Poll: The Parties’ Tax Policies

This Navigator Research report contains polling data on the latest perceptions of taxes and the economy, including which party is more trusted to handle a range of economic issues and who Americans believe benefit from tax policies.

The Democratic Party now holds a narrow advantage on a range of economic issues, including taxes and the cost of living.

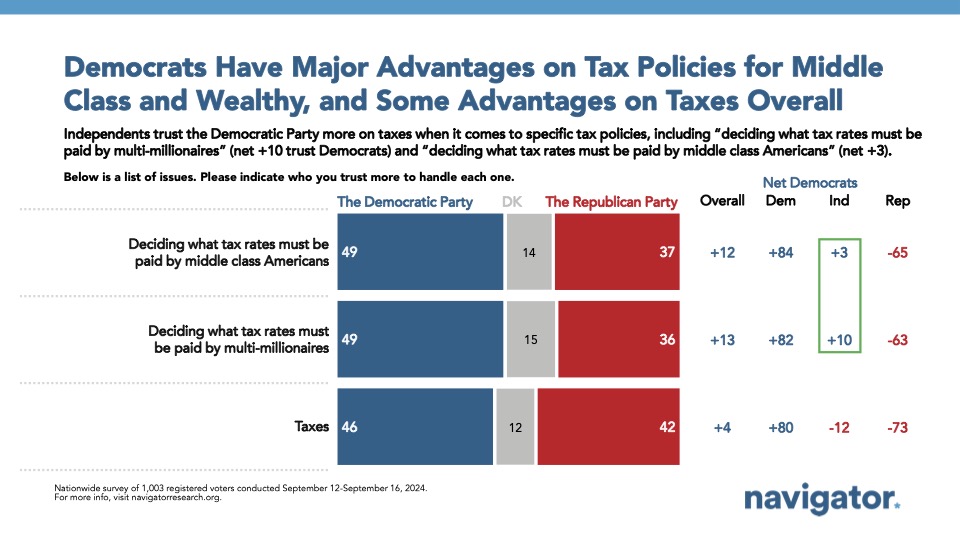

By a 13-point margin, Americans trust the Democratic Party to decide what tax rates must be paid by multi-millionaires (49 percent trust Democratic Party – 36 percent trust Republican Party), and by 12 points, Americans trust the Democratic Party more to decide what tax rate is paid by middle class Americans (49 percent trust Democratic Party – 37 percent trust Republican Party). Similarly, the Democratic Party now holds a narrow advantage on handling taxes in general (net +4; 46 percent trust Democratic Party – 42 percent trust Republican Party) and the cost of living (net +3; 46 percent trust Democratic Party – 43 percent trust Republican Party), while Americans are evenly divided on which party they trust to handle jobs and the economy (net +1; 45 percent trust Democratic Party – 44 percent trust Republican Party).

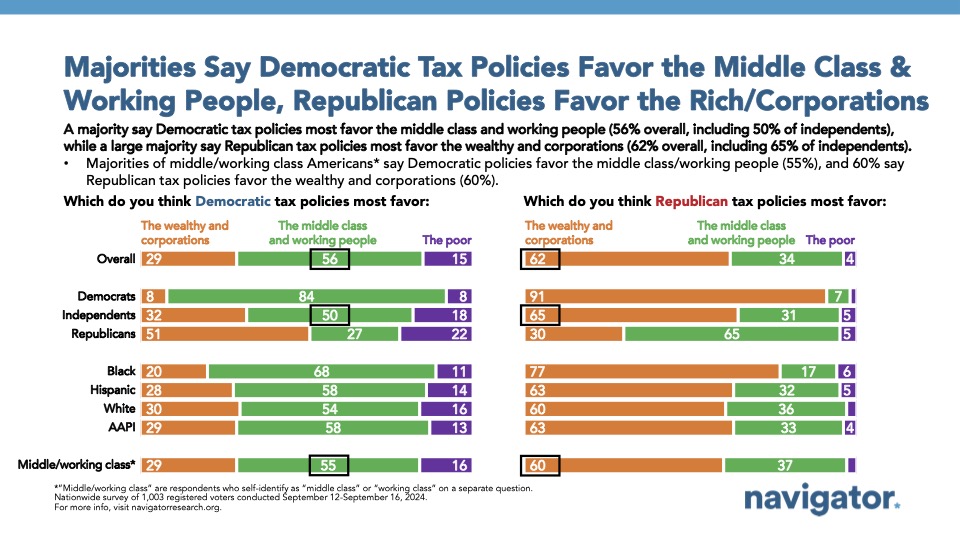

- A majority of Americans believe Democratic tax policies favor the middle class and working people (net +27; 56 percent favor middle class – 29 percent favor wealthy and corporations), while over three in five believe Republican tax policies most favor the wealthy and corporations (net -28; 34 percent favor middle class – 62 percent favor wealthy and corporations).

- Independents trust the Democratic Party more when it comes to handling what tax rate must be paid by multi-millionaires (net +10; 30 percent trust Democratic Party – 20 percent trust Republican Party). The Republican Party does hold trust advantages among independents when it comes to handling taxes generally (by 12 points), jobs and the economy (by 14 points), and inflation (by 18 points).

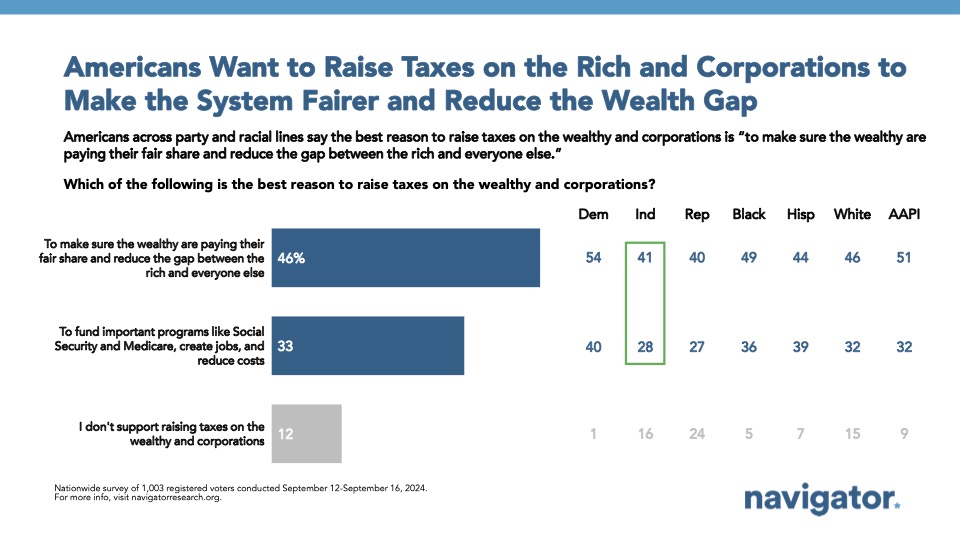

Reducing the gap between the rich and everyone else is seen as the best reason to raise taxes on the wealthy.

46 percent of Americans say the best reason to raise taxes on the wealthy and corporations is “to make sure the wealthy are paying their fair share and reduce the gap between the rich and everyone else,” including 54 percent of Democrats, 41 percent of independents, and 40 percent of Republicans. 33 percent believe the best reason to raise taxes on the wealthy and corporations is “to fund important programs like Social Security and Medicare, create jobs, and reduce costs.” Only 12 percent say they do not support raising taxes on the wealthy and corporations.

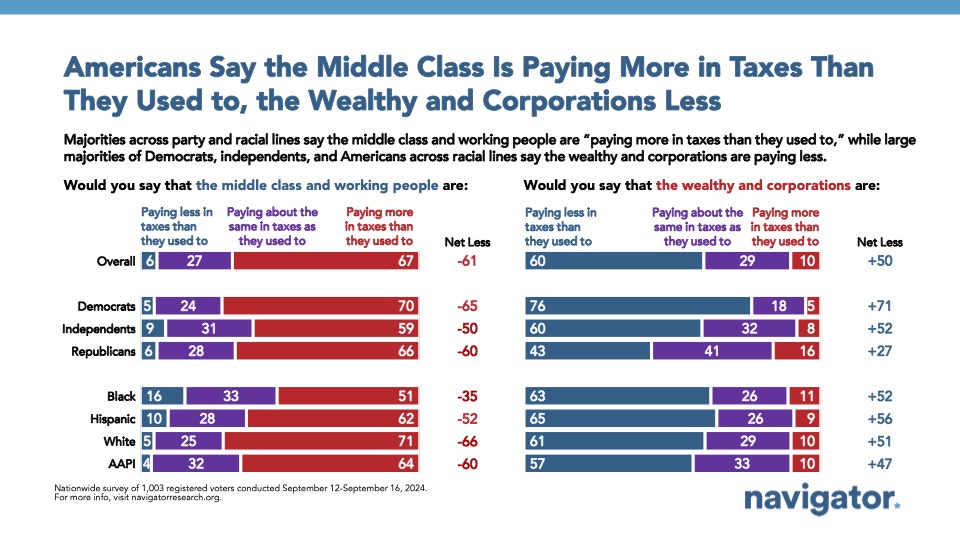

- Three in five believe the wealthy and corporations are paying less in taxes than they used to (60 percent paying less – 29 percent paying about the same – 10 percent paying more), while two in three believe the middle class and working people are paying more in taxes than they used to (67 percent paying more in taxes – 27 percent paying about the same – 6 percent paying less).

When advocating for raising taxes on the wealthy, it is important to specify that those earning less than $400,000 a year will not have their taxes raised.

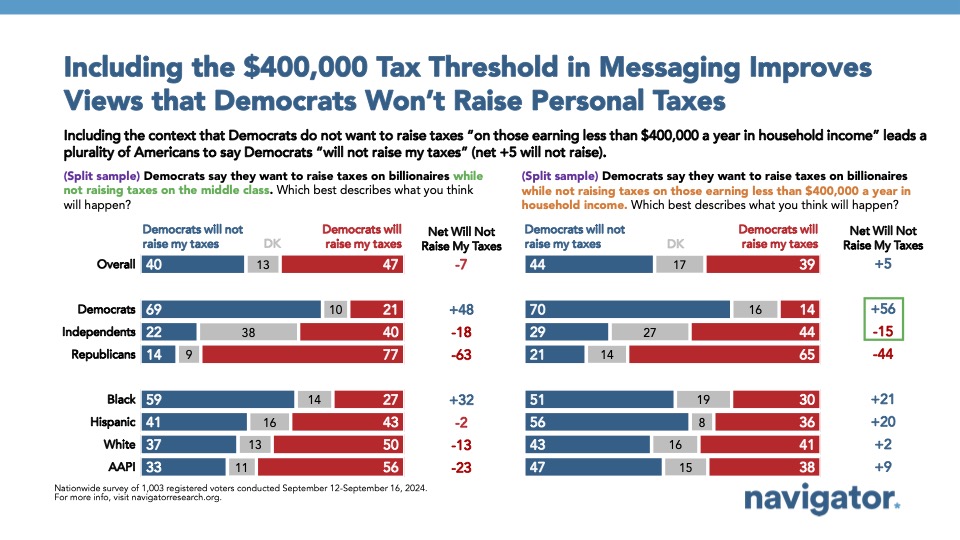

By a 5-point margin, Americans believe Democrats will not raise their taxes when Democratic tax policy is framed as “Democrats say they want to raise taxes on billionaires while not raising taxes for those earning less than $400,000 a year” (44 percent will not raise their taxes – 39 percent will raise their taxes). When framed as “Democrats say they want to raise taxes on billionaires while not raising taxes on the middle class,” a plurality believe their taxes will be raised (net -7; 40 percent will not raise their taxes – 47 percent will raise their taxes).

- Americans who identify as middle class believe Democrats will raise their taxes when framed as “Democrats say they want to raise taxes on billionaires while not raising taxes on the middle class” (net -13; 39 percent will not raise their taxes – 52 percent will raise their taxes), while the same group believes Democrats will not raise their taxes when framed as “Democrats say they want to raise taxes on billionaires while not raising taxes for those earning less than $400,00 a year” (net +10; 48 percent will not raise their taxes – 38 percent will raise their taxes).

About The Study

Global Strategy Group conducted a public opinion survey among a sample of 1,003 registered voters from September 12-September 16, 2024. 106 additional interviews were conducted among Hispanic voters. 76 additional interviews were conducted among Asian American and Pacific Islander voters. 100 additional interviews were conducted among African American voters. 106 additional interviews were conducted among independent voters. The survey was conducted online, recruiting respondents from an opt-in online panel vendor. Respondents were verified against a voter file and special care was taken to ensure the demographic composition of our sample matched that of the national registered voter population across a variety of demographic variables. The margin of error for the full sample at the 95 percent level of confidence is +/- 3.1 percentage points. The margin of error for subgroups varies and is higher.