Poll: The Economy, Recession, & Party Trust

This Navigator Research report contains polling data on the latest perceptions of the economy, including the share of Americans who believe the economy is in a recession, the most convincing indicators that the economy is improving, and which party is more trusted to handle a range of economic issues.

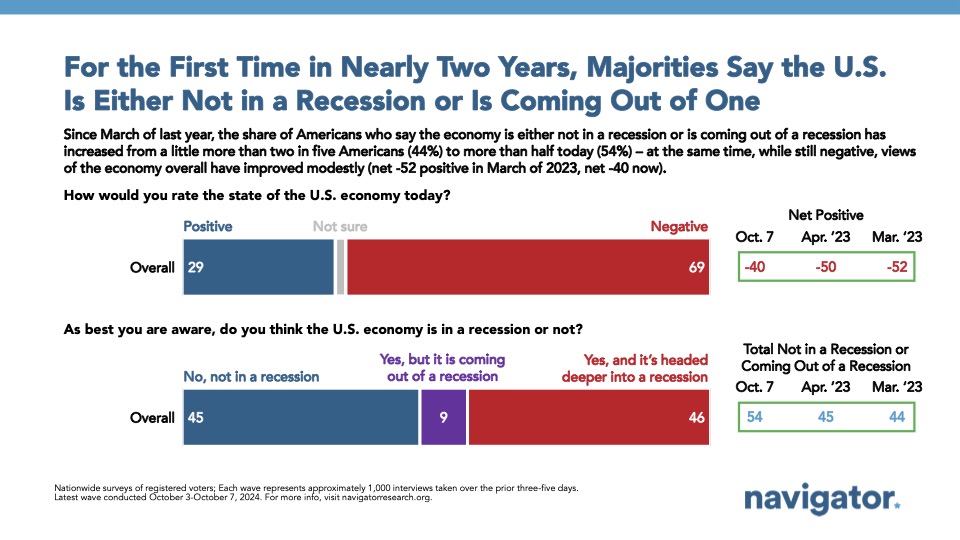

A majority of Americans believe the U.S. economy is either not in a recession or is coming out of one.

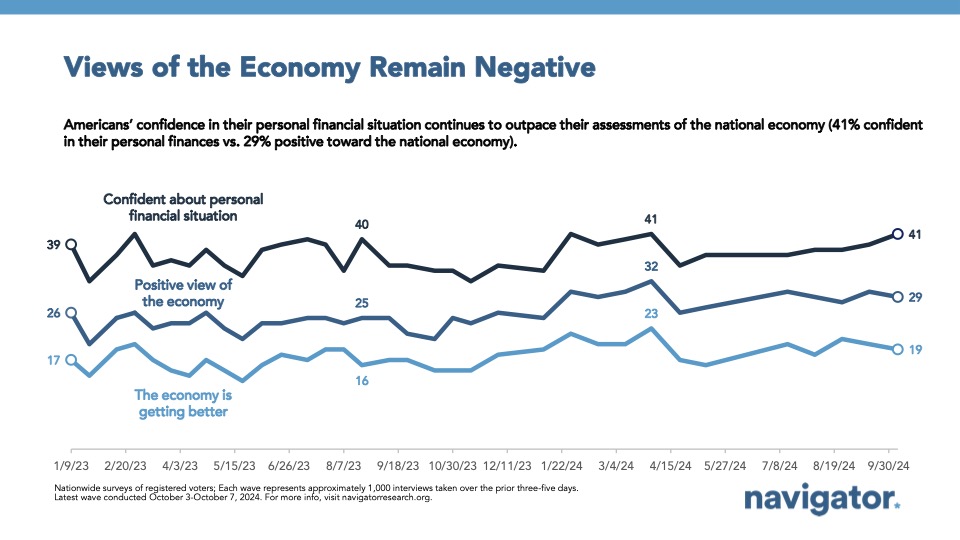

54 percent of Americans believe the U.S. economy is either not in a recession (45 percent) or is coming out of a recession (9 percent), a 10-point increase from March 2023 (33 percent not in a recession; 11 percent coming out of a recession). Perceptions of the economy remain pessimistic (net -40; 29 percent positive – 69 percent negative), though confidence in personal financial situations has seen small improvement (from net -20 in late August to net -14 now).

- Republicans are the most likely to believe the U.S. economy is headed deeper into a recession (59 percent), while two in three Democrats (66 percent) and a majority of independents (53 percent) believe the U.S. economy is either not in a recession or is coming out of one.

- Americans are more positive about the economy in their own community ( net -26; 35 percent positive – 61 percent negative) than the national economy (net -40) economy.

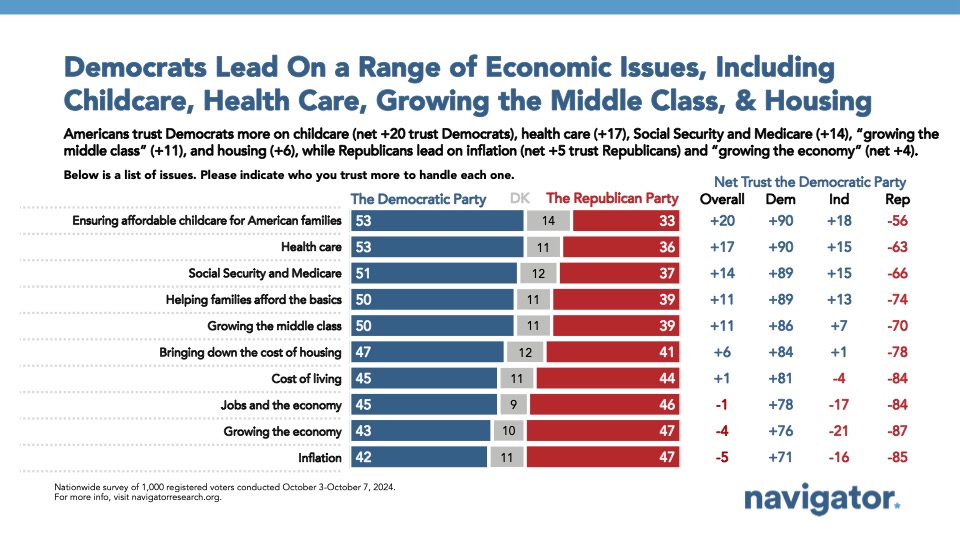

The Democratic Party holds trust advantages on handling a range of personal economic issues, while Republicans hold an advantage on handling inflation.

Americans trust the Democratic Party more when it comes to handling a range of economic issues, including ensuring affordable childcare by 20 points (53 percent trust the Democratic Party – 33 percent trust the Republican Party), helping families afford the basics by 11 points (50 percent trust the Democratic Party – 39 percent trust the Republican Party), growing the middle class by 11 points (50 percent trust the Democratic Party – 39 percent trust the Republican Party), and bringing down the cost of housing by 6 points ( 47 percent trust the Democratic Party – 41 percent trust the Republican Party). Americans are evenly split on who they trust to handle the cost of living (45 percent trust Democratic Party – 44 percent trust Republican Party) and jobs and the economy (45 percent trust Democratic Party – 46 percent trust Republican Party), and the Republican Party holds a 5-point advantage on handling inflation (42 percent trust the Democratic Party – 47 percent trust the Republican Party) and a 4-point advantage on growing the economy (43 percent trust the Democratic Party – 47 percent trust the Republican Party).

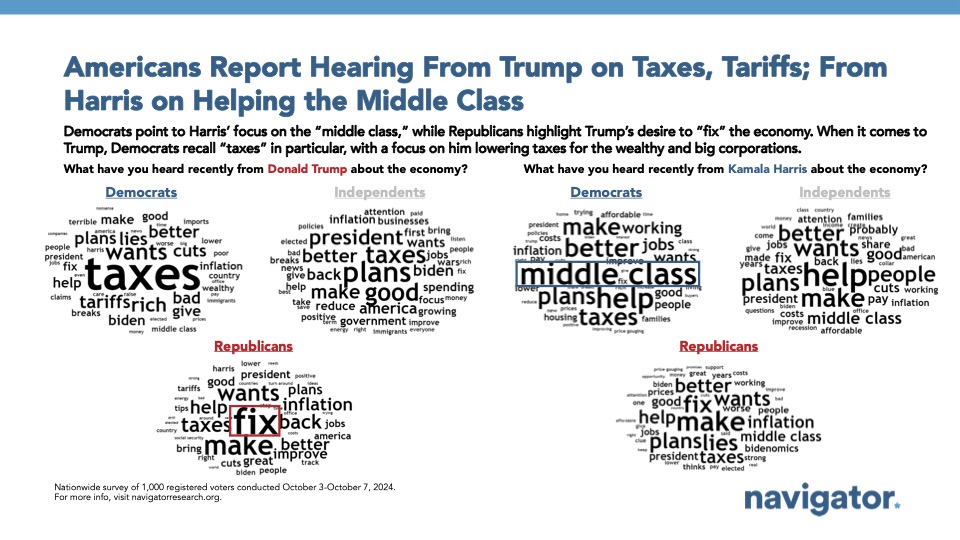

When asked about the major party candidates on the economy, Americans cite “taxes,” “inflation,” and “tariffs” most frequently when asked about former President Donald Trump; “help,” “middle class,” and “taxes” are most mentioned when asked about Vice President Kamala Harris on the economy.

While many independents are unsure or trust neither, independents do trust the Democratic Party more when it comes to a range of economic issues, including helping families afford the basics by 13 points (38 percent trust Democratic Party – 25 percent trust Republican Party) and growing the middle class by 7 points (37 percent trust Democratic Party – 30 percent trust Republican Party).

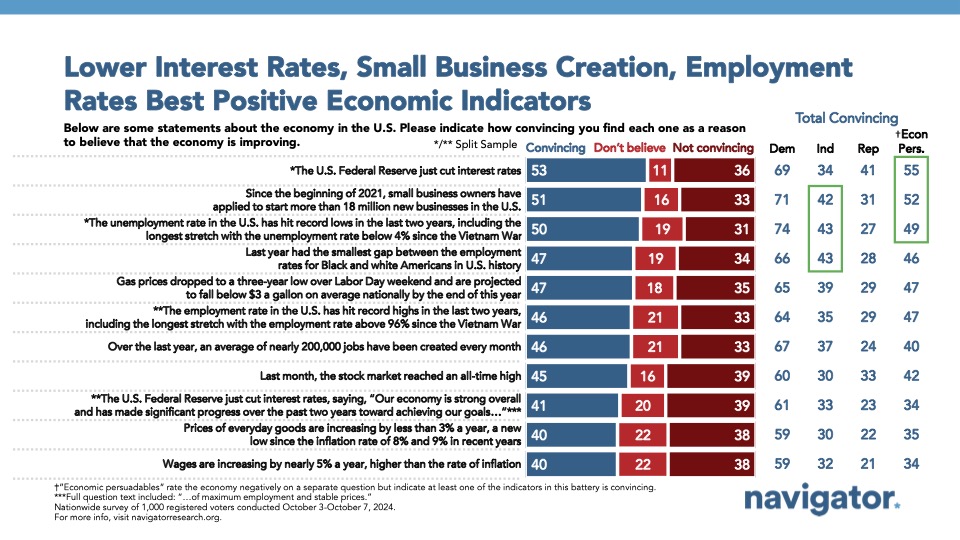

Americans find inflation-related metrics to be the least convincing indicators that the economy is improving.

The U.S. Federal Reserve cutting interest rates is seen as the most convincing indicator that the economy is improving (53 percent convincing – 36 percent not convincing) followed by small business owners applying to start 18 million new businesses since 2021 (51 percent convincing – 33 percent not convincing), and the unemployment rate hitting record lows (50 percent convincing – 31 percent not convincing).

Americans find the least convincing indicators of the economy improving to be “the prices of everyday goods are increasing by less than 3 percent a year, a new low” (40 percent convincing – 38 percent not convincing) and that wages are increasing at a rate higher than the rate of inflation (40 percent convincing – 38 percent not convincing).

Americans find the statement “the U.S. Federal Reserve just cut interest rates” (53 percent convincing – 36 percent not convincing) to be more convincing than when phrased as “the U.S. Federal Reserve just cut interest rates, saying, ‘Our economy is strong overall and has made significant progress over the past two years toward achieving our goals of maximum employment and stable prices” (41 percent convincing – 39 percent not convincing).

Reminder:

89 percent of Americans use personal economic indicators to judge the strength of the overall U.S. economy, with the most common indicators used to assess the economy being the cost of living (74 percent), the rate of inflation (67 percent), distantly followed by personal household income (33 percent). Macroeconomic indicators, including the GDP growth rate (20 percent), performance of the stock market (15 percent), and the global supply chain (11 percent) are among the least utilized to judge the strength of the economy.