Poll: Nearly Three in Five Battleground Constituents Oppose the Republican Tax Plan

This Navigator Research report covers the latest perceptions of the Republican tax plan and tariffs, including who battleground constituents trust most to make the wealthy pay their fair share and how new tariffs are seen as affecting the costs of everyday goods.

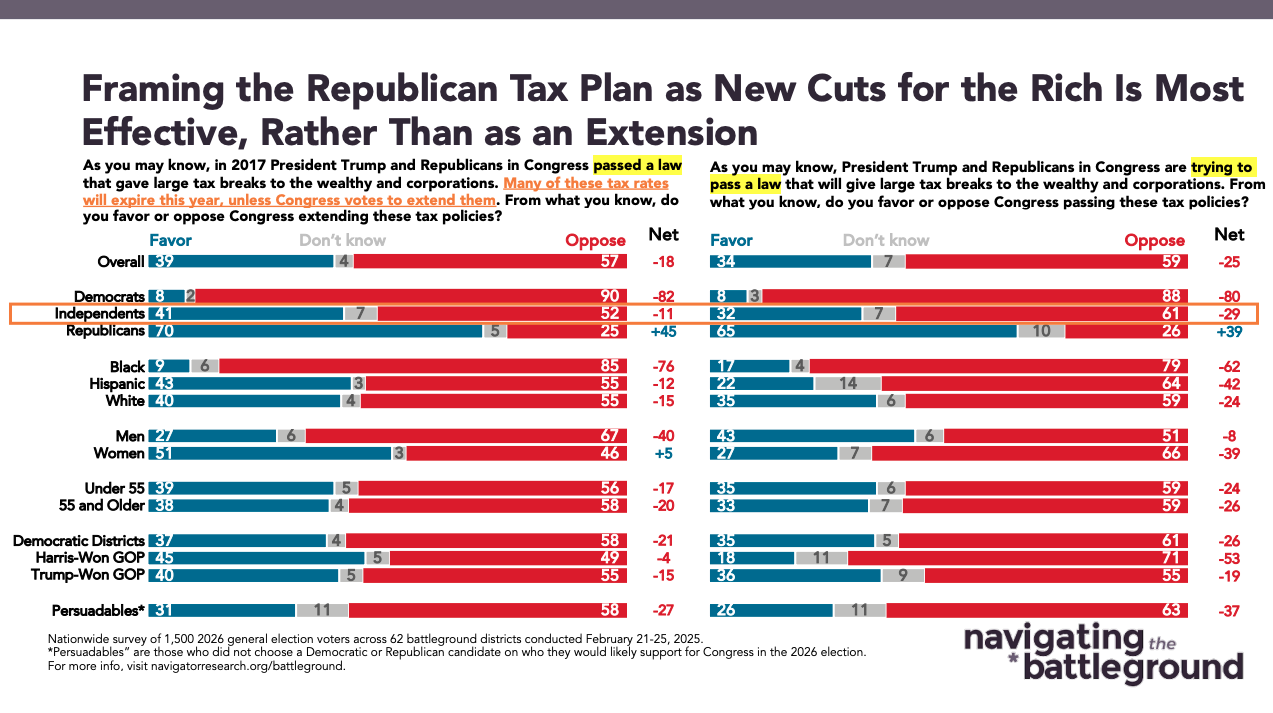

Nearly three in five oppose an extension of the 2017 Republican tax law, and an even greater share oppose it when framed as a new law to give tax breaks to the wealthy.

A majority of battleground constituents oppose extending the 2017 law “that gave tax breaks to the wealthy and corporations” (net -18; 39 percent favor – 57 percent oppose), including 90 percent of Democrats, 52 percent of independents, and 25 percent of Republicans. Opposition for the Republican tax plan is even greater when framed as “Trump and Republicans in Congress… trying to pass a law that will give large tax breaks to the wealthy and corporations” (net -25; 34 percent favor – 59 percent oppose), including 88 percent of Democrats, 61 percent of independents, and 26 percent of Republicans.

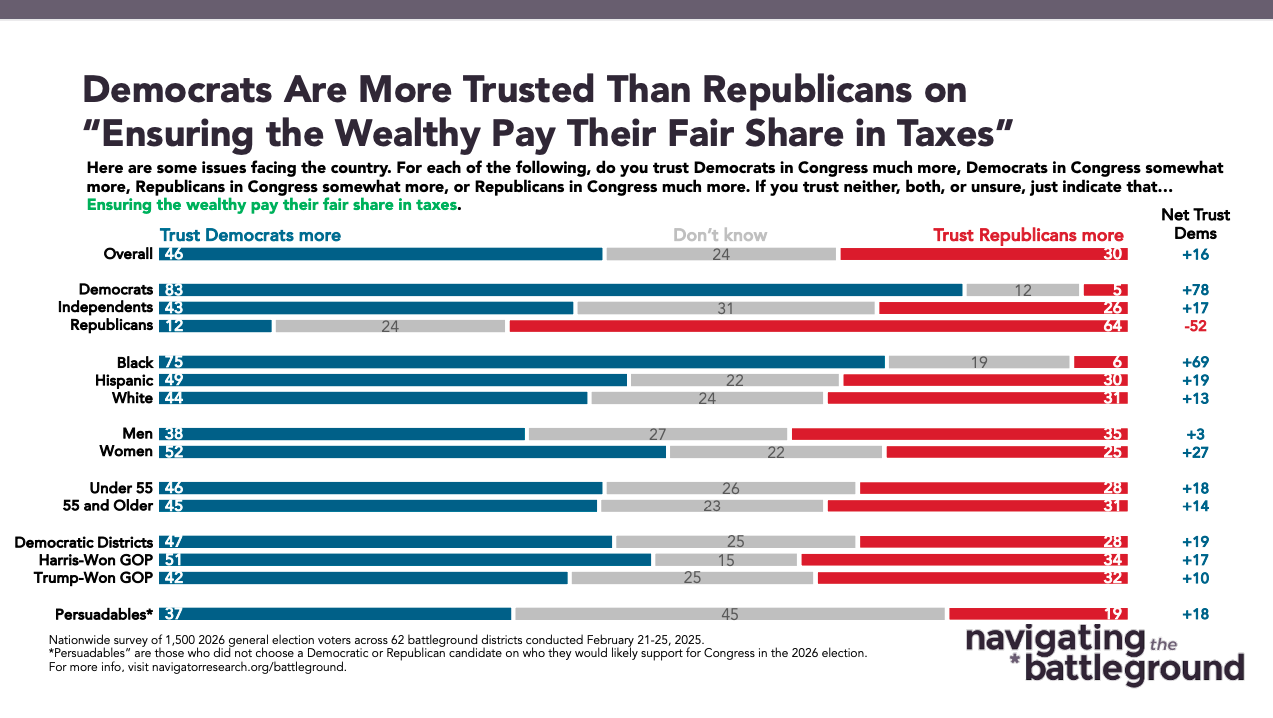

- A plurality of battleground constituents trust Democrats in Congress more to ensure the wealthy pay their fare share (net +16; 46 percent trust Democrats more – 30 percent trust Republicans more), including 83 percent of Democrats, 43 percent of independents, and 12 percent of Republicans.

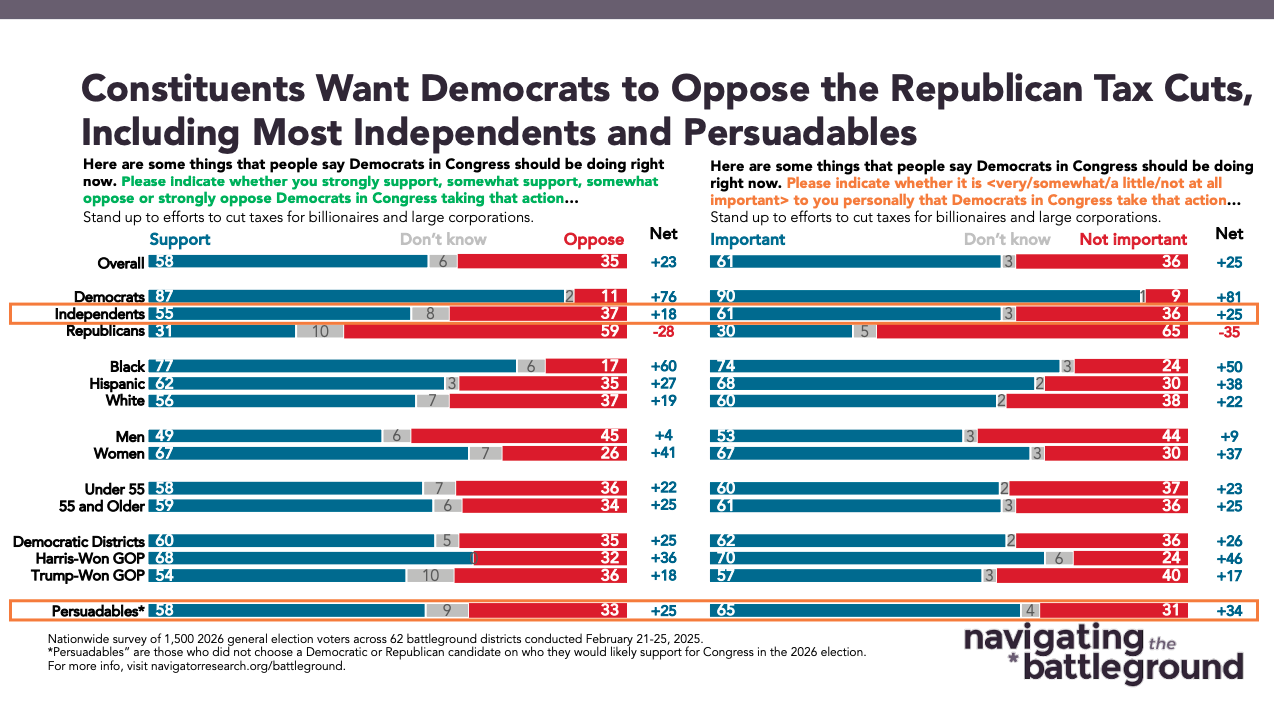

- 61 percent of battleground constituents say it is important to them that Democrats in Congress stand up to efforts to cut taxes for billionaires and large corporations, including independents by 25 points (61 percent important – 36 percent not important).

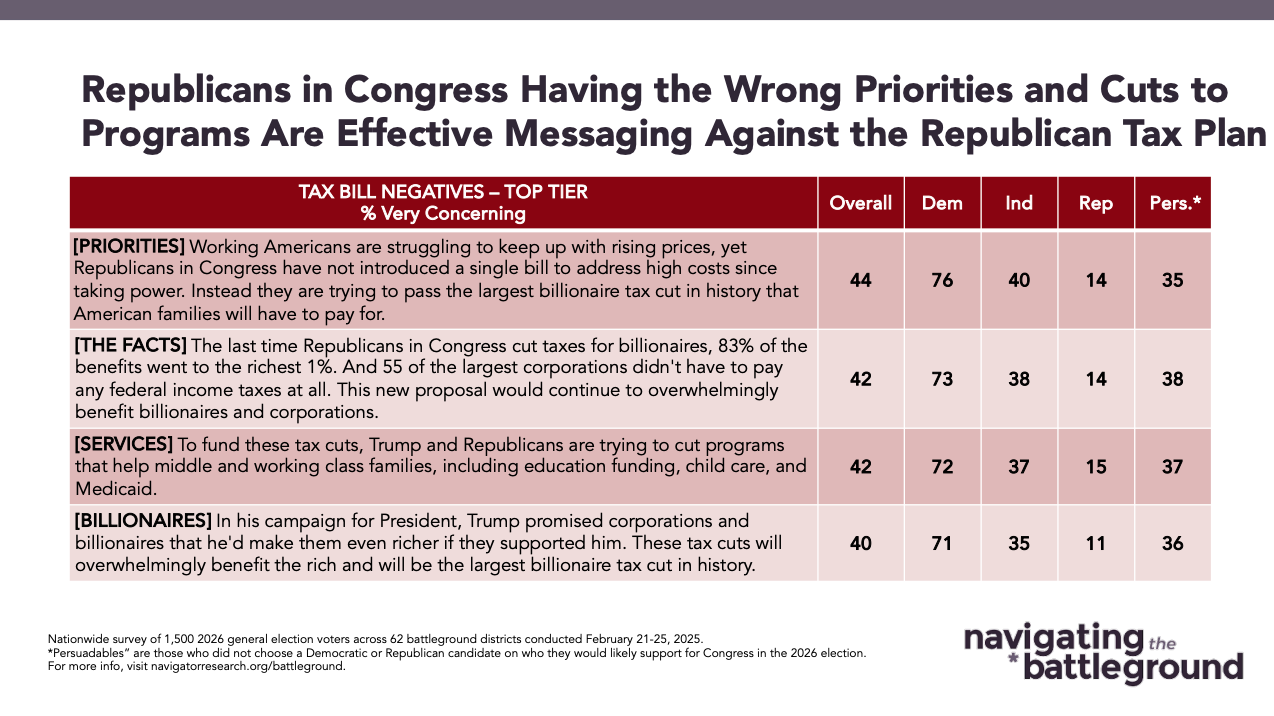

Messaging about Republicans in Congress having the wrong priorities is effective in pushing back on Trump and Republicans’ tax plan.

53 percent of battleground constituents find it concerning—including 44 percent who find it “very” concerning—that “working Americans are struggling to keep up with rising prices, yet Republicans in Congress have not introduced a single bill to address high costs since taking power… instead they are trying to pass the largest billionaire tax cut in history that Americans will have to pay for.” Similarly, 53 percent of battleground constituents—including 42 percent who find it “very” concerning—that “the last time Republicans in Congress cut taxes for billionaires, 83% of the benefits went to the richest 1%… and 55 of the largest corporations didn’t have to pay any federal income taxes at all… this new proposal would continue to overwhelmingly benefit billionaires and corporations.”

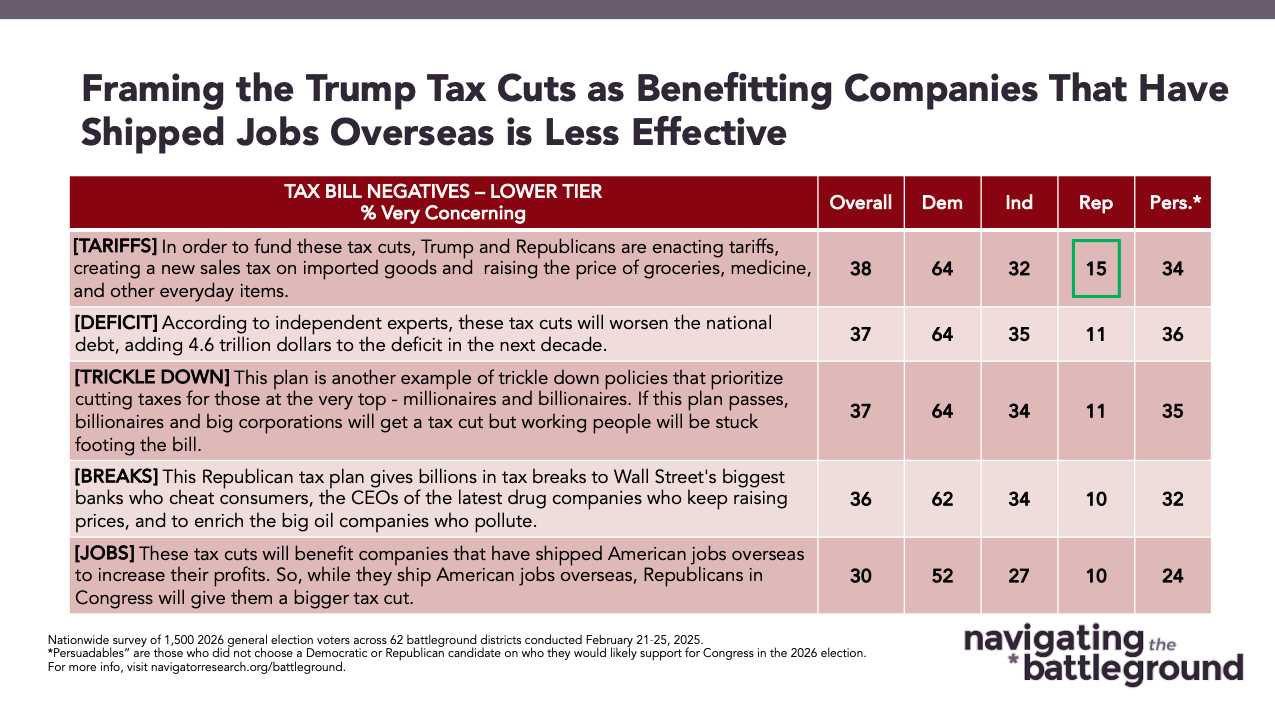

- 26 percent of Republicans find it concerning—including 15 percent who find it “very” concerning—that “in order to fund these tax cuts, Trump and Republicans are enacting tariffs, creating a new sales tax on imported goods and raising the price of groceries, medicine, and other everyday items.”

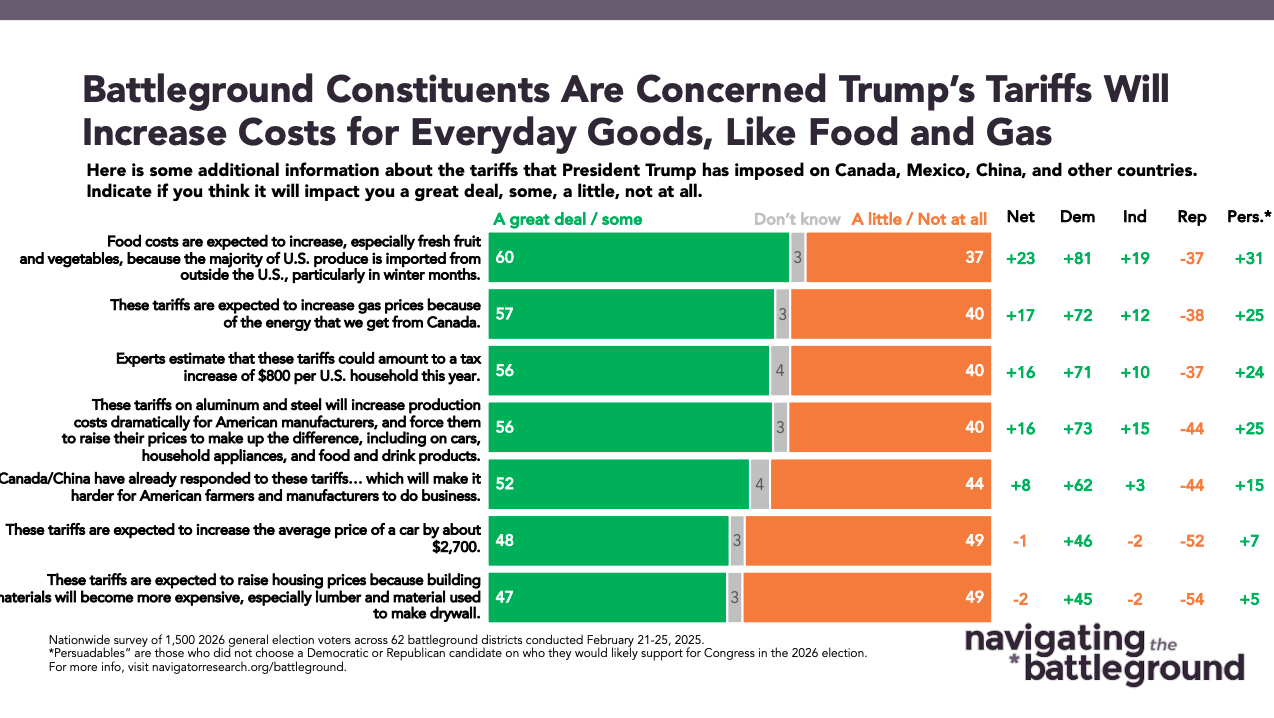

Battleground constituents are most concerned about their everyday costs—like food, energy, and household appliances—going up because of tariffs.

60 percent of battleground constituents believe that an increase in food costs due to tariffs would impact them, including 90 percent of Democrats, 57 percent of independents, and 30 percent of Republicans. Majorities also believe increased costs of gas and steel would impact them, including 57 percent of battleground constituents who believe that an increase in gas prices as a result of tariffs on Canada would impact them and 56 percent who believe that tariffs on steel and other manufacturing materials will impact them.

- Battleground constituents are relatively less concerned about the cost of housing rising because building materials will become more expensive like lumber and material used to make drywall (net -2; 47 percent would impact them – 49 percent would not impact them) or that tariffs are expected to increase the average price of a car by $2,700 (net -1; 48 percent would impact them – 49 percent would not impact them).

About The Study

This survey was conducted among a sample of 1,500 likely 2026 general election battleground constituents from February 21-February 25, 2025. The survey was conducted via text-to-web. Respondents were verified against a voter file and special care was taken to ensure the demographic composition of our sample matched that of the 62 congressional districts included in the sample across a variety of demographic variables. The margin of error for the full sample at the 95 percent level of confidence is +/- 2.5 percentage points.