Poll: Trump’s Tax Plan

This Navigator Research report contains survey data on the latest perceptions of Trump’s tax plan, including support for the plan and who Americans believe will be the most impacted.

Half of Americans are aware of Trump’s tax plan, but approval is split along party lines.

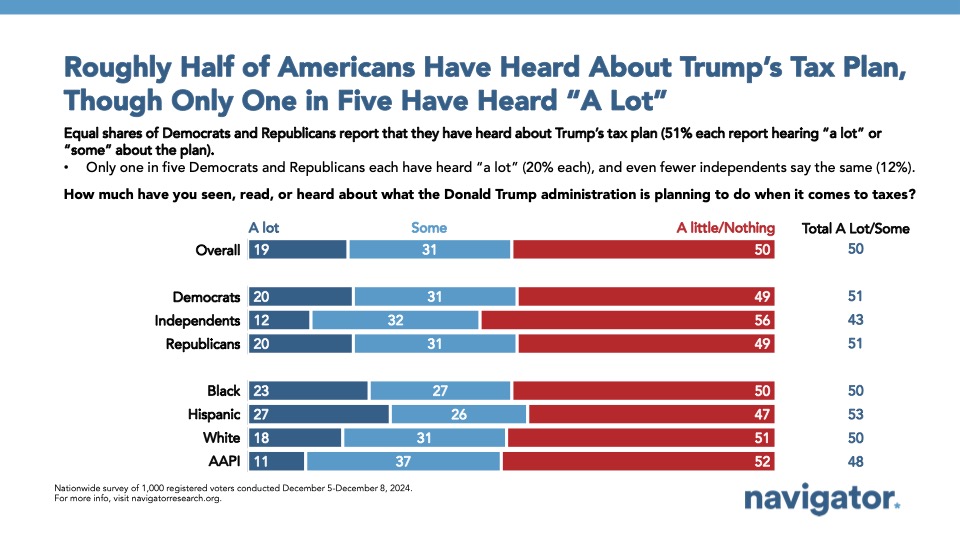

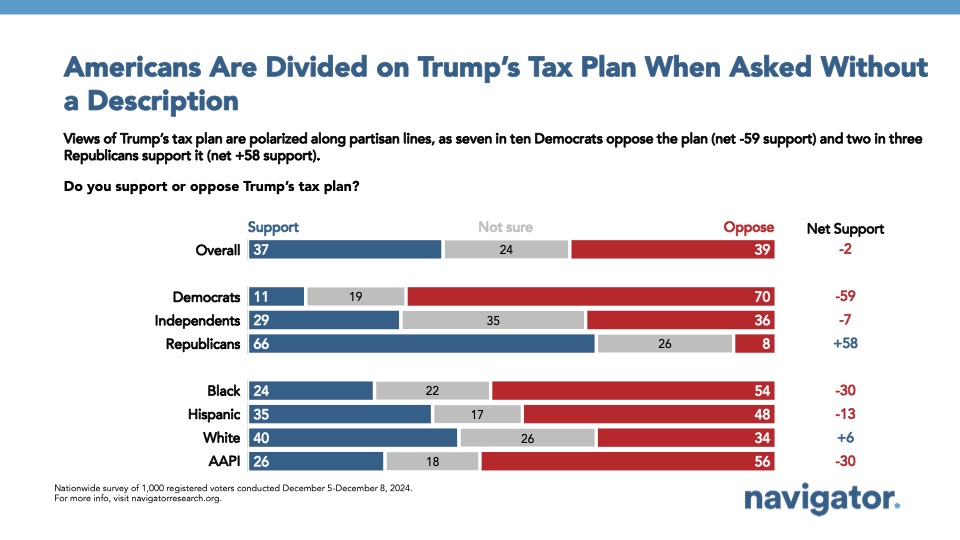

Half of Americans say they have seen, read, or heard “a lot” or “some” about Trump’s tax plan (50 percent), but only 20 percent of both Democrats and Republicans say they know “a lot” about the tax plan and just 12 percent of independents say the same. Support for Trump’s tax plan is initially evenly divided (net -2; 37 percent support – 39 percent oppose), with partisanship driving support: only one in ten Democrats express support (net -59; 11 percent support – 70 percent oppose) while two in three Republicans initially support his tax plan (net +58; 66 percent support – 8 percent oppose). While a plurality of independents start off opposed to Trump’s tax plan by 7 points (29 percent support – 36 percent oppose), more than one in three Americans are not sure about it (35 percent).

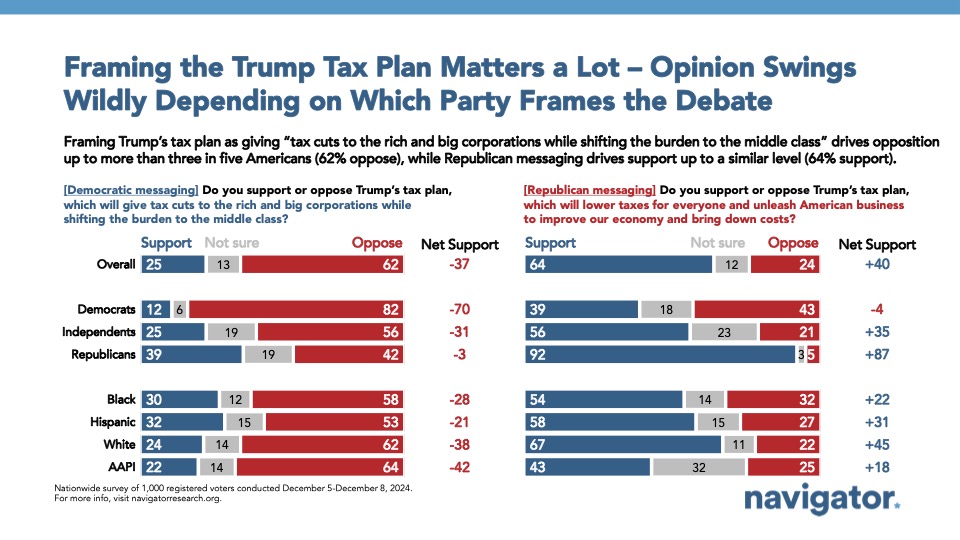

How Americans view Trump’s tax plan is largely contingent on how people hear it described.

When described as a plan that will “give tax cuts to the rich and big corporations while shifting the burden to the middle class,” Americans oppose the plan by a 37 points (25 percent support – 62 percent oppose), including Republicans by 3 points (39 percent support – 42 percent oppose), independents by 31 points (25 percent support – 56 percent oppose), and Democrats by 70 points (12 percent support – 82 percent oppose). However, when described as a plan that will “lower taxes for everyone and unleash American business to improve our economy and bring down costs,” nearly two in three support Trump’s tax plan (net +40, 64 percent support – 24 percent oppose), including 56 percent of independents.

- By a 10-point margin, Americans believe that Trump’s tax plan will “hurt people like me” (net -10, 32 percent would help people like me – 42 percent would hurt people like me), including a plurality of independents (net -19; 19 percent would help people like me – 41 percent would hurt people like me) and one in five Republicans (net +33; 52 percent would help people like me – 19 percent would hurt people like me).

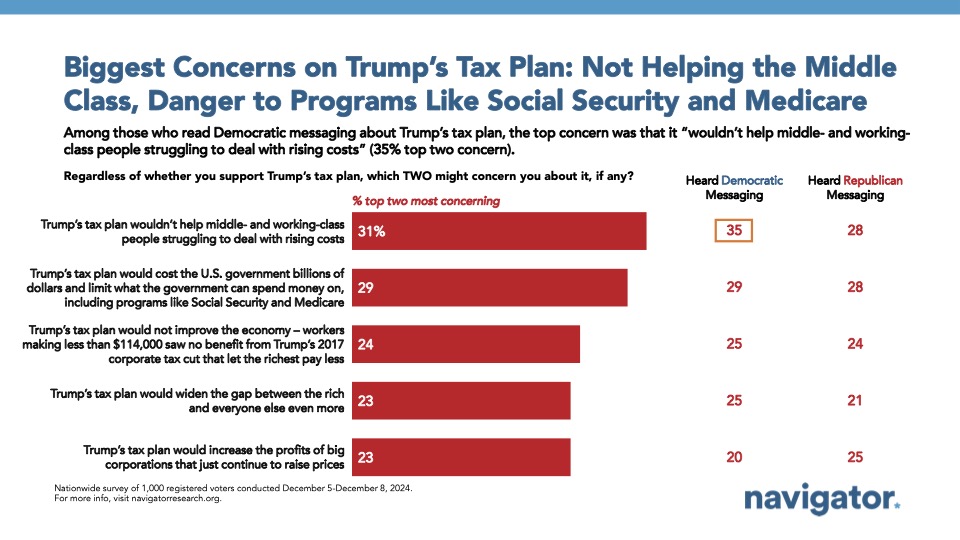

- Americans are most concerned that Trump’s tax plan “will not help the middle and working class people struggling to deal with rising costs” (31 percent) and that “Trump’s tax plan would cost the U.S. government billions of dollars and limit what the government can spend money on, including programs like Social Security and Medicare” (29 percent). They’re least concerned that it “would widen the gap between the rich and everyone else” (23 percent) and that it “would increase the profits of big corporations that just continue to raise profits” (23 percent).

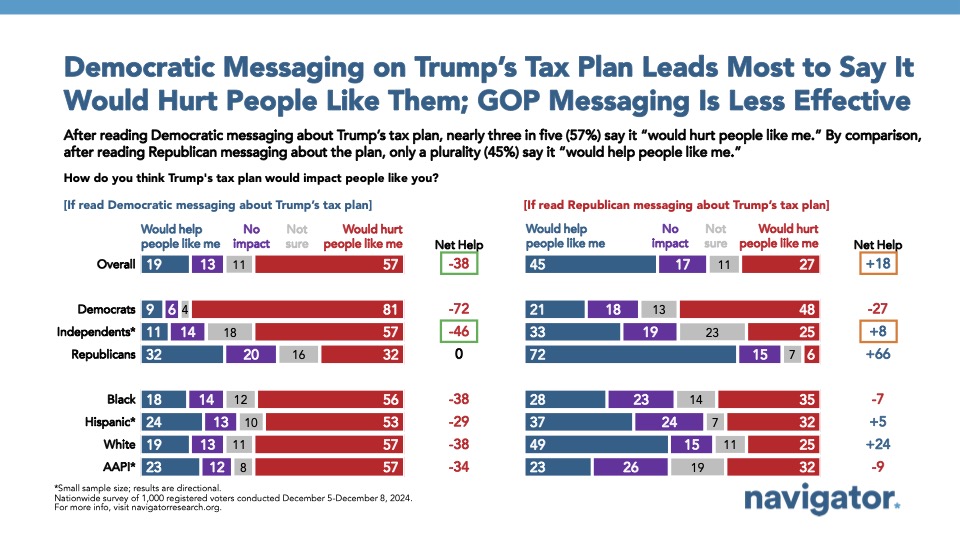

- Among those who had the plan described as one that will “give tax cuts to the rich and big corporations while shifting the burden to the middle class,” nearly three in five expressed that they felt it would hurt people like them (net -38; 19 percent would help people like me – 57 percent would hurt people like me); a plurality of those who had the plan described as one that will “lower taxes for everyone and unleash American business to improve our economy and bring down costs” said it would help people like them (net +18; 45 percent would help people like me – 27 percent would hurt people like me).

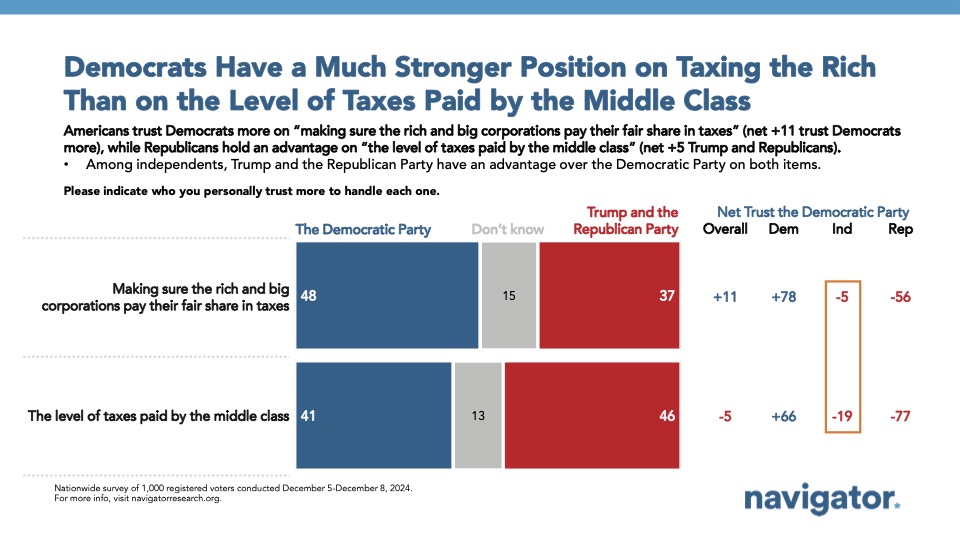

The Democratic Party is more trusted when it comes to making the rich and corporations pay their fair share in taxes than the Republican Party, but the Republican Party is more trusted when it comes to the level of taxes paid by the middle class.

By an 11-point margin, Americans trust the Democratic Party to “make sure the rich and big corporations pay their fair share in taxes” (net +11, 48 percent trust the Democratic Party – 37 percent trust Donald Trump and the Republican Party). However, Donald Trump and the Republican Party are more trusted to handle “taxes” more generally (net -10; 40 percent trust the Democratic Party – 50 percent trust Donald Trump and Republican Party) and are more trusted by a narrower margin to handle “the level of taxes paid by the middle class” (net -5; 41 percent trust the Democratic Party – 46 percent trust Donald Trump and Republican Party).

- In a head-to-head between the Democratic Party and the Republican Party without mentioning Donald Trump, Democrats are narrowly more trusted to handle “the level of taxes paid by the middle class” by 6 points (47 percent trust the Democratic Party – 41 percent trust the Republican Party).

About The Study

Global Strategy Group conducted a public opinion survey among a sample of 1,000 registered voters from December 5-December 8, 2024. 100 additional interviews were conducted among Hispanic voters. 72 additional interviews were conducted among Asian American and Pacific Islander voters. 100 additional interviews were conducted among African American voters. 100 additional interviews were conducted among independent voters. The survey was conducted online, recruiting respondents from an opt-in online panel vendor. Respondents were verified against a voter file and special care was taken to ensure the demographic composition of our sample matched that of the national registered voter population across a variety of demographic variables. The margin of error for the full sample at the 95 percent level of confidence is +/- 3.1 percentage points. The margin of error for subgroups varies and is higher.