Background

Throughout Navigator’s tracking, the economy has remained a top priority for Americans: Inflation and jobs & the economy have consistently been the top two issues Americans believe government should be focused on. Though the economy as a whole is improving, Americans continue to struggle to make ends meet, leading to consistent economic pessimism. While how Americans rate the economy depends heavily on partisanship and personal financial confidence, one group in particular is consistently more pessimistic about the economy: women.

American women are more likely than men to feel uneasy about their personal financial situations, and according to the National Bureau of Economic Research, are more likely to be affected by recession and unemployment, highlighted in the 2020 pandemic recession. While women experience the economy much differently than men, the way we message on the economy has failed to address the economy as an issue affecting women in a unique and dramatic way. It is essential that the progressive ecosystem not only continues to champion policies that ease the economic burden for women, but begins to think and talk about the economy as a women’s issue.

How Women Evaluate the State of the Economy

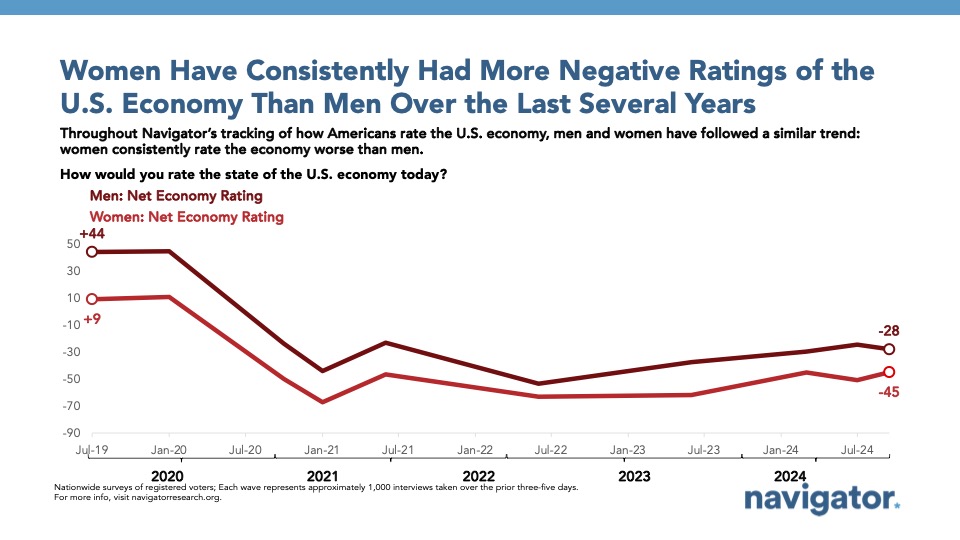

American women consistently are more pessimistic about the economy. Women have consistently rated the economy overwhelmingly more negatively than men in Navigator’s tracking, with our most recent tracking showing women’s views of the economy are underwater by 45 points, while men’s views of the economy are underwater by 28 points. While ratings of the economy follow similar trends for men and women, women consistently rate the economy more negatively.

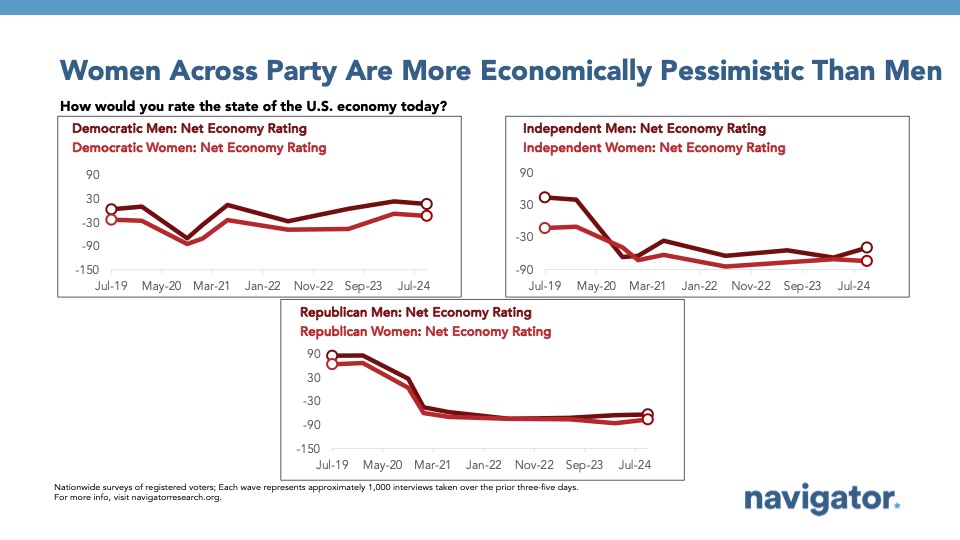

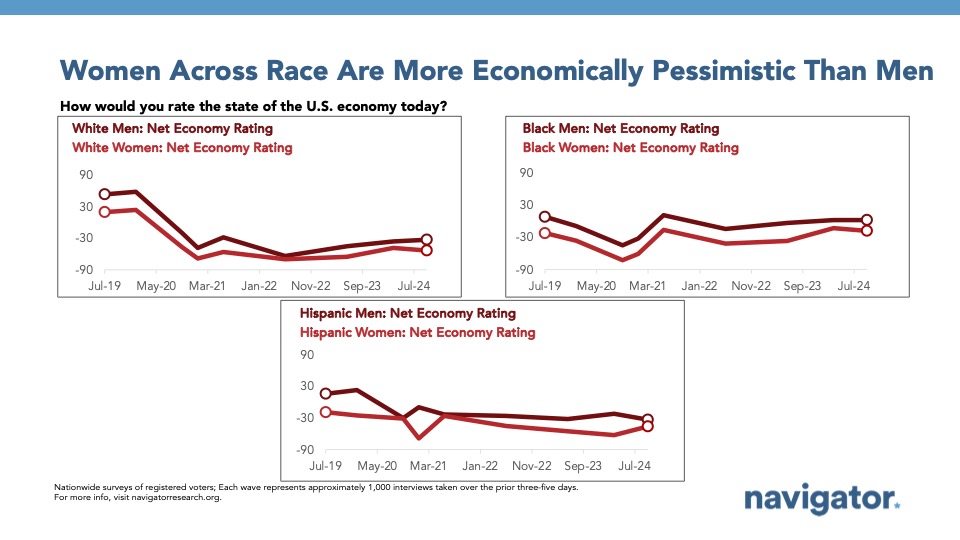

Although economic ratings can be largely driven by partisanship, women across party lines are more pessimistic about the economy than their male counterparts. Additionally, similar to partisanship, women across racial groups rate the economy worse than their male counterparts, though they follow similar trends.

In order to understand why women are consistently more negative than men on the economy, it’s important to understand the metrics Americans use to assess the economy. This past January, Navigator found that three in four Americans use the cost of living as a metric to assess how the economy is doing (74 percent), and nearly nine in ten Americans use either the cost of living, rate of inflation, or personal household income (89 percent). Women were more likely than men to say they use cost of living as a metric for assessing the economy (76 percent women; 71 percent men), as well as personal household income (37 percent women; 28 percent men) and income for American workers (35 percent women; 28 percent men). Men were much more likely to list the level of economic growth (27 percent men; 14 percent women) and the stock market (19 percent men; 13 percent women) as metrics used for assessing the economy.

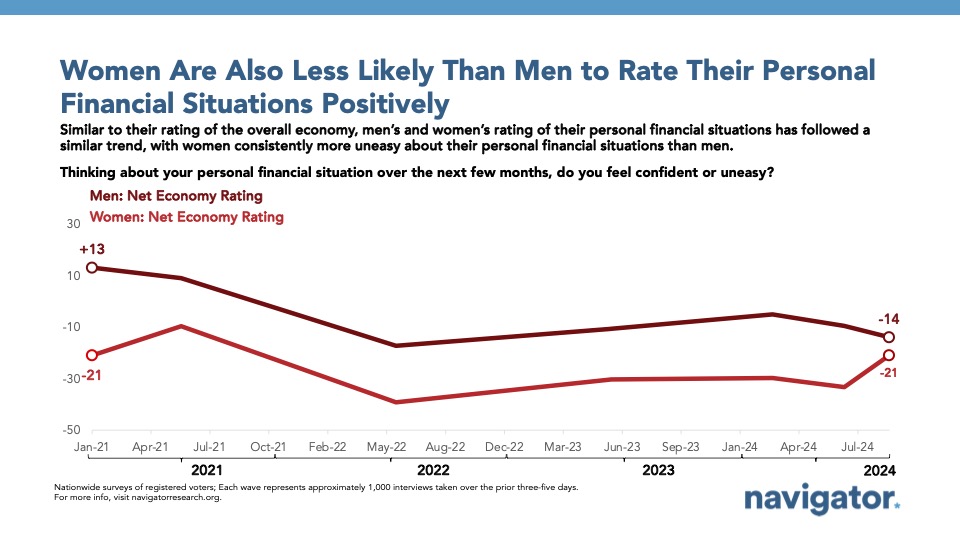

As women are overwhelmingly more pessimistic about the economy and more likely to use metrics that impact their daily lives to rate the economy, it is no surprise that women are also consistently more uneasy about their personal financial situations than men. With men being generally more confident about their personal finances, they’re allowed more space to assess the health of the economy from metrics that may not directly impact their day to day — while women are continuously faced with an economy that does not work for them.

How Women Perceive Economic Policies

Given the pessimism women feel towards the economy, and that pessimism being based largely on daily costs and personal financial metrics, it is essential that economic messaging focus on specific policies that reduce costs and put more money in the pockets of American women. Reducing the cost of living and making the economy more fair are guiding principles of progressive economic policies, so it is no surprise that many of these specific policies that ease economic burdens that disproportionately affect women are popular — and if amplified in messaging, may impact the way women perceive the economy. We looked at several specific policy areas where this is the case in our prior research: paid family and medical leave, the Child Tax Credit, health care policies, and housing policy.

Paid Leave and the Child Tax Credit

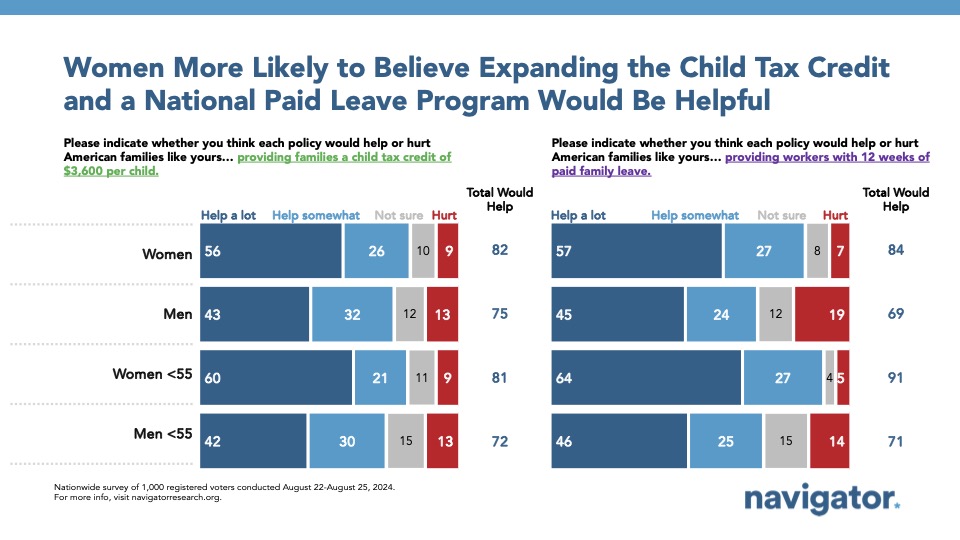

According to Navigator’s August survey, women are 15 points more likely than men to believe that providing workers with 12 weeks of paid family leave would be helpful for American families (84 percent women; 69 percent men). According to the Department of Labor, employed men and women are just as likely to have children under the age of 18 living in their house, however employed women are more likely to be heads of single parent households, and are more likely than men to need leave from work for family or medical reasons.

Women are also more likely to say that expanding the Child Tax Credit would help American families (81 percent) than men (75 percent), and are 13 points more likely to say it would help “a lot” (56 percent) than men (43 percent).

Health Care

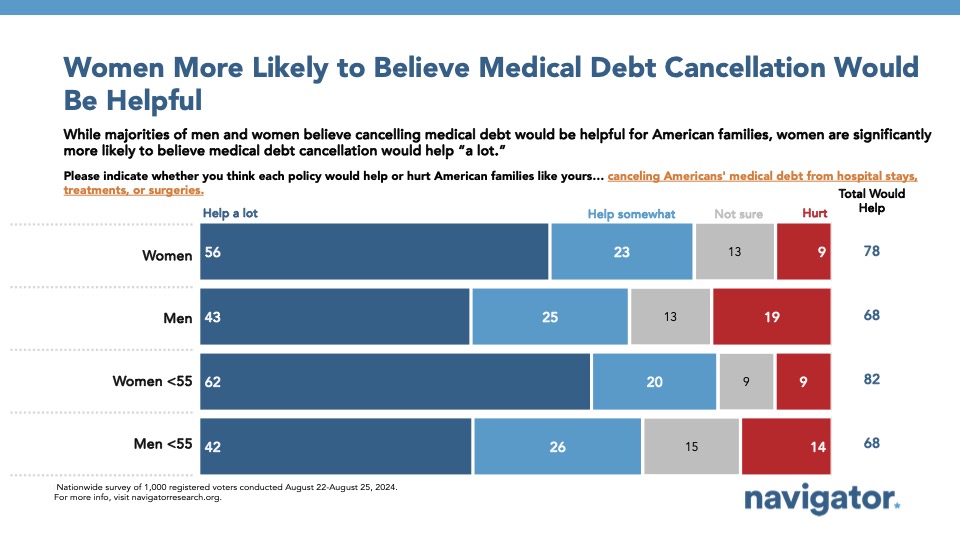

According to KFF research from 2022, nearly half of women have debt from medical or dental expenses (48 percent), compared to only one in three men (34 percent). According to the study, one in three who cited having medical debt said it led to lowering their credit score, three percent said it led to filing bankruptcy, and three percent said it led to them having to foreclose on their home. According to an August Navigator survey, women are 10 points more likely to say canceling Americans’ medical debt would be helpful for American families (78 percent women; 68 percent men), and are 13 points more likely to say it would help “a lot” (56 percent women; 43 percent men).

According to a 2023 report from the World Economic Forum, women pay 18 percent more on health care costs than men. Also indicated in Navigator’s tracking, Women are more likely to have health insurance through a government program such as Medicare or Medicaid (60 percent) than men (51 percent) and are also more likely to take prescription drugs (69 percent women; 56 percent men). An October Navigator survey found that over two in three women “strongly” support lowering health insurance premiums for Americans (89 percent total support, including 68 percent who “strongly” support), and 88 percent support allowing the government to negotiate for lower prescription drug costs, including 67 percent who would “strongly” support the action.

By a 44-point margin, American women would rather Congress focus on extending subsidies to make health care more affordable through the Affordable Care Act (61 percent), rather than focusing on extending the 2017 Trump tax law (17 percent). While men would also prefer Congress focus on extending health care subsidies, it is by a narrower margin (net +24; 55 percent extend the ACA subsidies – 31 percent extend the Trump tax law).

Housing

A May Navigator survey found three in five women blame greedy landlords who are jacking up prices for the rise in housing costs (60 percent) compared to just under half of men who feel the same (49 percent). Similarly, women are 10 points more likely than men to blame elected officials who fail to pass legislation to make housing more affordable (56 percent women; 46 percent men).

Nearly nine in ten American women support cracking down rent gouging by corporate landlords (87 percent, including 68 percent who “strongly” support), eliminating hidden and misleading rental fees (87 percent, including 67 percent who “strongly” support), and cracking down on high closing costs imposed by lenders (87 percent, including 63 percent who “strongly” support). Similarly, 84 percent of women believe cracking down on rent gouging from corporate landlords would be effective in lowering housing costs, and 83 percent believe providing tax credits and vouchers for middle class families to afford rent would be effective methods for improving the housing crisis.

Corporate Greed and Inflation

As women are more likely to feel uneasy about their personal finances, rising costs due to corporate greed pose a disproportionate stress for women. A January Navigator survey found that two in three women believe corporations being greedy and raising prices to make record profits is a major cause of inflation (66 percent), compared to just over half of men (52 percent). Similarly, an April survey found that women are 13 points more likely than men to believe the grocery and food manufacturing industry is prone to corporate greed practices (45 percent women; 32 percent men) and 10 points more likely to believe the oil and gas industry is prone to corporate greed (75 percent women; 65 percent men). The same survey revealed women are 16 points more likely than men to find the statement “Republicans in Congress voted to protect the wealthy and corporate tax cheats” to be very concerning (64 percent women; 48 percent men).

A majority of women across partisanship believe corporations being greedy and raising prices in order to make record profits is a major cause of inflation, including 76 percent of Democratic women, 64 percent of independent women, and 51 percent of Republican women. Over four in five across partisanship believe it is either a minor or major cause, including 90 percent of Democratic women (14 percent minor cause), 86 percent of independent women (22 percent minor cause), and 82 percent of Republican women (31 percent minor cause).

Messaging to Women

After billions of dollars in paid media spending in key battleground states in the 2024 election, both major parties continue their efforts to gain the support of women. While attacks on abortion rights are deeply unpopular and threaten the autonomy of women, it’s important to recognize that the economy also disproportionately affects women.

Throughout Navigator’s tracking, economic issues consistently emerge as the top priorities for women. In the latest tracking, 54 percent of women listed inflation as a top issue Congress should be focused on, followed by 39 percent who listed jobs and the economy, and 36 percent who listed Social Security and Medicare. Despite much of the messaging in the progressive ecosystem targeted towards women centering on abortion, abortion falls behind these economic issues as a top priority for 32 percent of women.

While the attack on abortion rights is an issue unique to women, the same can be said for the disproportionate way in which women are impacted by economic hardship. As the efforts to strip abortion rights are widely viewed as a way to control women, the progressive ecosystem should begin to package economic policies that leave women behind as another way right wing extremists attempt to strip women of autonomy.

Fortunately, there is no need to reinvent the wheel for progressive messaging. Progressives just need to point to their economic policies (that are already widely supported) when crafting messaging that specifically targets women. While American women are the most pessimistic about the state of the economy, they have the most to gain from policies that reshape the economy into one that is designed to work for everyone.