Poll: Taxes in the Battleground

This Navigator Research report contains polling data on support for raising taxes on billionaires and big corporations, support for a variety of tax reform policies, and how to communicate against making the Trump tax cuts permanent.

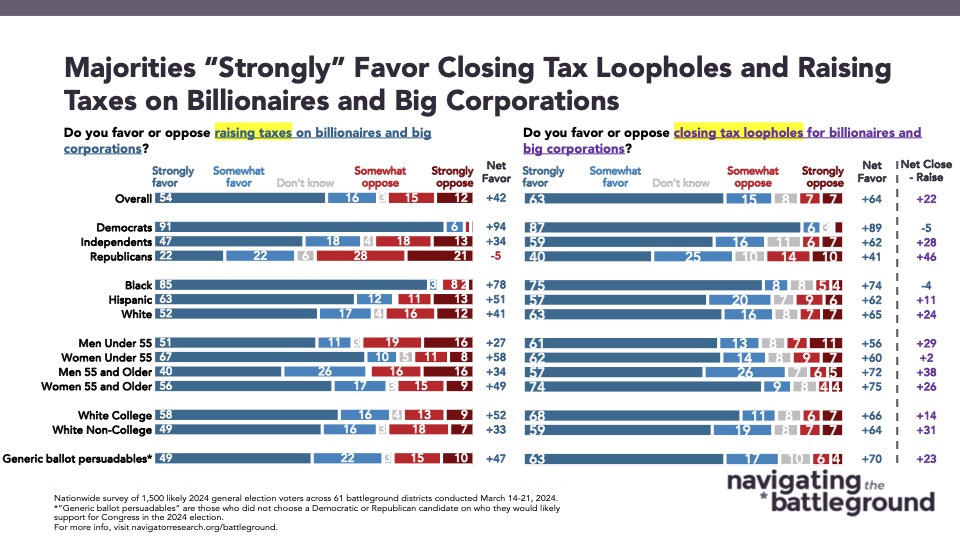

Seven in ten Americans in battleground districts support raising taxes on billionaires and big corporations, and nearly four in five support closing tax loopholes on them.

By 43 points, battleground constituents support raising taxes on billionaires and big corporations (70 percent favor – 27 percent oppose, including 54 percent who are “strongly” supportive). Support extends across partisanship, including nearly universal support among Democrats (96 percent), two in three independents (65 percent), and nearly half of Republicans (45 percent). Support is even stronger when framed as closing tax loopholes for billionaires and big corporations (net +64; 78 percent favor – 14 percent oppose, including 63 percent who “strongly” support).

- Seven in ten Americans living in Trump-won Republican districts support closing tax loopholes for billionaires and big corporations (69 percent), as do two in three Americans who feel the economy is doing poorly (63 percent).

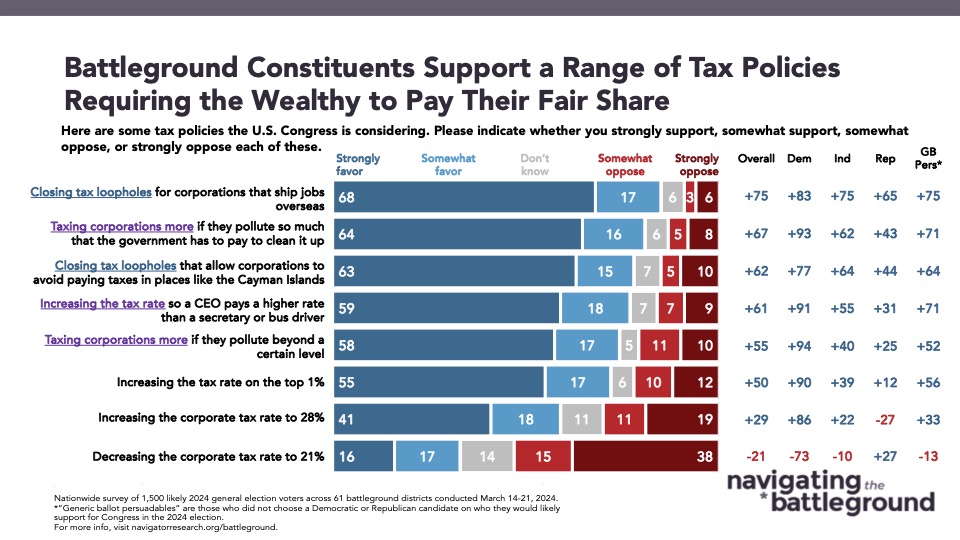

Support for tax policies is strongest when framed around addressing bad actions by corporations, including shipping jobs overseas, polluting, and tax evasion.

84 percent of Americans support closing tax loopholes for corporations that ship jobs overseas, including nine in ten Democrats (90 percent), over four in five independents (84 percent), and nearly four in five Republicans (78 percent). Other broadly supported tax reforms include “taxing corporations more if they pollute so much that the government has to pay to clean it up” (net +67; 80 percent support – 13 percent oppose), “closing tax loopholes that allow corporations to avoid paying taxes in places like the Cayman Islands” (net +62; 78 percent support – 16 percent oppose), “increasing the tax rate on the top 1 percent” (net +50; 72 percent support – 22 percent oppose), and “increasing the corporate tax rate to 28 percent” (net +29; 59 percent support – 30 percent oppose).

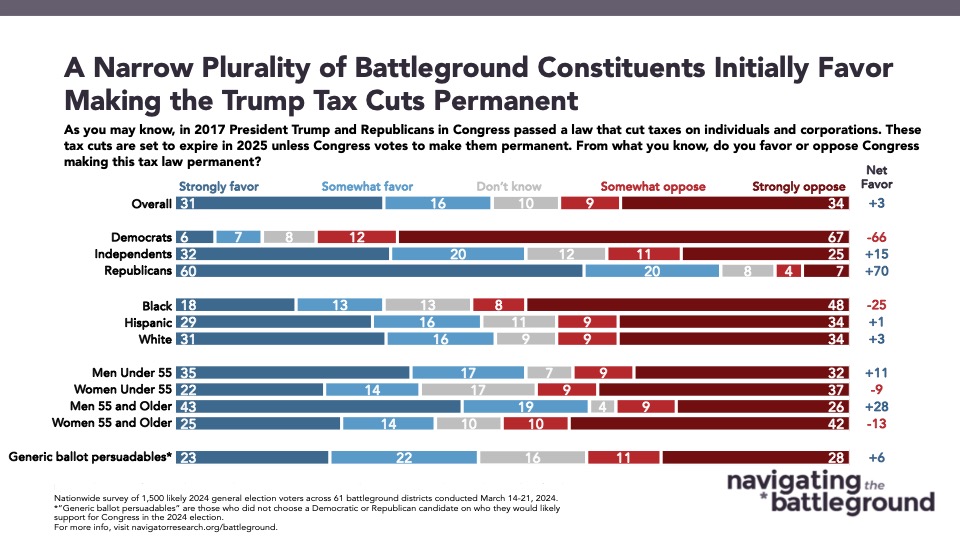

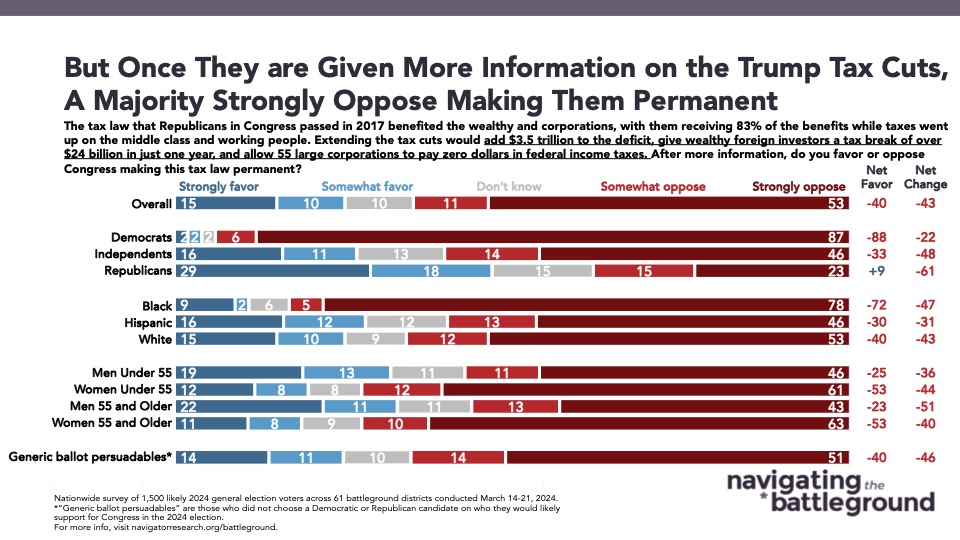

While battleground constituents are initially split on whether they support or oppose extending the Trump tax cuts, two in three oppose making these tax cuts permanent after learning more about them.

In an initial ask framed as “…President Trump and Republicans passed a law that cut taxes on individuals and corporations… [that] are set to expire in 2025 unless Congress makes them permanent,” battleground constituents start off nearly evenly split on whether these tax cuts should be made permanent (net +3; 46 percent support – 43 percent oppose). However, opposition grows to nearly two in three Americans when given the context that these tax cuts “…benefited the wealthy and corporations, with them receiving 83 percent of the benefits while taxes went up on the middle class and working people” and that extending the tax cuts beyond 2025 “would add $3.5 trillion to the deficit, give wealthy foreign investors a tax break of over $24 billion in just one year, and allow 55 large corporations to pay zero dollars in federal income tax” (net -40; 25 percent favor – 65 percent oppose).

- With this added context, independents become deeply unfavorable to making these tax cuts permanent (net -33; 27 percent favor – 60 percent oppose), including 46 percent who are “strongly” opposed to extending these tax cuts. Net support among Republicans in the battleground fell significantly after learning more about making these tax cuts permanent (from net +70 to just net +9) and were also opposed by more than three in five constituents living in both Trump-won GOP districts (net -44; 24 percent support – 68 percent oppose) and Biden-won GOP districts (net -35; 27 percent support – 62 percent oppose).

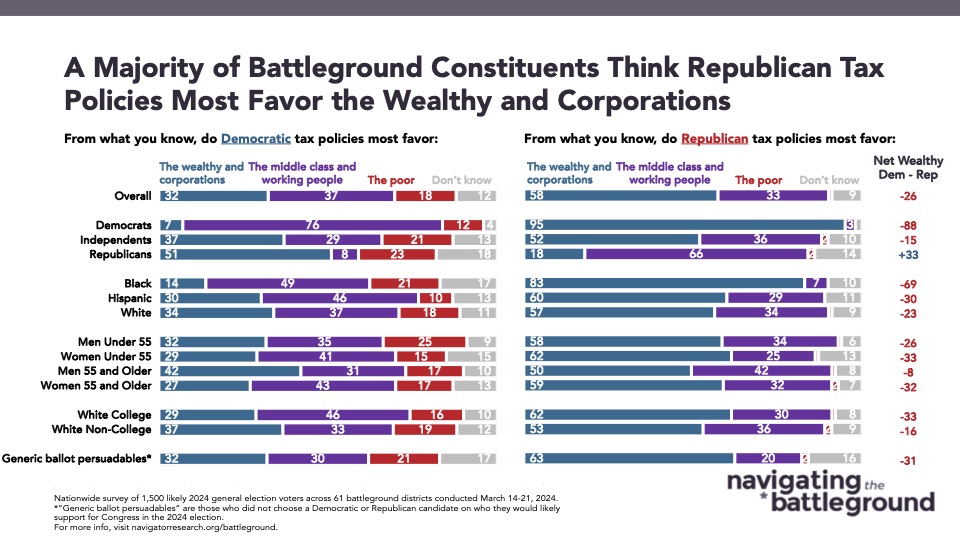

- By a 25-point margin, more battleground constituents think that Republican tax policies favor the wealthy and big corporations as opposed to the middle class and working people (33 percent middle class/working people – 58 percent wealthy/corporations). Conversely, a narrow plurality believe Democratic tax policies favor the middle and working class by 5 points (37 percent the middle class/working people – 32 percent wealthy/corporations).

By double-digit margins, a majority of battleground constituents agree that lowering taxes on corporations hurts the middle class.

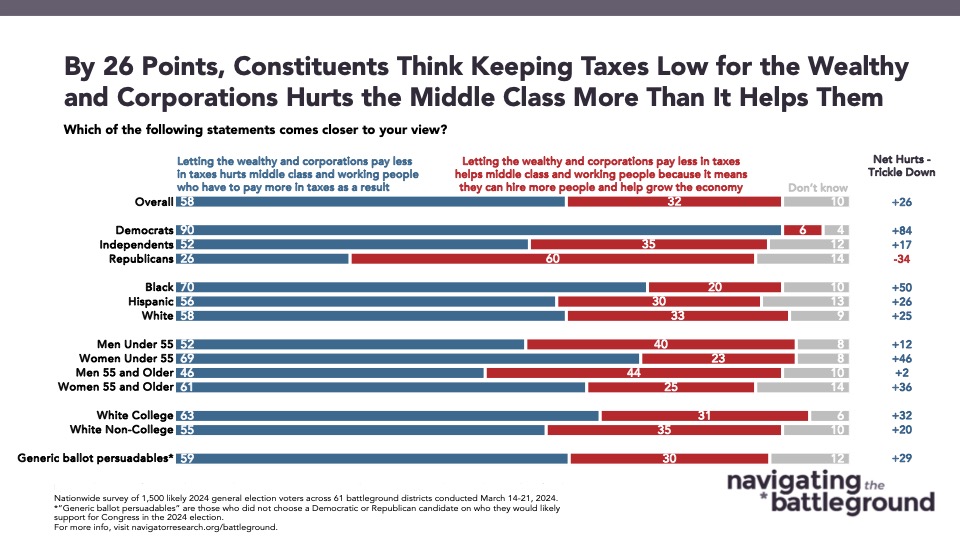

Battleground constituents agreed significantly more with a progressive argument that “letting the wealthy and corporations pay less in taxes hurts middle class and working people who have to pay more in taxes as a result” compared to a conservative argument that “letting the wealthy and corporations pay less in taxes helps middle class and working people because it means they can hire more people and help grow the economy” (net +26; 58 percent progressive argument – 32 percent conservative argument).

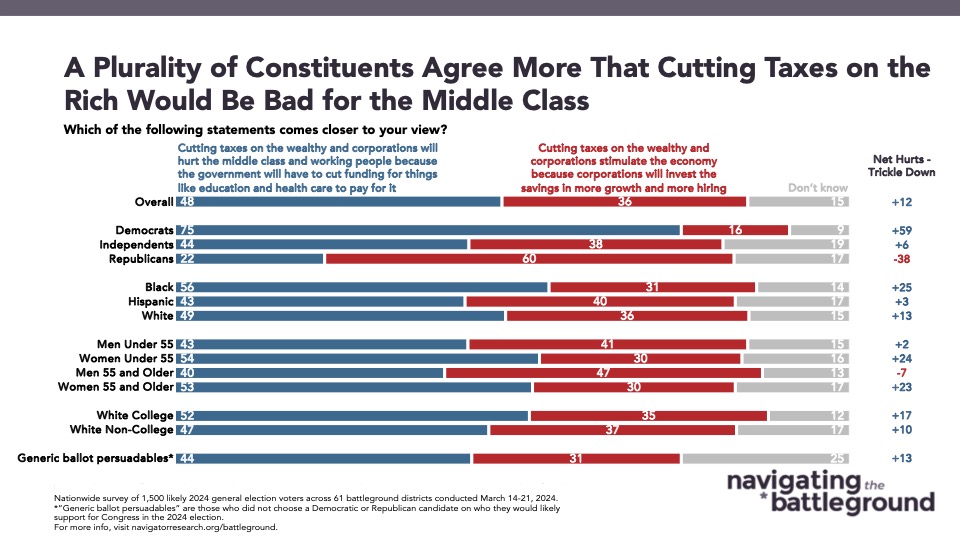

- Additionally, when asked whether cutting taxes on the wealthy and corporations hurts or promotes middle class growth, battleground constituents agreed more with a progressive statement that “cutting taxes on the wealthy and big corporations will hurt the middle class and working people because the government will have to cut funding for things like education” over a conservative argument that “cutting taxes on the wealthy and corporations stimulate the economy because corporations will invest the savings in more growth and more hiring” (net +12; 48 percent progressive argument – 36 percent conservative argument).

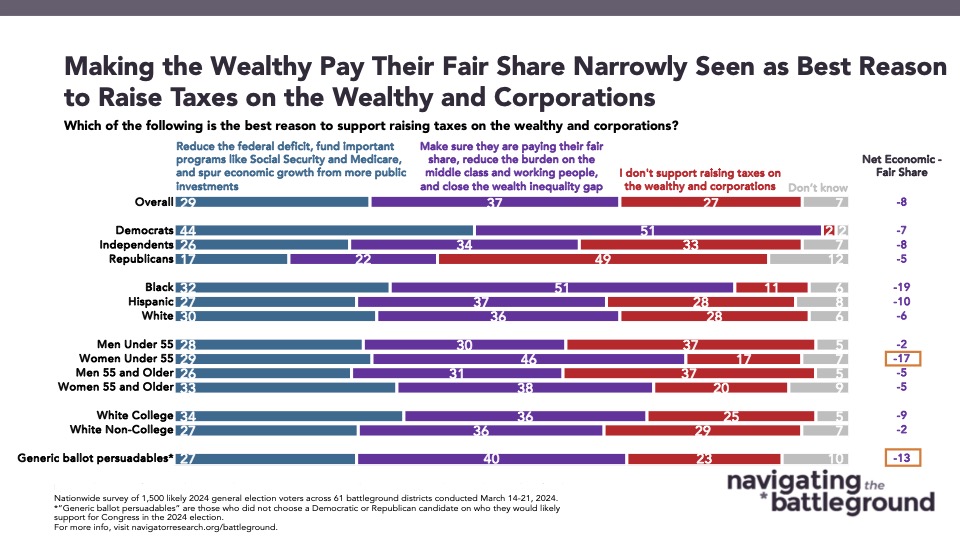

- The most compelling reason to support raising taxes on the wealthy and corporations is that “raising taxes on the wealthy and corporations will make sure they are paying their fair share, reduce the burden on the middle class and working people, and close the wealthy inequality gap” (37 percent), more so than “raising taxes on the wealthy and corporations will help reduce the federal deficit, fund important programs like Social Security and Medicare, and spur economic growth from more public investments” (29 percent).

About The Study

Impact Research conducted public opinion surveys among a sample of 1,500 likely 2024 general election voters from March 14-21, 2024. The survey was conducted by text-to-web (100 percent). Respondents were verified against a voter file and special care was taken to ensure the demographic composition of our sample matched that of the 61 congressional districts included in the sample across a variety of demographic variables. The margin of error for the full sample at the 95 percent level of confidence is +/- 2.5 percentage points. The margin for error for subgroups varies and is higher.