Battleground: The Republican Tax Plan

This Navigator Research report contains polling data on battleground constituents’ attitudes toward the Republican tax plan to make the Trump tax cuts permanent, specific concerns constituents have about different aspects of the proposal, and how these concerns drive increased opposition toward making them permanent.

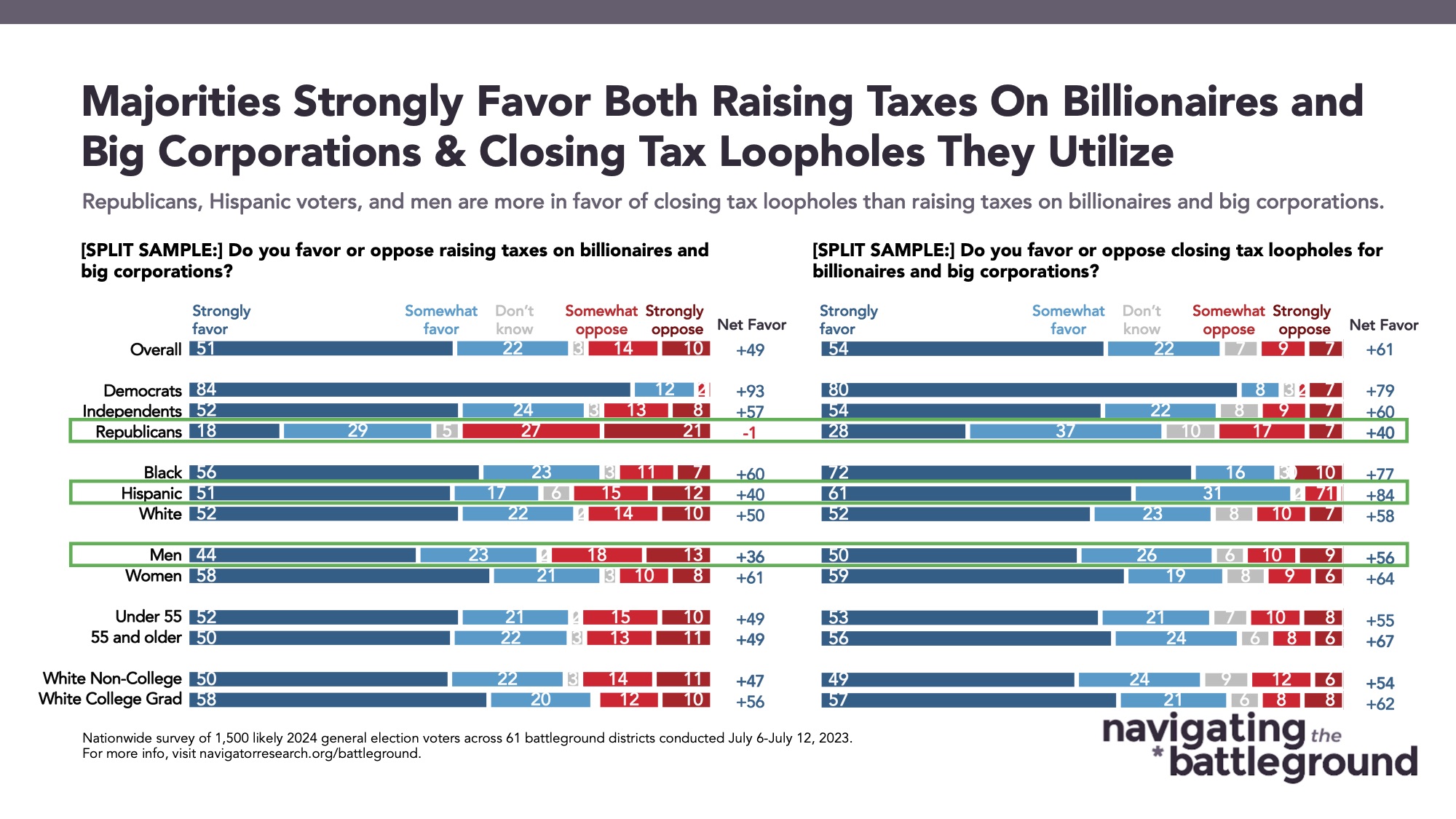

Three in four battleground constituents favor both raising taxes on billionaires and big corporations and closing tax loopholes they take advantage of.

By 49 points, battleground constituents are in favor of raising taxes on billionaires and big corporations (73 percent – 24 percent). Support comes from 96 percent of Democrats, 78 percent of independents, and nearly half of Republicans (48 percent). Net favorability grows to a net +61 when asking about closing tax loopholes on billionaires and big corporations (77 percent – 16 percent), driven by a significantly higher share of Republicans who are supportive of closing tax loopholes (65 percent). Closing tax loopholes is also a more popular framing among Hispanic voters (net +84 for closing tax loopholes; net +40 for raising taxes) and men (net +56 for closing tax loopholes; net +36 for raising taxes).

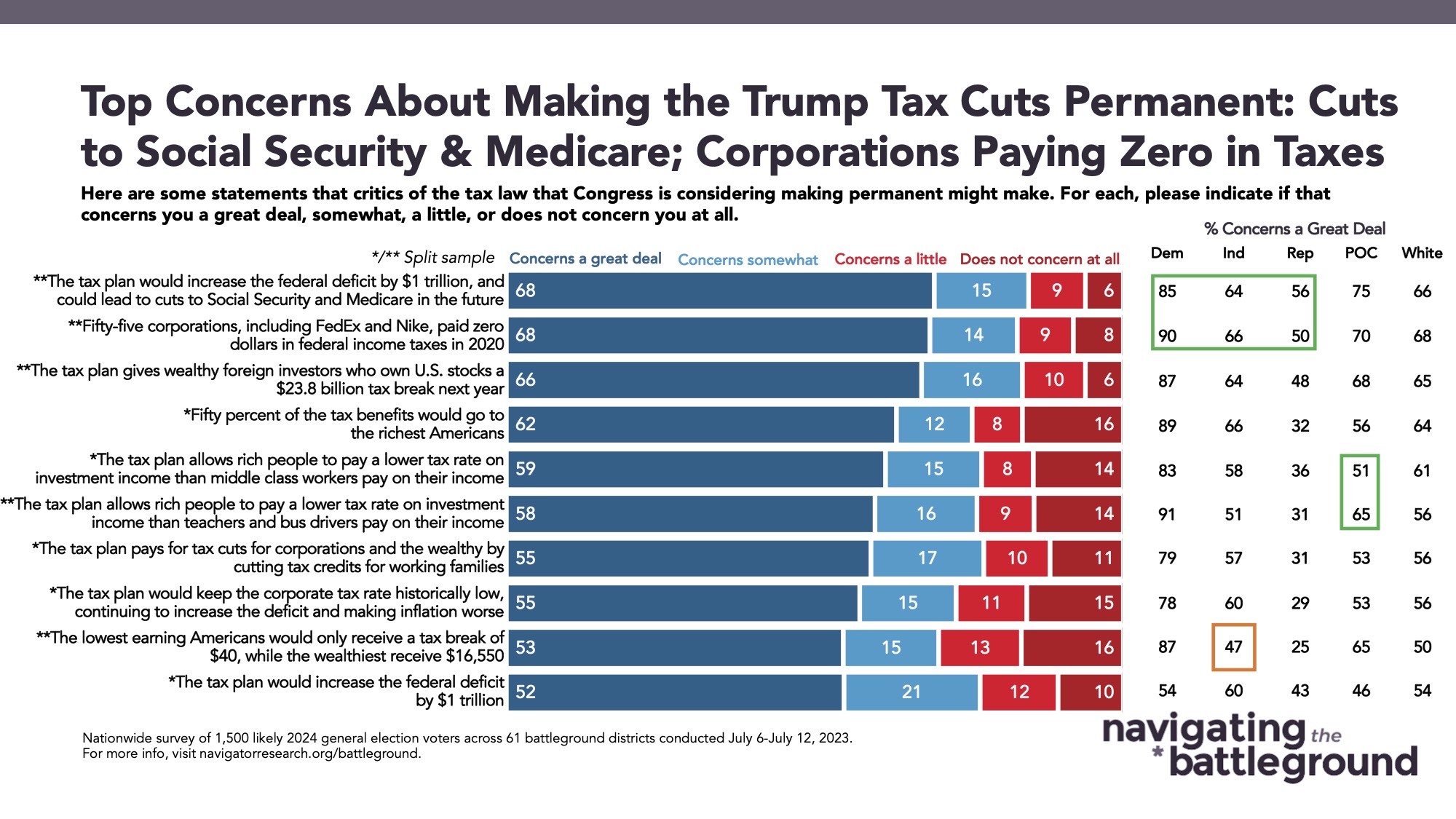

The best messages against making the Trump tax cuts permanent include concerns about effects on Social Security and Medicare, and those about the plan favoring the wealthy.

The strongest criticism of the tax plan is its proposed increase of the federal deficit by $1 trillion, which could lead to Social Security and Medicare cuts. This claim concerns 68 percent of battleground constituents a great deal, including a majority of Republicans (56 percent) and two in three independents (66 percent).

- Another effective message is about the 55 largest corporations that paid zero federal income tax in 2020: 68 percent of battleground constituents are concerned a great deal by this, and this argument resonates the most with battleground independents (66 percent express a great deal of concern).

- However, arguments against the tax law purely focusing on financial aspects, devoid of impact, prove less influential. The least impactful argument against the tax law is the claim that it would increase the federal deficit by $1 trillion: while a majority are concerned a great deal (52 percent), this falls 16 points behind the top-performing statements that call out the consequences for Social Security and Medicare and companies paying zero in federal taxes. An argument pointing out that the lowest-earning Americans only receive a tax break of $40 compared to the wealthiest receiving $16,500 also falls behind the more consequence-oriented arguments.

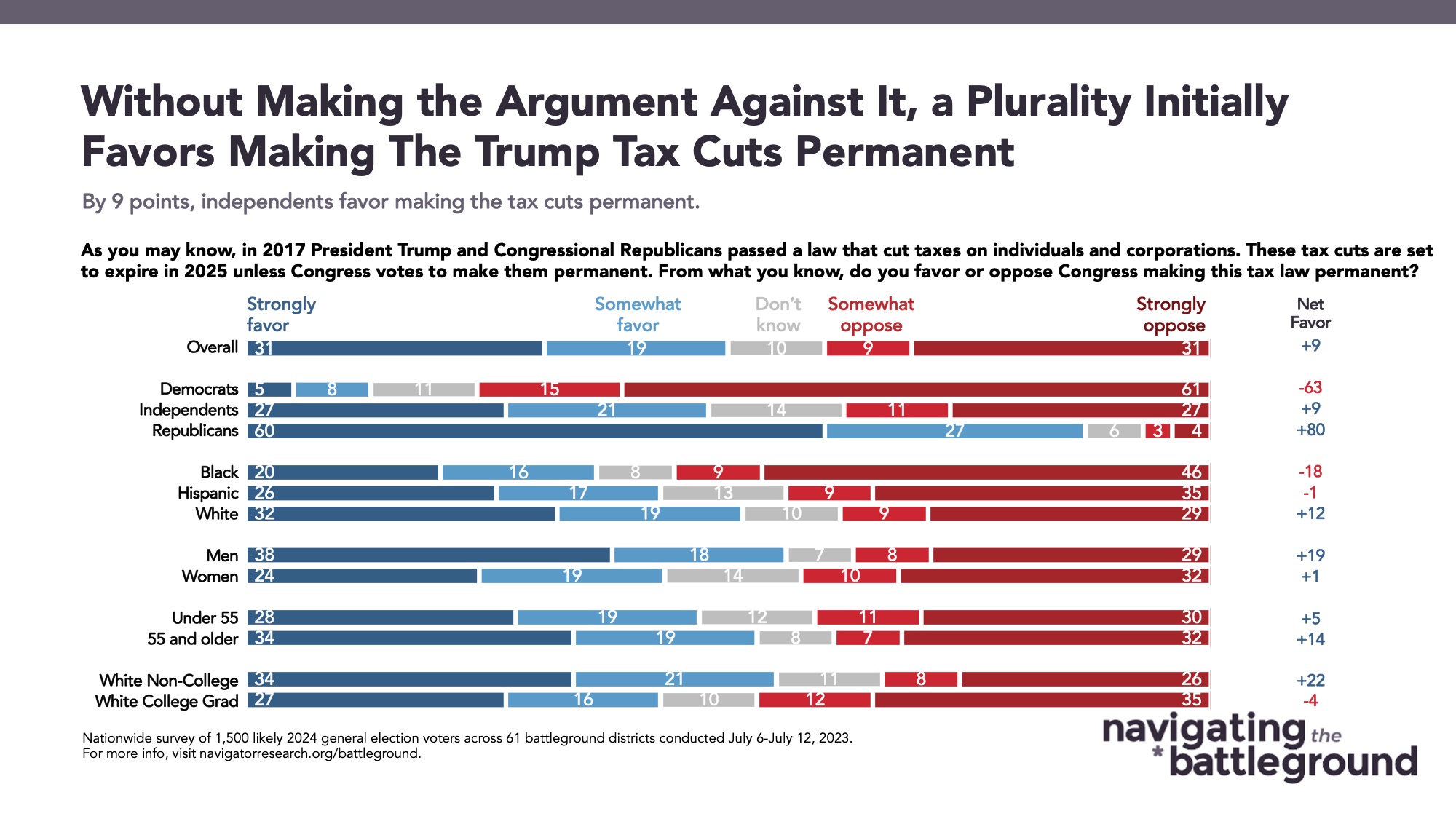

There is significant movement against making the Trump tax cuts permanent after battleground constituents see messages about the plan.

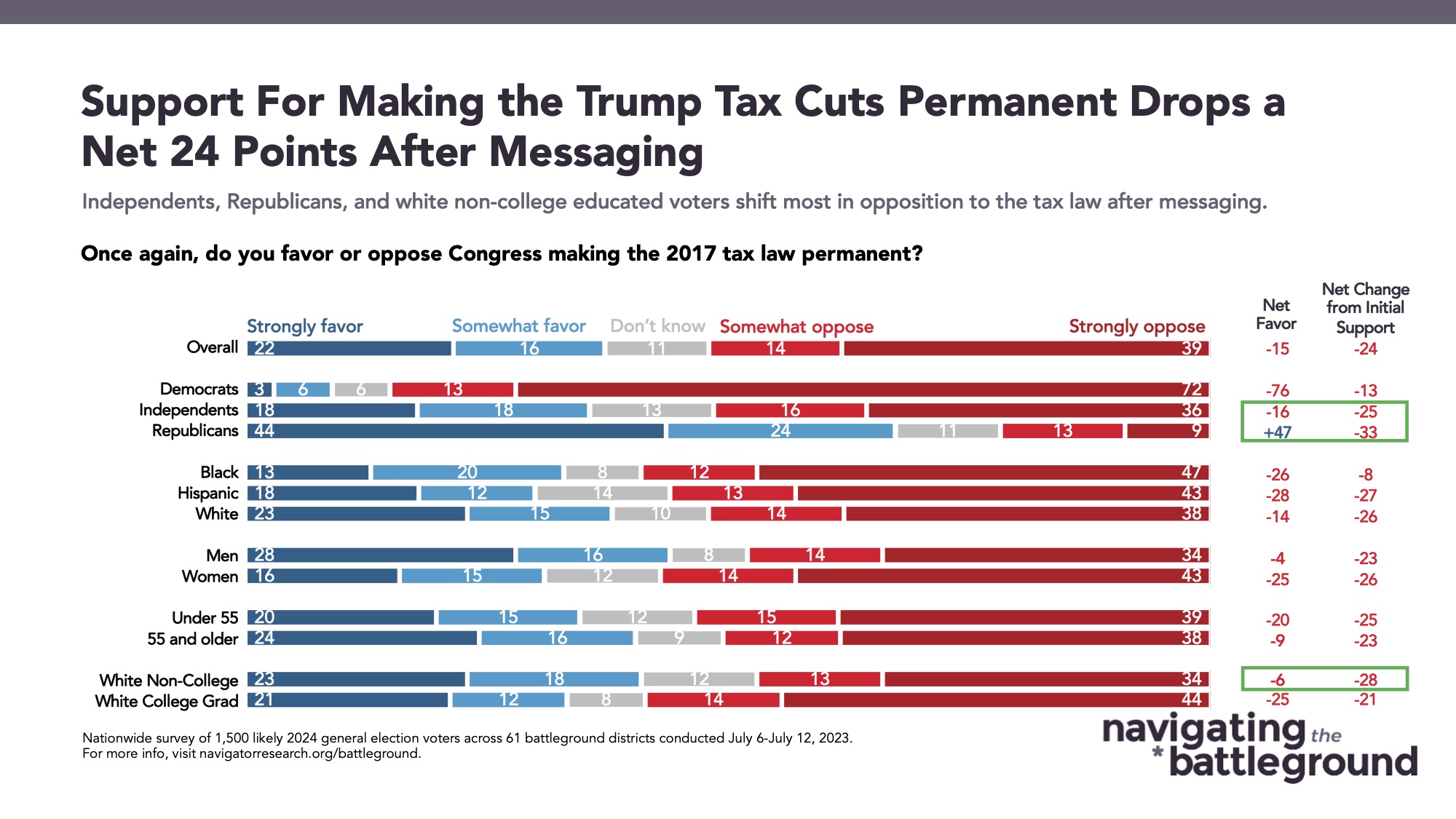

Before hearing any arguments against making the Trump tax cuts permanent, a plurality of battleground constituents favor making it permanent (net +9; 49 percent favor – 40 percent oppose). After exposure to a variety of arguments against making the Trump tax cuts permanent, there is a significant net 24-point drop in support from an initial net +9 to a net -15 (37 percent support – 52 percent oppose). The most dramatic drops came from battleground independents (by a net 25 points, from net +9 to net -16) and Republicans (by a net 33 points, from net +80 to net +47).

- Those whose opinion moves against making the Trump tax cuts permanent after messaging are less likely to have a four-year college degree (67 percent, compared to 60 percent overall), are more likely to live in a household making less than $100,000 a year (64 percent, compared to 54 percent overall), are more Republican or Republican-leaning (56 percent, compared to 44 percent overall), and are more female (60 percent, compared to 54 percent overall).

About The Study

Impact Research conducted public opinion surveys among a sample of 1,500 likely 2024 general election voters from July 6-July 12, 2023. The survey was conducted by a mix of text-to-web (74 percent) and an opt-in, online panel (26 percent). Respondents were verified against a voter file and special care was taken to ensure the demographic composition of our sample matched that of the 61 congressional districts included in the sample across a variety of demographic variables. The margin of error for the full sample at the 95 percent level of

confidence is +/- 2.5 percentage points. The margin for error for subgroups varies and is higher.