As Congress continues to conduct its critical oversight functions, the Trump administration has been increasingly antagonistic toward fulfilling requests and subpoenas. Following a week where Trump proclaimed, “we’re fighting all the subpoenas,” progressives need to be equipped to win important arguments about transparency, the rule of law, and government oversight. To this end, our new survey focused on messaging guidance on two key fronts: the Mueller Report and Trump’s tax returns.

The Mueller Report revealed wrongdoing, but Americans are divided on the extent and seriousness of Trump’s misdeeds

In the weeks following the public release of the Mueller Report, one thing is clear: a majority (56%) believe the report revealed President Trump engaged in wrongdoing, while only 21% believe he was totally exonerated (another 23% don’t know). Even among Republicans, of whom 86% approve of the president’s job performance, just 44% believe that Trump was exonerated. And among Americans who have heard a lot or some about the report (72%), the percentage who believe Trump committed wrongdoing rises to 65%. This may inform the public’s strong inclination to side with Democrats in Congress on oversight and related issues:

- Americans trust congressional Democrats over President Trump by 13 points (46% to 33%) when it comes to “the rule of law” and by 9 points (42% to 33%) when it comes to “government transparency.”

- By 6 points (48% to 42%), Americans continue to be more concerned that the Trump administration will get away with corruption and unethical behavior more so than Democrats going too far in oversight.

While most think Trump engaged in some wrongdoing, the public is somewhat divided on the extent and seriousness of it: 17% believe the report showed wrongdoing but conclusively did not show criminality, 29% believe the report was inconclusive on criminality, and 9% believe it recommended he should be charged with crimes.

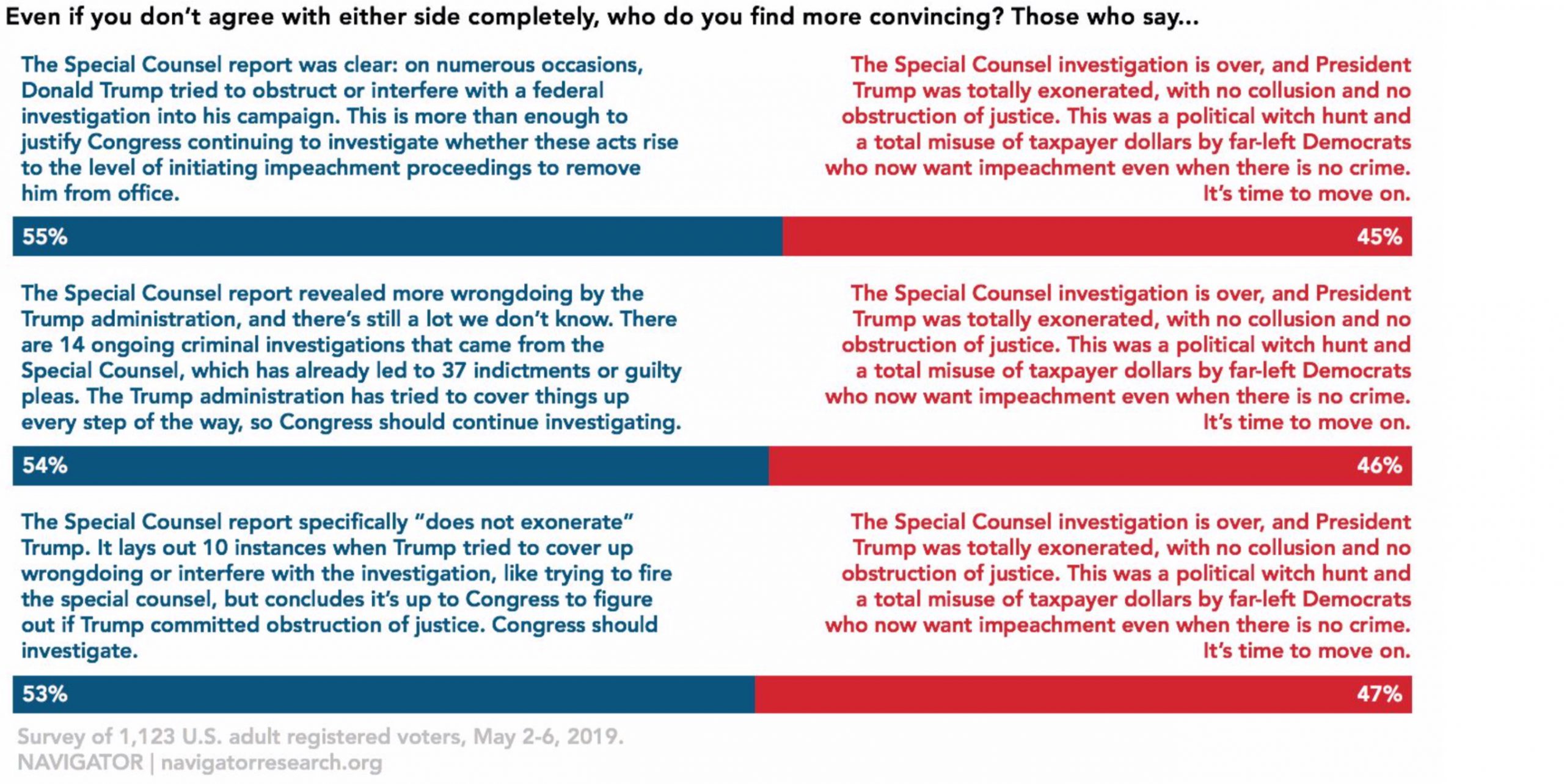

Navigator looked at several potential frameworks progressives can use to defeat the conservative argument that the investigation was a political witch hunt wasting taxpayer money while exonerating Trump. Each progressive argument tested beats back conservative counters by six to 10 points, regardless of whether the focus of the argument is further investigating instances of potential obstruction outlined in the report, enumerating the ongoing investigations that started from the Special Counsel’s work, or emphasizing the number of illicit contacts between the Trump campaign and Russians. Even an argument calling for continued congressional investigation to determine whether the President’s actions rise to the level of initiating impeachment proceedings wins by a 55% to 45% margin, suggesting the mere mention of impeachment proceedings does not deter most Americans from saying it is necessary for Congress to continue their investigations.

When making the case for continued inquiry into matters identified by the Mueller Report, it is important for progressives to remind the public that compelling evidence of obstruction has already been uncovered and needs further examination.

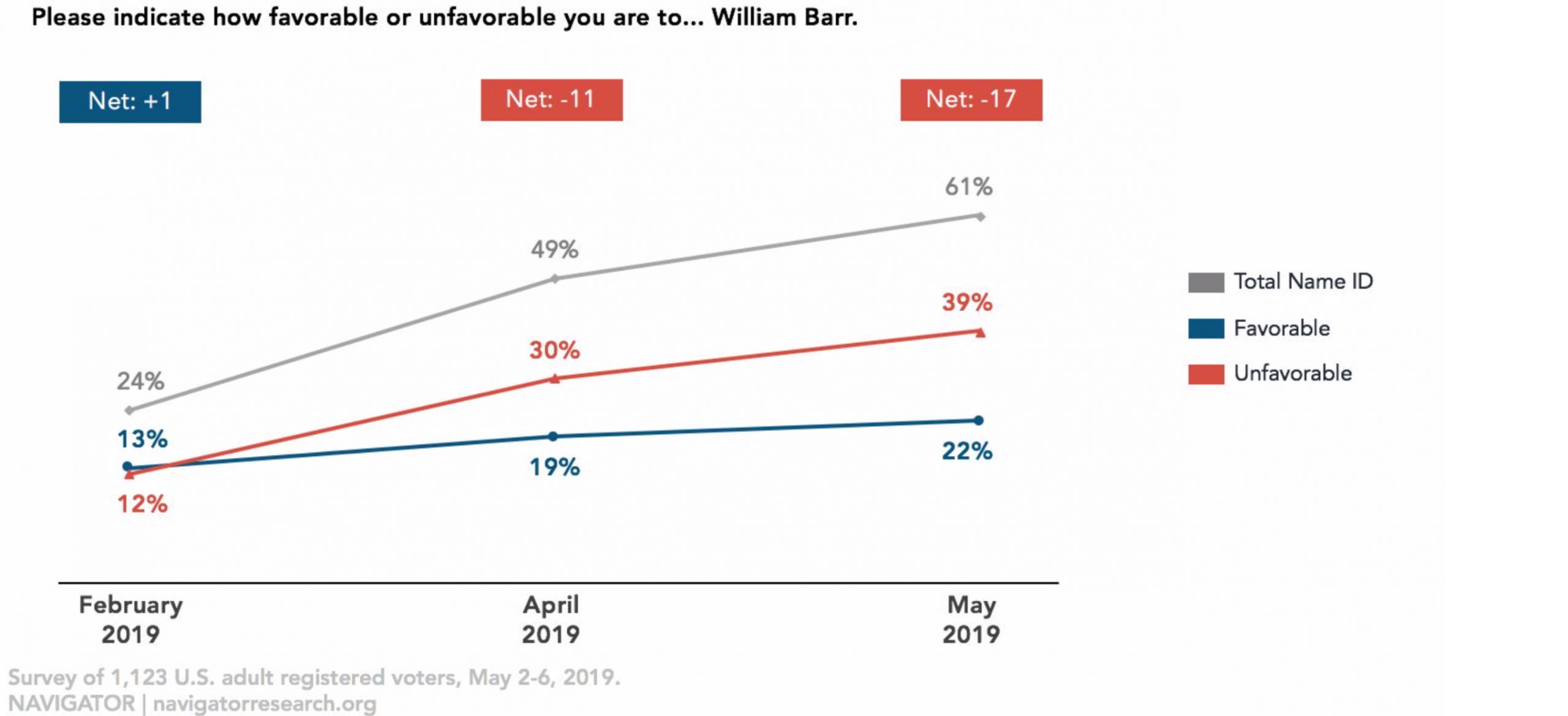

It’s not just regarding the investigation itself that Americans side with progressives. The public has not responded well to Attorney General William Barr or his handling of the release of the report.

- Barr has become better known and less popular. In just three months’ time, the percentage of Americans familiar with Barr has increased from 24% to 61%. Yet his unfavorability has increased significantly more (12% in February to 39% now) than his favorability (13% in February to 22% now).

- Only 31% approve of the way Barr has handled the public release of the Mueller Report, compared to 44% who disapprove.

- Mueller’s version of events is more trusted than Barr’s by a 39% to 21% margin, expanding to 47% to 16% when Barr is described as “Trump’s Attorney General.”

Given the Attorney General’s personal unpopularity, progressives may benefit from criticizing his handling of the release to bolster the importance of continued investigations.

Americans want Congress to obtain Trump’s tax returns: it’s about knowing who the president really is, and where he gets his money

Despite the president’s continued refusal, the public supports congressional action to obtain Trump’s tax returns. Overall, 58% support Congress’ efforts while only 30% disapprove.

- Notably, there is plenty of intensity in favor of Congress obtaining his returns, and not much intensity on the other side: 41% strongly support Congress obtaining them; only 17% strongly oppose.

The president has argued that he cannot release his taxes because he is under audit, but Americans across the political spectrum believe it is more about Trump protecting personal interests that run counter to what’s best for the country.

- Asked what Trump’s actual motivations are for withholding the returns, 63% expect his returns will reveal unflattering information about the president. Specifically, the public expects his returns will reveal he has committed tax fraud (39% place this in the top two), he has paid little to no taxes (27%), he has financial ties to Russia (17%), he is not as rich as he says he is (15%), or that he does not contribute much to charity (3%).

- Only (21%) believe Trump’s audit explanation is among the top reasons for not releasing his returns. Even among Republicans, only 37% cite the audit in their top two suspected motivations.

- Americans’ concerns about what is in Trump’s tax returns align with their theory on why he is concealing them, with the most concerning issues revolving around the potential of tax fraud or other crimes (37%) or the president having paid little to no taxes (30%).

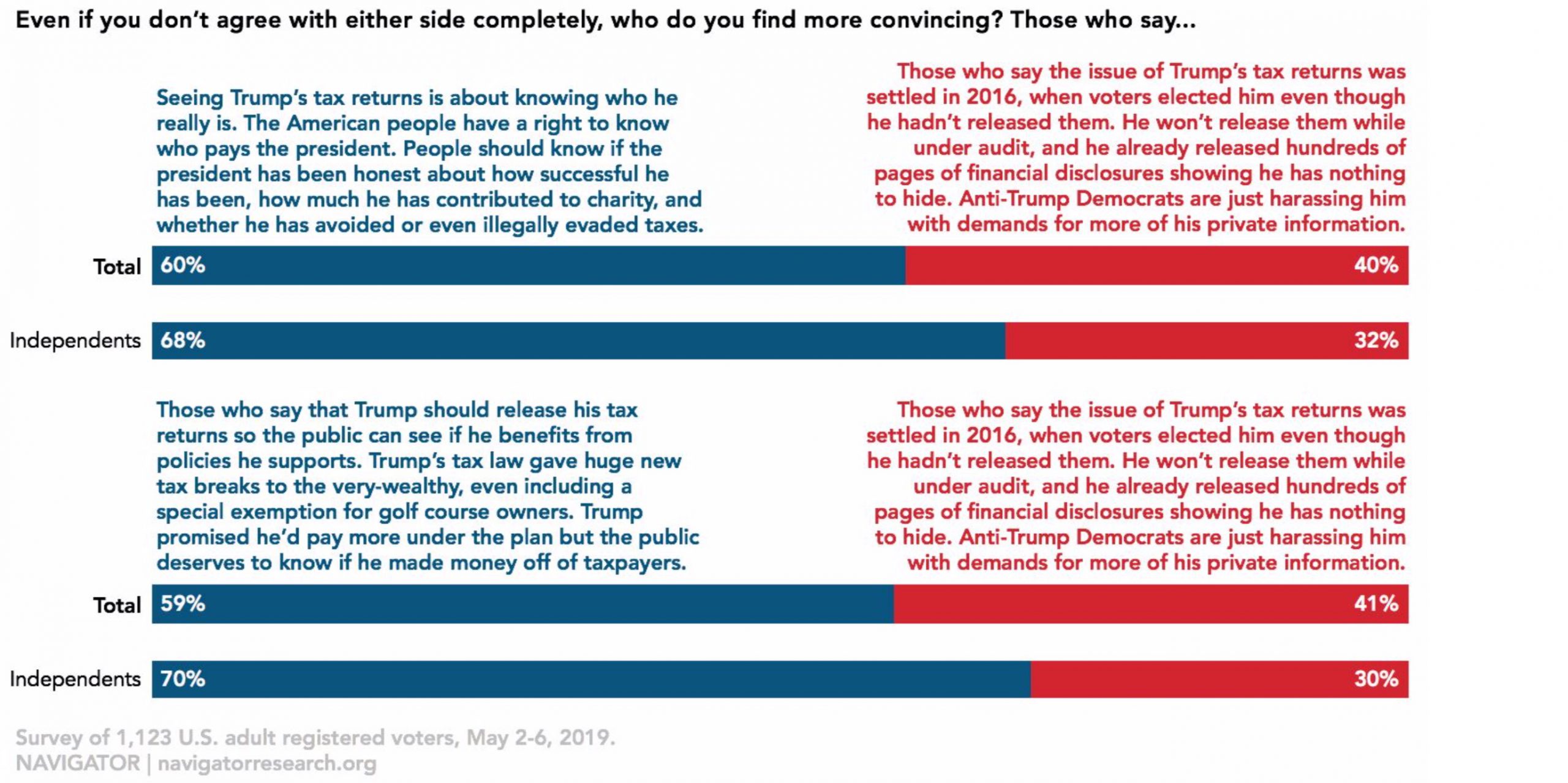

Progressives are well-stocked with potential arguments to further this debate. The most important points of emphasis for advocates: always remind the public that revealing Trump’s tax returns is, first and foremost, about transparency that serves the public interest.

- A progressive argument focusing on the public having “a right to know who pays the president” and “if the president has been honest about how successful he has been, how much he has contributed to charity, and whether he has avoided or even illegally evaded taxes” bests the conservative counter-argument by 20 points (60% to 40%; 68% to 32% among independents).

- A similar argument focused on needing to know whether Trump has personally benefited from his policies bests the opposition’s counter-argument 59% to 41% (70% to 30% among independents).

While progressives can win an argument about Trump’s tax returns on the national security implications of his ties to Russia and Saudi Arabia, the message invoking foreign interests is less effective overall (53% support the progressive argument versus 47% siding with Trump’s message; it also loses to the conservative argument among independents 44% to 56%).

A separate Navigator language test suggests progressives should leverage public distrust of Trump’s motivations when describing his decision to conceal his tax returns. Most Americans say they interpret Trump’s actions as “suspicious” (42%), a “cover up” (33%), or “secretive” (28%). At the same time, it would be premature to describe the president’s actions as “corrupt” (28% overall, but only 8% among non-Democrats) or “criminal” (15%).

The bigger picture: Donald Trump has a serious credibility issue with the public

Previous research by Navigator1 and other public polling outlets2 has shown most Americans are deeply skeptical of President Trump’s honesty as well as the motivations behind the lies. This is important context for this edition’s findings: when it comes to the Special Counsel’s investigative findings or Trump’s tax returns, most Americans are receptive to progressive arguments focusing on honesty, accountability, and transparency. Progressives are well-positioned to claim the mantle of protecting the public interest when engaging in these debates and can contrast themselves with a president more interested in protecting himself.

1 Navigator Research national survey conducted January 28-31, 2019 among 1,116 registered voters.

2 Quinnipiac University national survey conducted March 1-4, 2019, among 1,120 registered voters.