Poll: Affordable Care Act (ACA)

This Navigator Research report contains polling data on the latest perceptions of the Affordable Care Act (ACA) and tax fairness, including the share of Americans who believe Congress should prioritize extending ACA subsidies over the Trump tax cuts, and messaging guidance on health care and tax fairness issues.

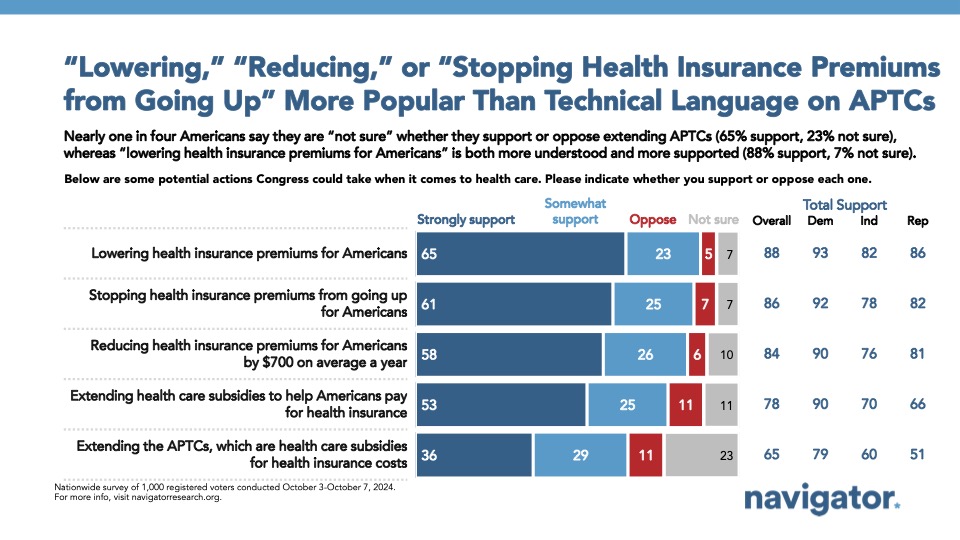

Overwhelming majorities support the government lowering health insurance premiums and extending health care subsidies to help Americans pay for health insurance.

88 percent of Americans support lowering health insurance premiums for Americans, including 93 percent of Democrats, 86 percent of Republicans, and 82 percent of independents. Nearly four in five Americans also support “extending health care subsidies to help Americans pay for health insurance” (net +67; 78 percent support – 11 percent oppose). However, when phrased more technically as “extending the APTCs, which are health care subsidies for health insurance costs,” it remains popular, but support drops to just 65 percent.

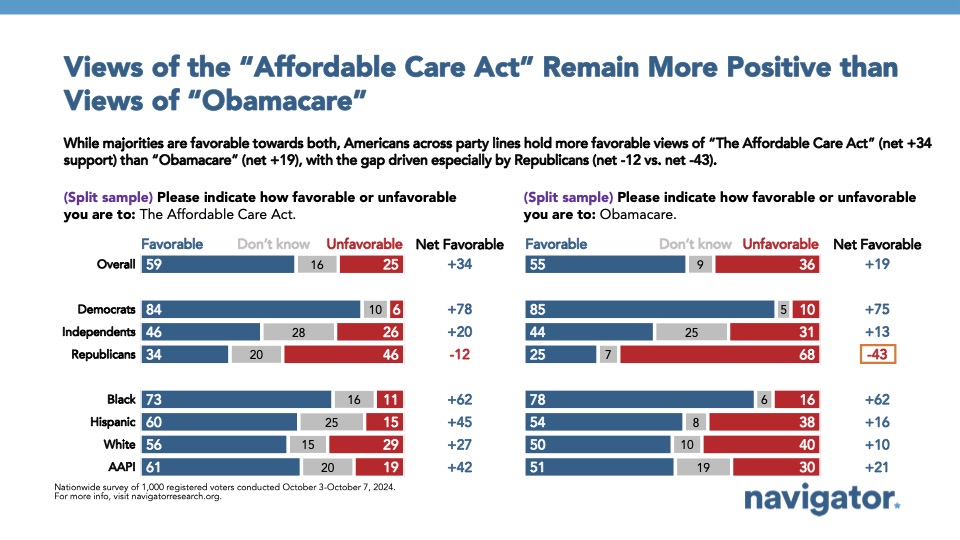

By a 34-point margin, Americans view the Affordable Care Act favorably (59 percent favorable – 25 percent unfavorable), including Democrats by a 78-point margin (84 percent favorable – 6 percent unfavorable), independents by a 20-point margin (46 percent favorable – 26 percent unfavorable), and even a third of Republicans express a favorable opinion of the ACA (net -12; 34 percent favorable – 46 percent unfavorable). The ACA has a higher net favorability rating across partisanship than “Obamacare,” with Democrats viewing “Obamacare” favorably by a 75-point margin (85 percent favorably), independents viewing it favorably by a 13-point margin (44 percent favorable – 31 percent unfavorable), and only a quarter of Republicans viewing it favorably (net -43; 25 percent favorable – 68 percent unfavorable).

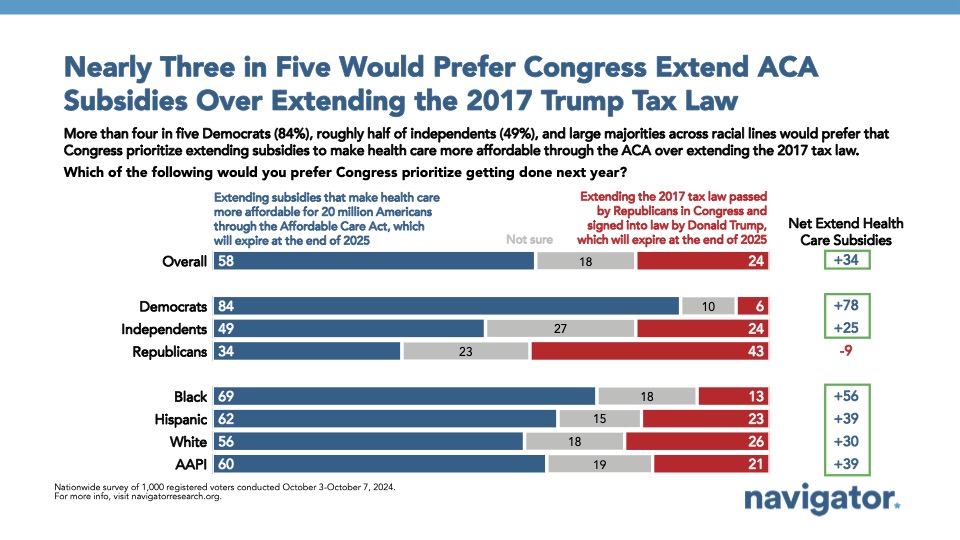

Nearly three in five Americans would prefer Congress prioritize extending health care subsidies through the ACA over extending the 2017 Trump tax law.

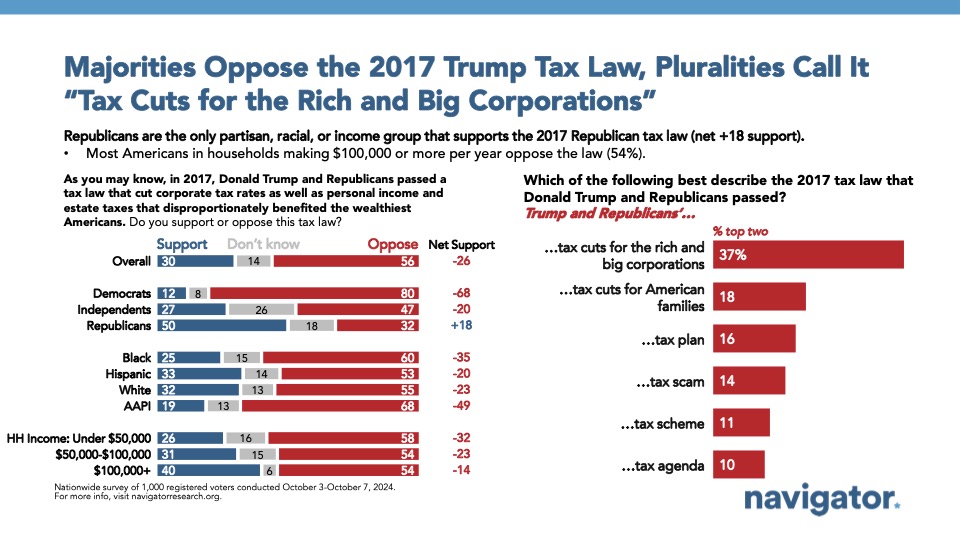

Trump and Republicans’ 2017 tax law is 26 points underwater with Americans (30 percent support – 56 percent oppose), garnering opposition from four in five Democrats (net -68; 12 percent support – 80 percent oppose), half of independents (net -20; 27 percent support – 47 percent oppose), and one in three Republicans (net +18; 50 percent support – 32 percent oppose). As both the subsidies through the ACA and the Trump tax law are set to expire in 2025, three in five Americans say they would rather Congress prioritize extending ACA subsidies in order to make health care more affordable than to extend the Trump tax law (58 percent prefer extending ACA subsidies – 24 percent support extending the Trump tax law).

Among those most likely to believe Congress should focus on extending ACA subsidies rather than extending the Trump tax law are Black Americans (69 percent support extending ACA subsidies – 13 percent support extending the Trump tax law), women (61 percent support extending ACA subsidies – 17 support extending the Trump tax law), and Americans between under the age of 35 (61 percent support extending ACA subsidies – 24 percent support extending the Trump tax law).

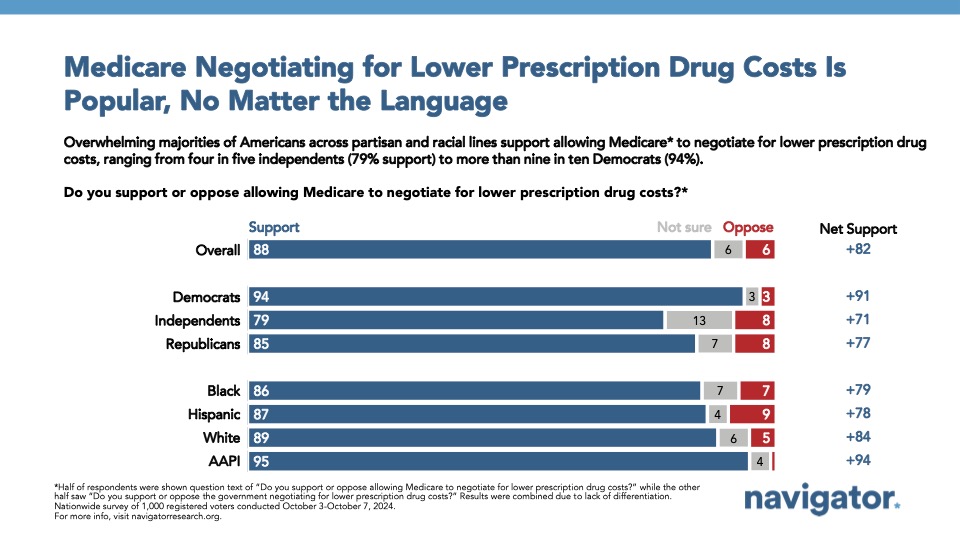

While both are overwhelmingly popular, the phrasing “allowing Medicare to negotiate for lower prescription drug costs” (net +85; 89 percent support – 4 percent oppose) garners slightly more support than “the government negotiating for lower prescription drug costs,” (net +81; 88 percent support – 7 percent oppose), a shift mainly driven by independents (net +82 support Medicare negotiating; net +59 support government negotiating).

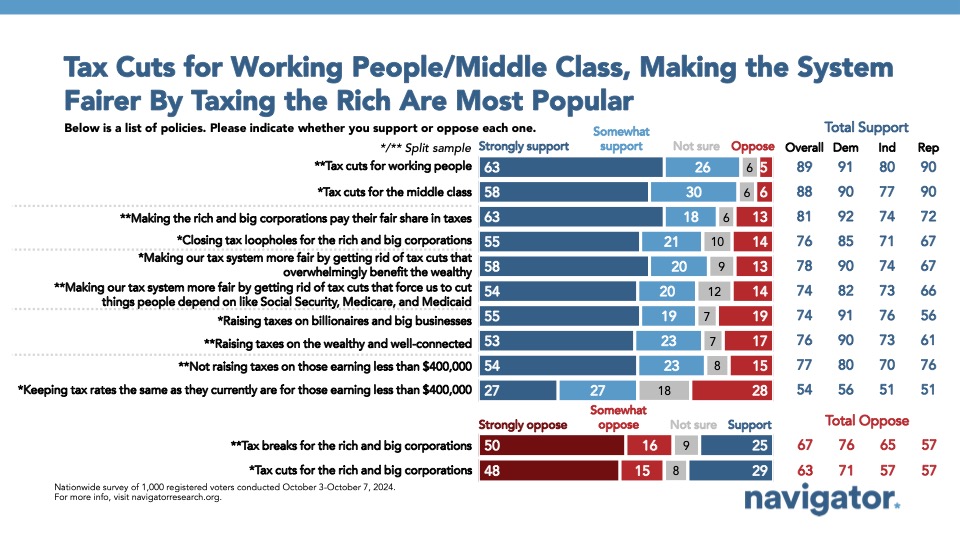

Tax cuts for working people and making the rich and big corporations pay their fair share are overwhelmingly popular.

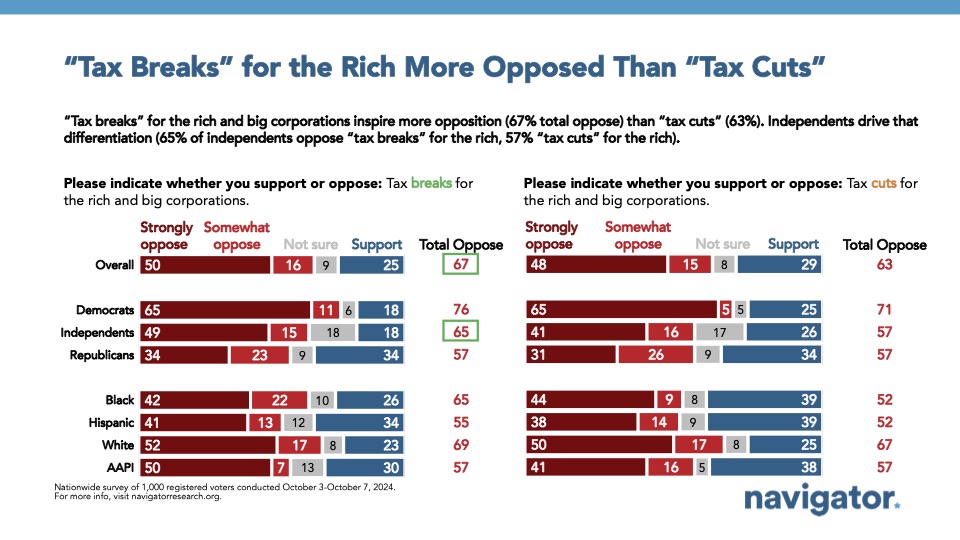

Nearly nine in ten Americans support tax cuts for working people (89 percent), while four in five support making the rich and big corporations pay their fair share in taxes (81 percent). By contrast, more than three in five Americans oppose cutting taxes for the rich and big corporations (63 percent oppose), including 76 percent of Democrats, 65 percent of independents, and 57 percent of Republicans.

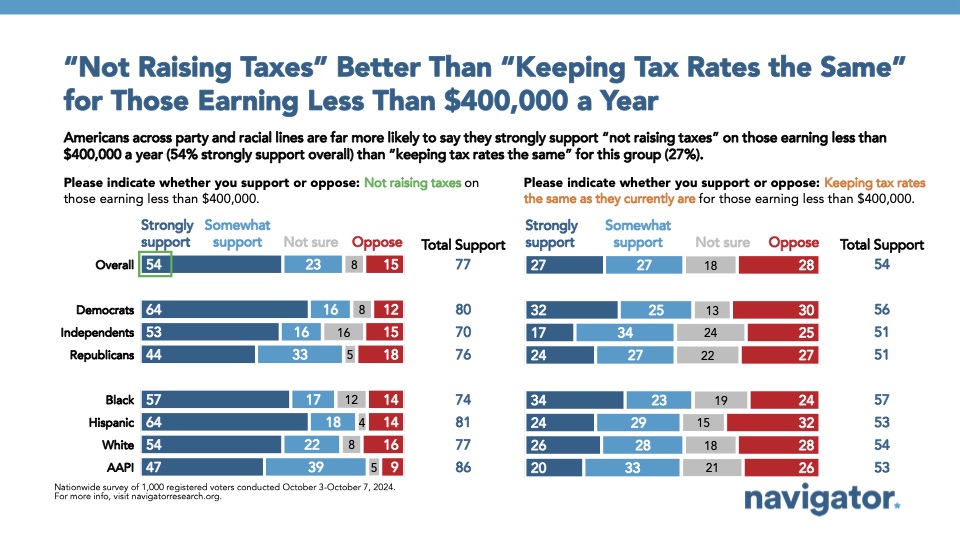

“Not raising taxes on those earning less than $400,000” earns higher levels of support (net +62; 77 percent support – 15 percent oppose) than when phrased as “keeping tax rates the same as they currently are for those earning less than $400,000” (net +26; 54 percent support – 28 percent oppose).

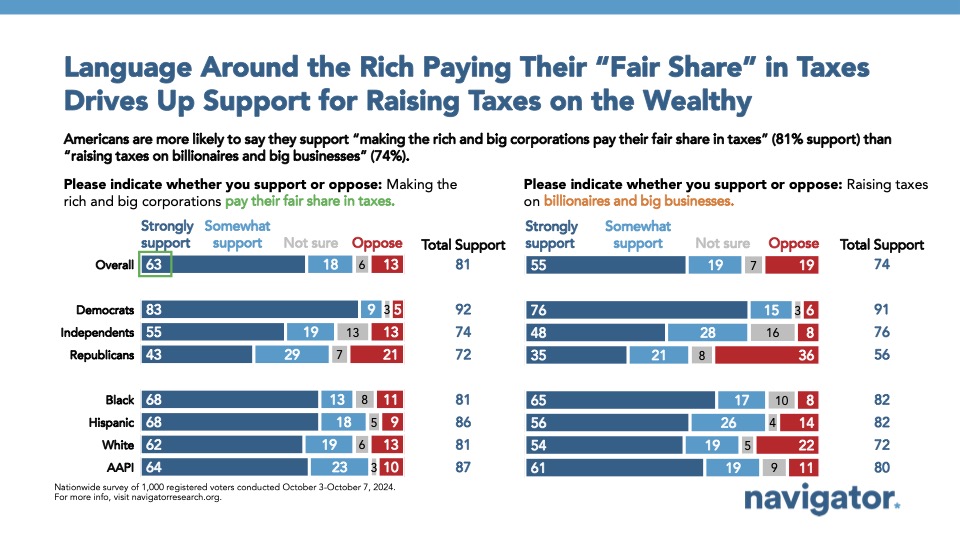

“Making the rich and big corporations pay their fair share in taxes” earns slightly higher support net +68; 81 percent support – 13 percent oppose) than when phrased as “closing tax loopholes for the rich and big corporations” (net +62; 76 percent support – 14 percent oppose).

“Tax breaks for the rich and big corporations” garners more opposition (net -42; 25 percent support – 67 percent oppose) than when phrased as “tax cuts for the rich and big corporations” (net -34; 29 percent support – 63 percent oppose).