Poll: House Republicans’ Proposed Budget Plan

This Navigator Research report covers the latest perceptions of House Republicans’ proposed budget plan.

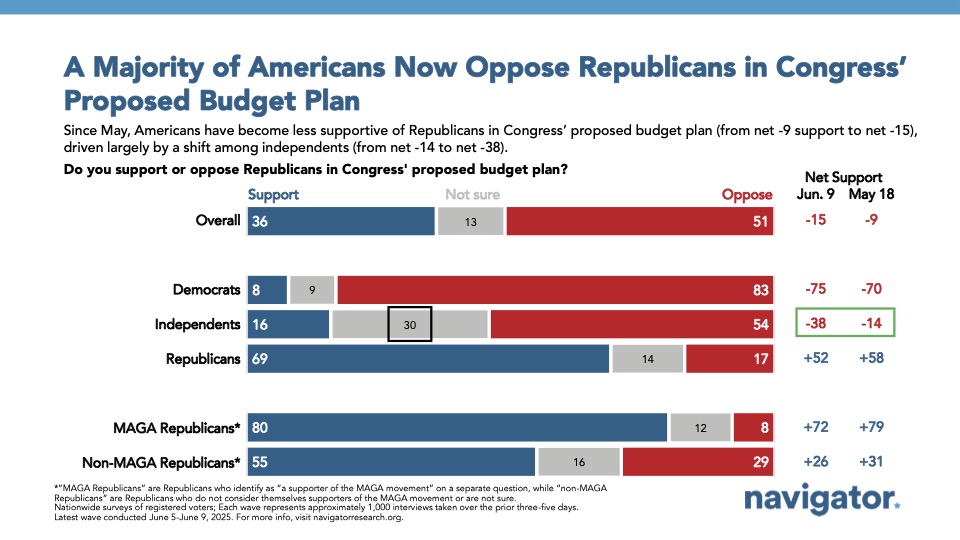

A majority of Americans (51 percent) now oppose the Republican budget plan following its passage in the House. Opposition outweighs support by 15 points, with just 36 percent supporting the GOP budget bill. Opposition to the bill has increased six points since May and has grown the most among independents. In May, support among independents was at net -14. It now stands at net -38. Notably, 30 percent of independents say they are “not sure” if they support or oppose the tax bill.

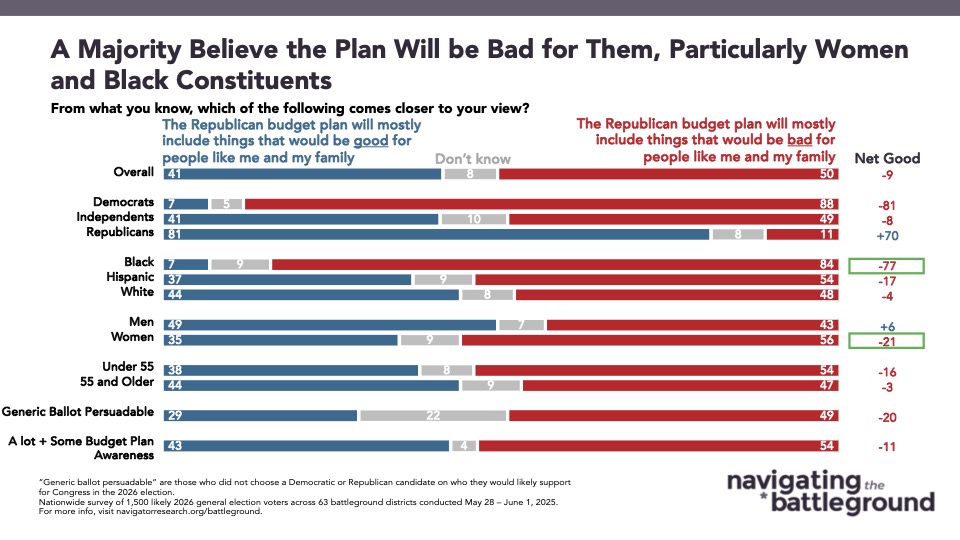

In the Battleground: Half of battleground constituents believe the Republican budget plan would be bad for people like them, compared to just 41 who believe it would be beneficial, including 56 percent of women and 84 percent of Black battleground constituents.

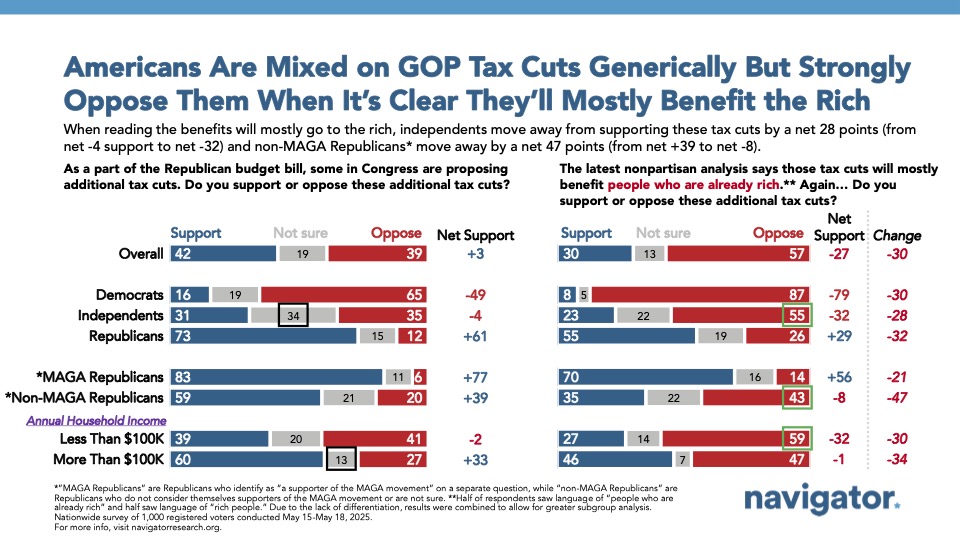

Americans have mixed views on tax cuts in the Republican tax bill — but support plummets when they hear that these additional tax cuts would mostly benefit those who are already rich.

Learning that additional tax cuts would benefit those who are already rich leads 55 percent of independents and a 43 percent plurality of non-MAGA Republicans to oppose the budget plan.

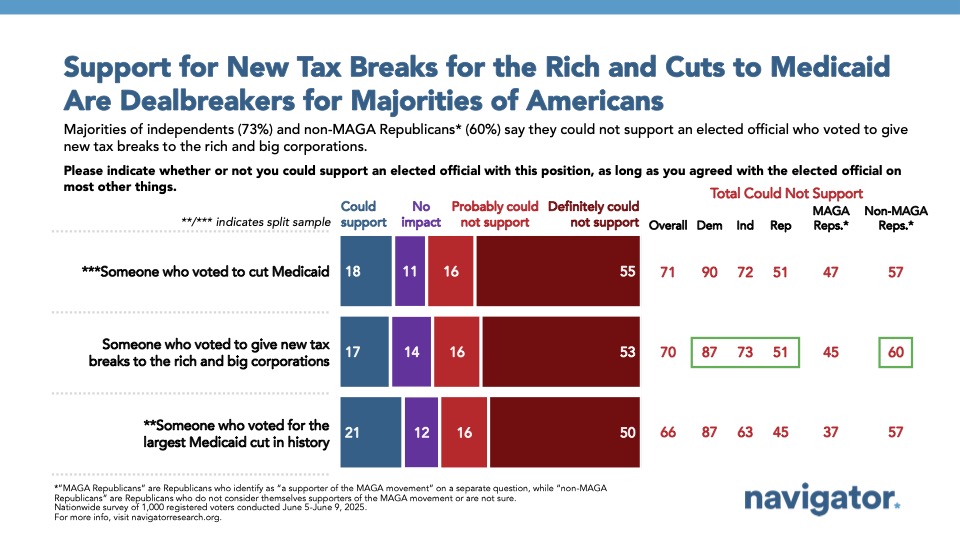

Giving new tax breaks to the rich and big corporations is a dealbreaker for Americans across partisanship: 87 percent of Democrats, 73 percent of independents, and 51 percent of Republicans say they could not support an elected official who voted to give new tax breaks to the wealthy.

Recommendations:

- Focus on the impact when messaging about Congressional Republicans’ proposed budget plan: Costs will go up and benefits will be cut, while the wealthy and big corporations receive additional tax breaks.

- Acknowledge the tax system is broken and rigged to benefit the wealthiest individuals instead of people who work for a living.

- Highlight the “why” — Republicans in Congress want to cut Medicaid and increase costs for everyday Americans so they can give additional tax breaks to already wealthy individuals and corporations.

Read More

About The Study

full sample at the 95 percent level of confidence is +/- 3.1 percentage points. The margin of error for subgroups varies and is higher.