, nearly three in four have a positive view of the Child Tax Credit.

- Across party lines, Democrats (+55), independents (+20), and Republicans (+4) all have a net favorable opinion of the Child Tax Credit.

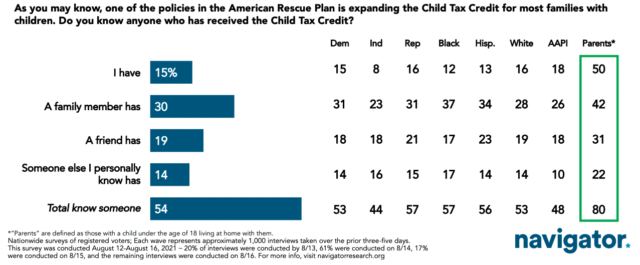

Half of Parents Report Receiving the CTC, as the Majority of Americans Now Say They Know Someone Who Has

Half of Parents Report Receiving the CTC, as the Majority of Americans Now Say They Know Someone Who Has

Nearly one in five Americans overall report receiving the Child Tax credit, while a majority say they know someone who has; among parents, half have received the Child Tax Credit, and four in five know someone who has.

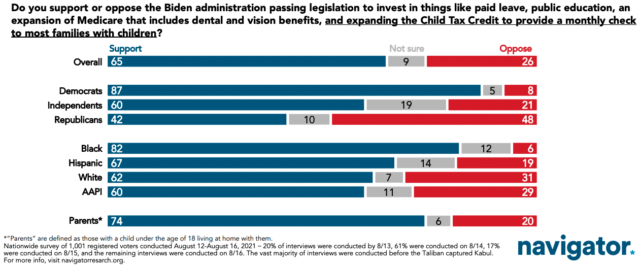

Two in Three Americans Support Biden’s Economic Investment Agenda, Including the Expanded Child Tax Credit

Two in Three Americans Support Biden’s Economic Investment Agenda, Including the Expanded Child Tax Credit

Three in five independents support public investment from the Biden administration (60%), as do three in four parents (74%).

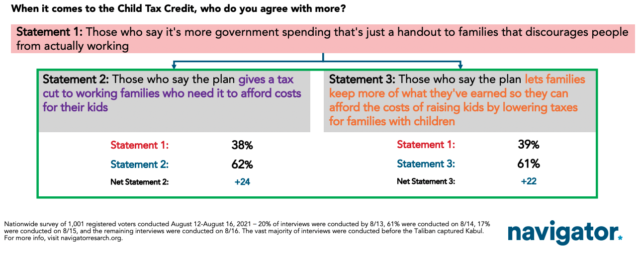

Framing CTC as a Tax Cut for Working Families Bests Conservative “Handout” Messaging

Framing CTC as a Tax Cut for Working Families Bests Conservative “Handout” Messaging

Progressive framing of the Child Tax Credit as a “tax cut for working families” and as a plan to put more money in families’ pockets by letting them keep “more of what they’ve earned” by “lowering taxes” are both more compelling than the conservative argument that it is a “handout” that “discourages people from actually working.”

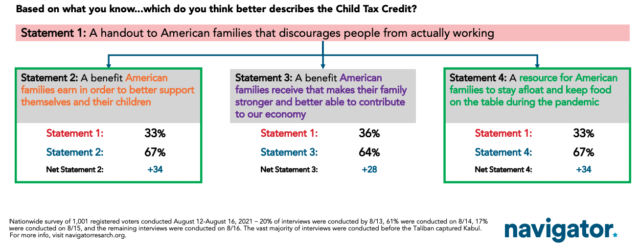

Americans View Child Tax Credit as Something “Earned” to “Support Children” and “Stay Afloat”

Americans View Child Tax Credit as Something “Earned” to “Support Children” and “Stay Afloat”

Again, Americans are not compelled by conservative language calling the Child Tax Credit a handout: more Americans find language of a benefit that is earned to help families better support themselves and their children and as a resource to help families keep food on the table most effective, followed by a benefit to make families stronger.

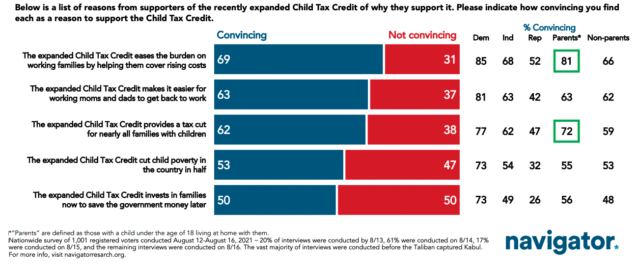

Easing the Burden on Families, Helping Parents Get Back to Work, and Tax Cuts Are Most Effective Positive CTC Frames

Easing the Burden on Families, Helping Parents Get Back to Work, and Tax Cuts Are Most Effective Positive CTC Frames

A bipartisan majority find easing “the burden on working families” to cover rising costs convincing, including 66% of non-parents. A majority of parents find each message convincing as a reason to support the Child Tax Credit.

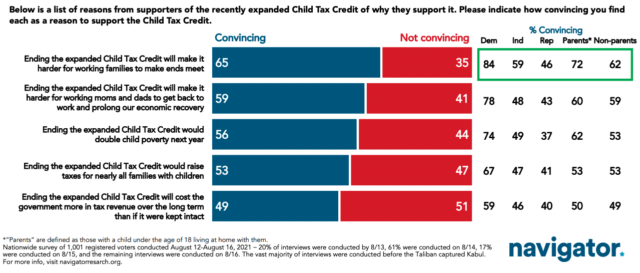

The Threat of Making It Harder for Families to Make Ends Meet Is Most Compelling Consequence of Ending CTC

The Threat of Making It Harder for Families to Make Ends Meet Is Most Compelling Consequence of Ending CTC

A majority of Democrats, independents, non-parents, and parents find messaging about how ending the expanded CTC will make it harder for families to make ends meet convincing, as do a plurality of Republicans.

About The Study

This release features findings from a national online survey of 1,001 registered voters conducted from August 12-August 16, 2021. 102 additional interviews were conducted among Hispanic voters. 66 additional interviews were conducted among Asian American and Pacific Islander voters. 101 additional interviews were conducted among African American voters. 100 additional interviews were conducted among independent voters.